Tuesday, February 9, 2010

Monopoly “Money ”

“Everyone knows that the State claims and exercises [a] monopoly of crime … and that it makes this monopoly as strict as it can. It forbids private murder, but itself organizes murder on a colossal scale. It punishes private theft, but itself lays unscrupulous hands on anything it wants, whether the property of citizen or alien.” —

Albert Jay Nock, reducing the matter to its undeniable essentials, in his indispensable work Our Enemy, The State.

One of the most enduring tidbits of economic pseudepigrapha is this incontestable statement dubiously attributed to Ludwig von Mises: “Government is the only institution that can take a valuable commodity like paper and make it worthless by applying ink.” The same principle holds true with respect to the debasement of the official coinage.

Owing to the Regime’s relentless debasement of the dollar, pennies and nickels are actually worth more as metal than as U.S. currency. In late 2006, the United States Mint — an agency with no legislative authority — issued a rule forbidding people, on pain of imprisonment, to make economically sensible use of coined “money” they had earned through legitimate commerce.

Americans who possessed large quantities of pennies and nickels were informed that it was a federal offense punishable by a $10,000 fine or five years in prison to melt them down and extract the marketable metals from those government-issued slugs.

This is a “crime”? Three pennies, one of them a pre-1983 97% copper coin, were melted in a science experiment intended to separate the zinc from the copper. According to the U.S. Mint, this was a federal offense.

The same penalties apply to Americans who travel abroad with more than $5 worth of the coins in their possession, or ship more than $100 in pennies and/or nickels out of the country (for purposes deemed “legitimate” by the criminal syndicate headquartered in Washington, D.C.).

Those penalties, which were imposed Soviet-style by way bureaucratic ukase, rather than legislative action, are a portent of much more draconian currency controls to come.

In a recent interview, economic analyst Doug Casey addressed what he calls “the grim reality of impending currency controls” — that is, punitive measures imposed by the Regime to prevent Americans from moving their money abroad in order to protect it from official theft through direct taxation and the more subtle pilferage called inflation.

“I don’t know what form the exchange controls are going to take, but there are two general possibilities: regulation and taxation,” observed Casey. “The regulations might take the form of a rule prohibiting you from taking more than X-thousands of dollars abroad per year without special permission. No expensive vacations, no foreign asset purchases without state approval.”

Such Foreign Exchange (FX) controls “have been used since the days of the Roman Empire,” Casey continues. “A country debases its currency, raises taxes beyond a certain level, and makes regulations too onerous — and productive people naturally react by getting their capital, and then themselves, out of Dodge. But the government can’t have that, so it puts on FX controls. They’re almost inevitable at this point.”

Shortly before the Soviet empire collapsed, its ruling elite imposed the death penalty for violations of its currency exchange laws, Casey recalls. It’s not impossible to imagine a similar state of affairs taking hold as Washington’s globe-straddling collectivist Empire implodes. It shouldn’t be forgotten, of course, that every government imposition on the rights and property of the individual is a contingent death sentence for those who dare defend themselves against the State’s criminal aggression.

Redeemable in real money: A 100,000 gold certificate of the kind used in “sovereign” transactions before Washington closed the “gold window.”

Casey’s analysis is sound, but he is insufficiently alarmist. The regulations put in place by the U.S. Mint in early 2006 are currency controls of exactly the kind he describes — a fact noted in the title of the agency’s news release announcing the final version of the restrictions (“United States Mint Limits Exportation and Minting of Coins,” April 17, 2007). In keeping with the kleptomaniacal impulses that characterize every public policy inflicted on us by Washington, the Mint announced that coins that were melted or exported in violation of its rule would be “forfeited” — that is, stolen — on behalf of the Regime.

As Casey pointed out, the Regime will promote FX controls by depicting those who seek to protect their earnings as “unpatriotic,” and demonizing those who try to get their money out of the USSA as greedy, unscrupulous enemies of The People — “wreckers,” to use the appropriate Stalinist epithet.

It’s difficult to depict people who melt down pennies and nickels as Plutocrats. However, the Mint did make a feint in the direction of faux patriotism by denouncing those “few individuals” who would extract valuable metal from state-issued slugs as selfish clods determined to “take advantage of the taxpayer.”

