The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 517,000 jobs, which was well above expectations. The words used by the media to describe the report included “stunner” and “wow.” President Joe Biden claimed the number proves his administration has delivered economic prosperity. The administration has also noted that in the official numbers, the unemployment rate is at a multidecade low. This, Biden and his supporters insist, proves the economy is remarkably strong.

There are at least a few things going on that are problematic for this narrative, however. For one, the Fed is actively taking steps to reduce the money supply in an effort to slow price inflation. A second problem is that the federal government’s own numbers show that total employment actually fell in January. A third issue is the fact that what job growth exists is in part-time employment. Taking these together—and considering what they tell us about where we are in the current economic cycle—it’s very difficult to buy into any narrative that attempts to paint the economic situation as strong, much less “wow.”

Even the Fed Is Predicting Bad Employment News

Even Fed chair Jerome Powell refuses to use last month’s employment report as any sort of indication of the future state of the employment market. At Wednesday’s Federal Open Market Committee (FOMC) press conference, for example, Powell was careful to state that the effects of the Fed’s (mild) tightening—i.e., raising the target interest rate, shrinking the Fed’s balance sheet—have yet to be seen. This is remarkable given that Fed personnel virtually always paint a rosy picture of the economy regardless of the timing. Rarely will one find a Fed chairman saying “We see a recession on the horizon.” Yet Powell last week admitted that he expects more unemployment soon (although he insisted it would be mild and stuck to the “soft landing” scenario.)

At this point, however, many industries rely heavily on continued easy money from the Fed. In the face of rising interest rates, we can expect layoffs. We can already see the effects in the tech sector, and without ultralow interest rates, demand for real estate services is plummeting as well. Housing slumps are often a sign of coming employment slumps.

Part-Time and Full-Time Employment Have Inverted, and That Means Recession

In recent months, employment growth has increasingly been driven by part-time rather than full-time employment. Since September, in fact, month-to-month employment growth in full-time jobs has been negative, while growth in part-time jobs has been positive.

We see a similar trend in year-over-year job growth as well. In fact, in January’s jobs report, year-over-year growth in part-time jobs totaled 1.6 million, while growth in full-time jobs was only 1.4 million. The reverse is usually true in a time of economic expansion. For example, for much of 2018, year-over-year growth in full-time jobs numbered in the millions, while part-time employment actually fell.

Sometimes this situation reverses. Indeed, a switch from full-time-driven employment to part-time-driven employment usually indicates that a recession is coming. We saw it happen in 1981, 1990, 2001, 2008, 2020. Now it’s happened again in 2023.

This rarely gets reported in the headlines about job growth. We only hear about the establishment survey of total jobs at big employers (seasonally adjusted), which makes no distinction between full-time and part-time work. It also tells us nothing about whether people are taking on second jobs.

But if we look at the household employment survey, which looks at employed persons and part-time status, we find that many of the jobs we’re hearing about in last month’s “wow” jobs numbers are actually part-time work. Most of the reported job growth, in fact, was apparently part-time.

This could be due to several factors, not least of which is the fact that nominal year-over-year wage growth slowed in January—and real wages likely went down as well. As inflation continues to take a bite out of the family budget, more workers will need to take on extra work. At the same time, employers may be reluctant to shoulder the cost of full-time workers as the economy softens.

In fact, the lack of real wage growth should cause us to question the narrative of the “robust” economy overall. Average hourly earnings in January were up 4.35 percent year over year. But according to the Cleveland Fed’s inflation nowcast, Consumer Price Index (CPI) inflation in January was 6.4 percent. That means real wage growth fell by 2.1 percent. The cost of living is going up, and real wages have now fallen for twenty-two months in a row.

Apparently, the “wow” job growth isn’t enough to actually get wage growth to exceed price inflation.

All That Job “Growth” Is Just Seasonal Adjustment

Another reason to doubt the job-growth narrative is the fact that all the job growth reported by the BLS obscures the fact that total jobs in the real world actually went down last month. That actual jobs fell last month isn’t shocking, however, as total employment almost always goes down in January. It is reported as positive only due to sizable seasonal adjustments. But when the economy is in a transitional period, as it is now, seasonal adjustments may or may not actually reflect the current situation. In fact, as we can see in the next graph, when not seasonally adjusted, month-to-month January employment usually falls by at least two million jobs. Many Januarys in recent years have seen job losses of 2.8 million or more. In many cases, the BLS’s adjustments bring these numbers up by approximately three million.

