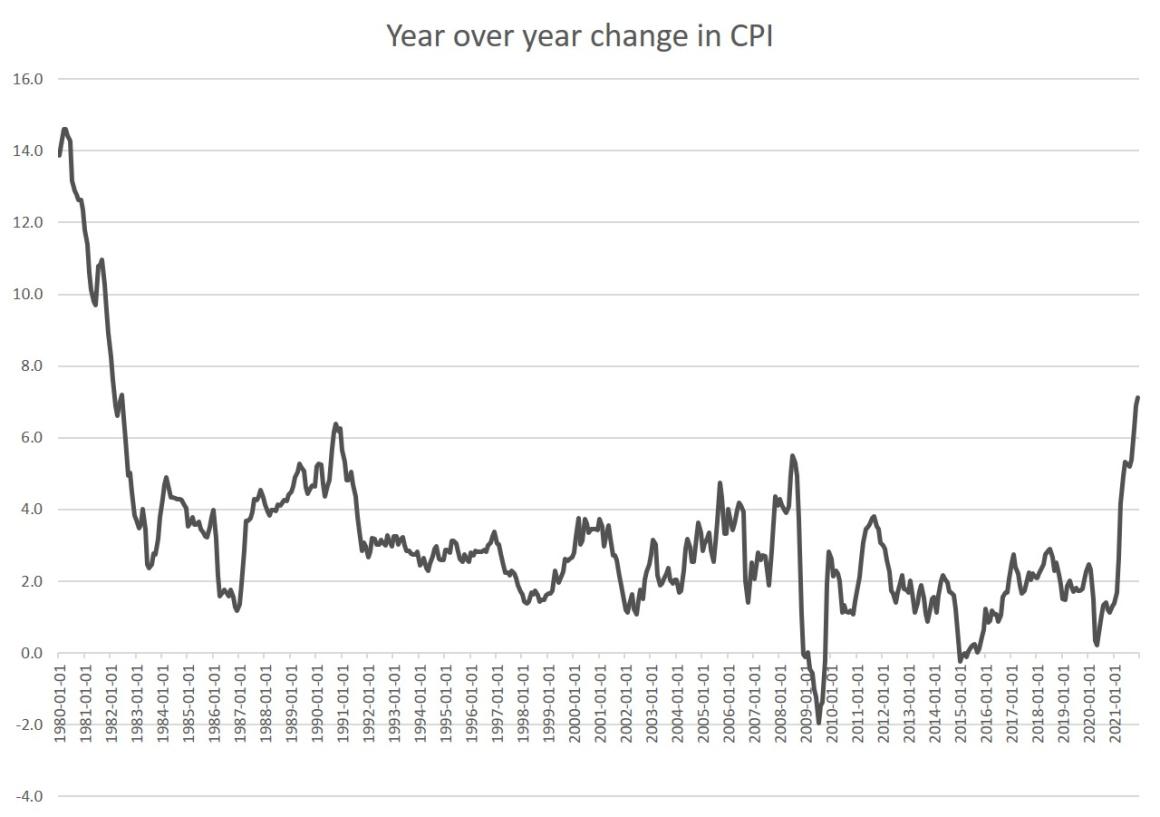

According to new data released Wednesday by the Bureau of Labor Statistics, price inflation in December rose again to a new multidecade high, rising to the highest level recorded in nearly forty years. According to the Consumer Price Index for December, year-over-year price inflation rose to 7.1 percent. It hasn’t been that high since June 1982, when the growth rate was at 7.2 percent.

December’s increase was up from November’s year-over-year increase of 6.9 percent. And it was well up from December 2020’s year-over-year increase of 1.3 percent.

This surge in price inflation is likely to further increase political pressure on the Federal Reserve and Chair Jerome Powell to “do something” about price inflation. After months of insisting that price inflation is “transitory” and not a cause for concern, it became clear by October 2021 that price inflation was surging to some of the worst levels experienced in several decades.