Never forget: In the collectivist lexicon, the adjectives “greedy” and “selfish” apply only to those who wish to keep what they have honestly earned, rather than to those who wish to steal that property through the use of officially sanctioned criminal means.

Individuals who wish to melt down coins they have legitimately earned — coins that are their property to be used as the owners see fit — face kidnapping and imprisonment at the hands of the same government that tirelessly steals the value of the same currency in order to serve the interests of the parasite class. And now the same Regime appears to be poised to “solve” this problem by removing every vestige of value from its coinage.

The Obama Junta’s FY 2011 budget contains a provision incorporating the so-called “Coin Modernization and Taxpayer Savings Act,” which was first proposed two years ago. The purpose of that measure — which would effectively repeal Art. I, section 8, line five of the United States Constitution — is to authorize the Treasury Department to develop and use “new metallic content for circulating coins….” This is necessary, according to the bill, because “international demand along with market speculation for commodity metals has, over the past several years, increased the cost of producing circulating coins in the United States….”

That statement is a reeking pile of unfiltered Bolshevik: The costs and market value of copper, zinc, and nickel appear to be going up because the dollar — under the pressure of Washington’s incontinent profligacy — is losing its purchasing power. This is why minting pennies currently costs 1.62 cents a copy, and the unit cost of forging a nickel is nearly six cents.

The “solution” to this, of course, is to permit the Secretary of the Treasury — the charming fellow presiding over the redistribution of what remains of our aggregate personal wealth into the hands of Wall Street’s corporatist criminal elite — to issue new government-approved slugs made entirely of trash metal, which we will be compelled by “law” to use as currency.

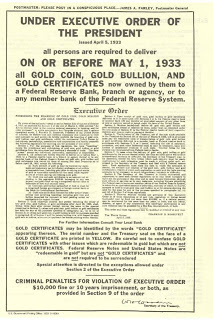

Sometimes it’s just that obvious: Notice of FDR’s 1933 executive order demanding that Americans surrender their gold to the regime. Westbrook Pegler was exactly right.

While Washington prepares for the terminal debasement of its currency, the rulers within its seraglio of collectivist soviets (sometimes amusingly referred to as “states”) are contemplating currency exchange restrictions of their own.

The government afflicting the otherwise lovely state of Washington, for example, is considering the imposition of a sales tax on gold and silver coins and bullion. This amounts to a government-inflicted surcharge on a currency transaction. It would also punish those who choose to invest in gold and silver rather than the stock market.

While sensible people (including a few relatively decent legislators) in the Evergreen State have thrown up impediments to the proposed currency exchange tax, the state legislature is pursuing a similar end through indirect means: The state’s Department of Revenue seeks an increase in the business-and-occupation tax paid by bullion dealers.

This tax penalty wouldn’t apply to people who throw away their money in the stock market, as the architects of our corporate socialist system would prefer. It would likely drive business to dealers in other states not foolish enough to impose such liabilities on coin and bullion dealers — until similar penalties are imposed on currency exchanges by the tax-consumers in other states, of course.

There is no reason rooted in logic, history, or the Constitution for the government to retain its monopoly on issuing currency. For most of America’s history prior to the advent of the Federal Reserve (aka the Focus of Evil in the Modern World), there were no legal tender laws requiring the use of government-issued currency. The constitutional provision referring to the power to “coin” money refers to standardizing the weight and purity of currency made from real money — that is, gold and silver (or even, if the market approves, copper).

Representative Ron Paul (R-Constitution) has proposed a measure that entitled the “Free Competition in Currency Act” that would repeal the legal tender laws that created the Regime’s monopoly on the issuance of currency. Section 3 of that bill would impose a nation-wide ban on taxing “the sale, exchange, or other disposition” of coins, bullion, or any other monetary instrument used in free commerce.

Rep. Paul’s freedom in currency act is an organic and necessary compliment to his bill to audit the Federal Reserve System (as a first step toward abolishing that engine of fraud and mass bloodshed). Since ruling elites do not consent to being deposed by legislative means, it’s impossible for me to believe that either of those bills will ever be enacted. But they may provide useful guidance when — not “if” — the current system collapses under the insupportable weight of its accumulated corruption.

Dum spiro, pugno!

Content retrieved from: http://freedominourtime.blogspot.com/2010/02/monopoly-money.html.