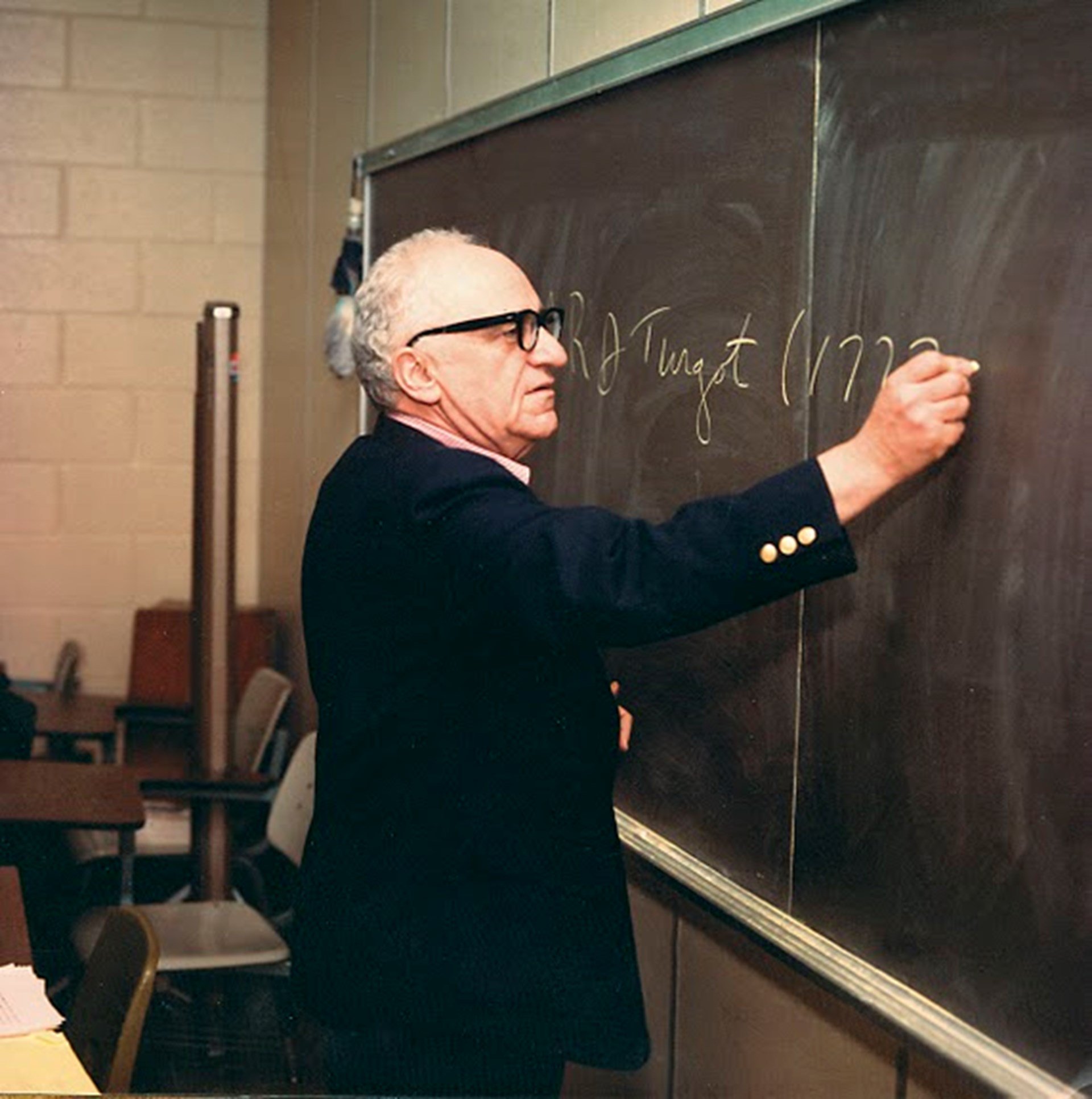

Is the current adjustment appropriate under the circumstances? We don’t know. It’s pure guesswork. And this all brings to mind Murray Rothbard’s observation about some of the trouble we encounter with these adjustments:

The further one gets from the raw data the further one goes from reality, and therefore the more erroneous any concentration upon that figure. Seasonal adjustments in data are not as harmless as they seem, for seasonal patterns, even for such products as fruit and vegetables, are not set in concrete. Seasonal patterns change, and they change in unpredictable ways, and hence seasonal adjustments are likely to add extra distortions to the data.

With numerous indicators pointing toward recession and with the Fed in the middle of a tightening period, the BLS is applying more or less the same January seasonal adjustment as usual. Will that prove to be the “correct” adjustment in 2023? It’s impossible to say, and it’s certainly impossible to take the make-believe number of “517,000 new jobs” as evidence of the underlying economic fundamentals at all. This sort of extrapolation is especially dangerous when job growth is increasingly all about part-time work.

Taken all together, January’s jobs report would seem to back up Powell’s claim that overall, the full effects of a falling money supply have yet to be fully felt. Looking at January’s jobs numbers as evidence of a strong job market requires that we ignore what we know about real wages, part-time jobs, falling home prices, and more.

This article was originally featured at the Ludwig von Mises Institute and is republished with permission.