Since then, the Fed has completely changed its tune, and Powell this week called inflation a “severe threat” and reiterated that the Fed plans to raise the target federal funds rate:

As we move through this year…if things develop as expected, we’ll be normalizing policy, meaning we’re going to end our asset purchases in March, meaning we’ll be raising rates over the course of the year.

Note the conditional “if things develop as expected.” Naturally, the Fed’s planned tightening will depend heavily on whether or not the Fed’s economic indicators show ongoing economic improvement and a bullish stock market.

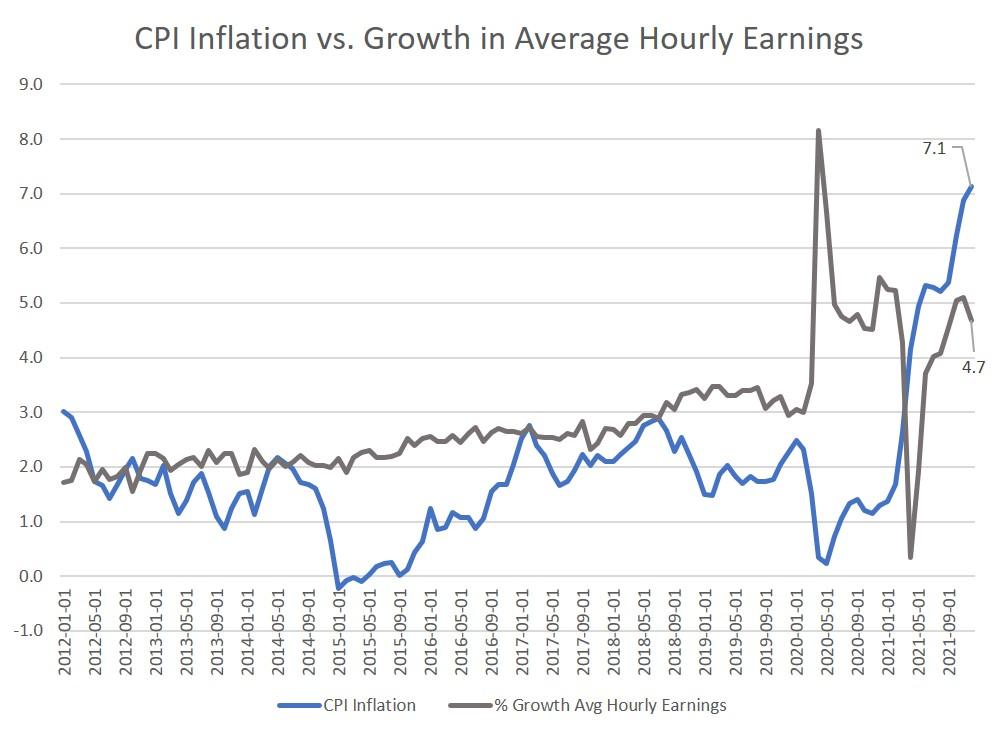

For many Americans, though, the news is already bad, and inflation is taking a bite out of workers’ purchasing power. December’s numbers on average hourly earnings show that inflation is continuing to erase the gains made in workers’ earnings. During December 2021, average hourly earnings increased 4.7 percent year over year. But with inflation at 7.1 percent, earnings clearly aren’t keeping up:

Source: Bureau of Labor Statistics (table B-3, “Average Hourly and Weekly Earnings of All Employees on Private Nonfarm Payrolls by Industry Sector, Seasonally Adjusted“; last modified Sept. 15, 2015); Consumer Price Index.

