All across the economic dashboard, inflation indicators are blinking red. Most recently, the Personal Consumption Expenditures (PCE) index, calculated by the Bureau of Economic Analysis, rose 5.7% from November 2020 to November 2021. That’s the biggest year-over-year surge since September 1983.

Many mistakenly attribute today’s rising prices solely to supply chain woes, and government officials are happy to fertilize that mythology—as Kamala Harris reflexively did last week in her rambling, didn’t-do-the-reading response to a question from Margaret Brennan:

Kamala Harris is asked about the inflation crisis and it did not go well. pic.twitter.com/rHre6FsbLu

— The First (@TheFirstonTV) December 30, 2021

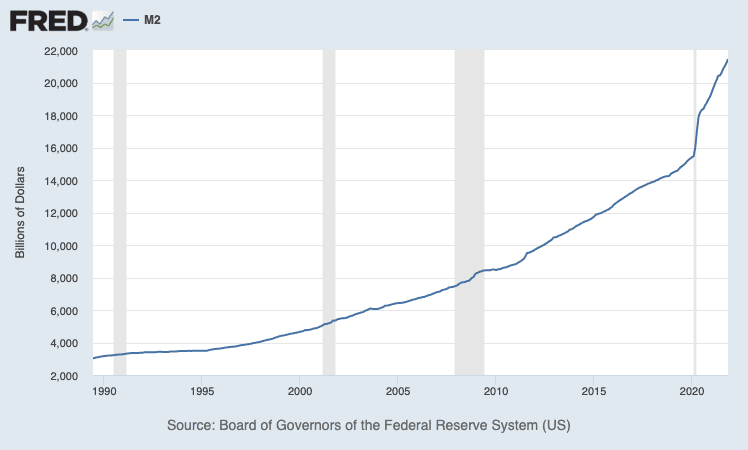

The truth is, in the words of economist Milton Friedman, “inflation is always and everywhere a monetary phenomenon.” In other words, today’s rising prices are primarily the result of the Federal Reserve’s relentless creation of new money, which serves to facilitate the government’s multi-trillion dollar deficit-spending addiction.

Note, the Fed’s rampant money creation facilitates deficit spending, but, in the end, it doesn’t actually pay for it. Instead, it functions as a massive scam that hides the price of deficit spending by ultimately passing it on to all of us via inflation.

While the new-money effect on prices is compounded by supply chain failures, those failures are themselves driven in part by higher demand fueled by the extra cash in circulation.

Manipulating Markets, Burying a Tax

When the government spends more than it takes in, the difference is funded by issuing Treasury bonds, bills, and notes.

In a rational, un-manipulated market, a profligate spender that’s already more than $29 trillion in debt would have to pay high interest rates to issue a new set of IOUs. Today’s 10-year Treasury rate, however, is just 1.5%. That utterly irrational rate is the direct result of the Federal Reserve’s manipulation of the Treasury debt market.

Specifically, the Fed routinely buys enormous amounts of Treasury debt, artificially pushing the interest rate down in the process. Because it’s prohibited from buying Treasury debt directly, the Fed contravenes the spirit of the law by buying it from large investment banks like Goldman Sachs and JP Morgan Chase—who profit from their role in what’s close to a money-laundering scheme.

What’s most critical to understand is that the Fed buys all those Treasury securities with new money created out of thin air. Unlike in earlier times, U.S. dollars aren’t backed by anything at all. Pouring trillions more of them into the economy can’t create enduring wealth, it can only sap the value of money that’s already in circulation.

Fed-created inflation thus functions as a stealth tax: Rather than taking your money directly and openly, the government reduces the value of your money through the opaque tax we call inflation.

As Friedman said, “Inflation is taxation without legislation.” Inflation is also taxation without any prescribed maximum rate. More ominously, nobody has any real control over the rate.

Once rightly charged with maintaining the value of the dollar—a mission it failed in spectacular fashion—the Fed now explicitly seeks to erode its value by 2% a year. However, with inflation accelerating well beyond that pace, it’s clear Fed officials appointed to play god with the economy have once again lost control, just as they’ve done through the cycle of booms and busts that have led us to this point.

Inflation Tax Hits Low-Income Americans Harder

Though inflation is a tax we all pay, the burden doesn’t fall evenly. With inflation assaulting American wallets at the highest pace in nearly four decades, a recently-published analysis finds that it’s taking a greater toll on lower-income Americans.

The study by Penn Wharton Budget Model found the average household will have had to spend $3,500 more in 2021 to achieve the same level of consumption as in 2020. However, “since lower-income households spend more of their budget on goods and services that have been more impacted by inflation…lower-income households will have to spend about 7 percent more while higher-income households will have to spend about 6 percent more,” wrote Zheli He and Xiayue Sun.

That’s not the only way the Fed printing press contributes to wealth inequality:

- Since there’s a lag between money creation and the resulting price inflation, those who get to use the new money first have a leg up—and Wall Street investment banks and major government contractors are among the first in line.

- The Fed’s creation of money and artificially low interest rates also disproportionately benefits the wealthiest Americans by inflating the value of their invested assets.

The Fed Has Painted Itself into a Corner

With inflation heating up, the Fed and its high-spending DC co-conspirators have boxed themselves in.

If the Fed stops printing dollars that finance runaway federal spending and force interest rates down, inflation may ease but the deficit will mushroom even larger due to higher interest rates on Treasury debt. Higher rates will also affect home and car buyers. Markets will crash and the economy too.

“Either the government is going to have to supply the money or the spending is not going to happen,” said economist and Euro Pacific Capital CEO Peter Schiff on his podcast. “So, either we have a recession, or we have even worse inflation. Because if the government has to print more money to fund more stimulus spending so that consumers can afford to keep buying stuff at higher prices, well then we have an even bigger inflation problem on our hands.”

Though it would cause a major economic disruption, the healthy, long-term alternative is for Congress to embrace fiscal responsibility by sharply reducing the scope of federal government to what’s actually prescribed in the Constitution, slashing a couple trillion dollars from the budget, ending America’s sprawling imperial presence abroad, making the dollar real money again, and dramatically reforming if not eliminating the Federal Reserve.

Don’t count on reelection-minded politicians to do any of that anytime soon. Those measures may someday be adopted, but only after a major calamity gives America no alternative.

This article was originally featured at Stark Realities and is republished with permission.