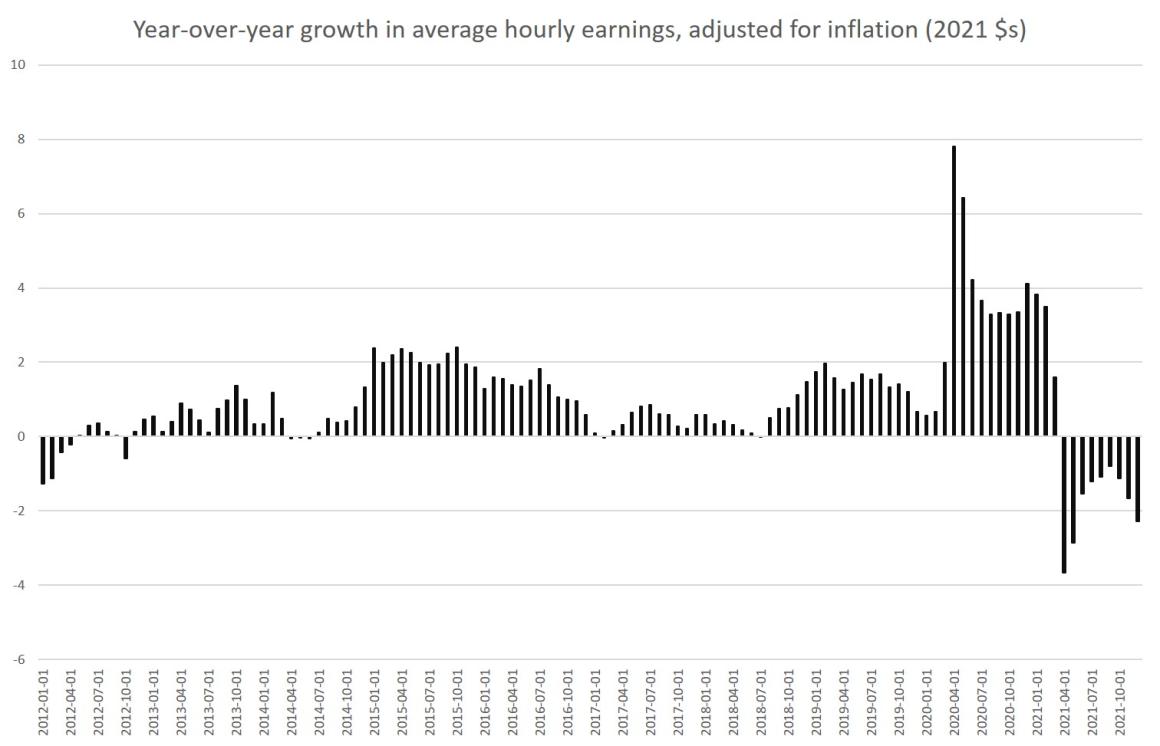

Looking at this gap, we find that real earnings growth has been negative for the past eight months, coming in at—2.3 percent year-over-year growth for December 2021.

Source: Bureau of Labor Statistics (table B-3, “Average Hourly and Weekly Earnings of All Employees on Private Nonfarm Payrolls by Industry Sector, Seasonally Adjusted“; last modified Sept. 15, 2015); Consumer Price Index.

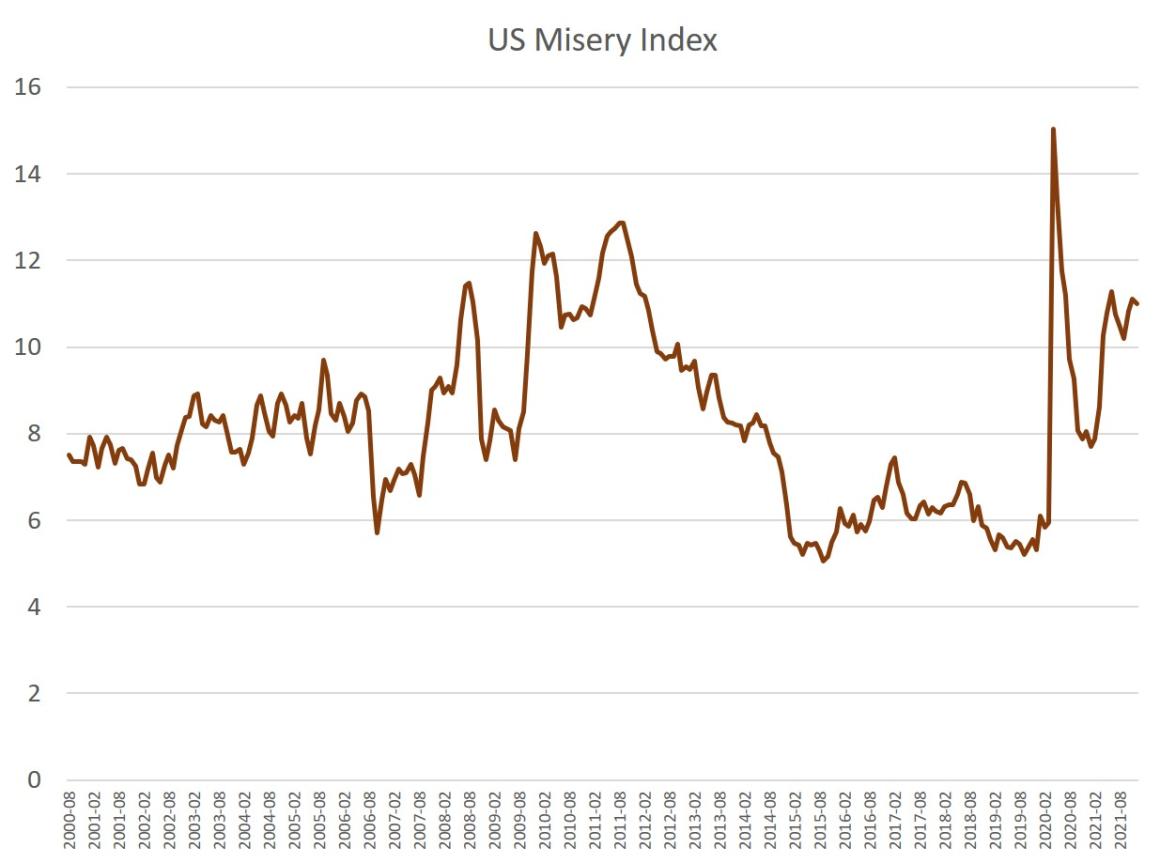

Combined with December’s unemployment rate of 3.9 percent, November’s inflation growth puts the U.S. misery index at 11. Those are “recession-like levels” and similar to the misery index levels experienced when the unemployment rate surged in the wake of the 2008 financial crisis.

In addition to Consumer Price Index inflation, asset-price inflation will likely continue to be troublesome for consumers as well. For example, according to the Federal Housing and Finance Agency, home price growth has surged in recent months, with year-over-year growth now coming in at 16.4 percent.

Apparently, though, the earnings data isn’t capturing the reality of how great the economy really is. As Newsweek noted last week, much of the American public is unhappy with today’s economy in which earnings are falling behind thanks to inflation. But this doesn’t bother economists like Gary Burtless of the Brookings Institution, who points to the stock market as evidence that the public’s “perceptions may not mirror reality.” More explicit was Paul Krugman, who declares: “[T]his is actually a very good economy, albeit with some problems.” Mark Zandy at Moody’s analytics insists “the economy is booming. It’s busting out all over.”

Many voters—who perhaps aren’t quite as prosperous and distant from the troubles of daily life as highly paid economists—disagree with these rosy assessments. And that will continue to result in additional pressure to both the administration and the Fed.

But we’ll find out very soon if the Fed agrees with the idea that the economy is “busting out all over.” Although Powell has stated that he believes the economy no longer needs emergency stimulus, that doesn’t mean the economy can tolerate anything more than a tiny amount of trimming to the Fed’s asset purchases, low interest rates, and other manifestations of quantitative easing. The fact is that in our bubble economy, the boom can only continue so long as infusions of newly created credit continue. The Fed likely won’t have to reverse course on quantitative easing for very long before the lack of ongoing stimulus puts the U.S. on a path to recession. And this likely ends up being the choice the Fed faces: Will it choose to keep the boom going by avoiding a real scaling back of stimulus? Or will it truly try to tackle inflation and set off a recession as a result?

Given that it’s an election year, it’s hard to see the Fed doing anything that might even risk a recession, but if Consumer Price Index inflation continues to climb, the Fed might be forced to do so.