Of all the government or quasi-government institutions, there is perhaps none as openly opaque in its operations and unaccountable for its failures as the Federal Reserve. For, unlike its top rivals for this most dubious of distinctions, like the CIA, NSA, or DOD, which do their law bending and money wasting largely of sight and out of mind, the nation’s money supply is so ubiquitous, so ever-present in the lives of the ordinary person that its activities must of necessity take place before the public eye. Hence, the gradual development of Fed Speak; that is, the art of speaking so technocratically that none but the most arcanely initiated have any hope of understanding what is being said or done.

Consider a few commonplace examples, which one can find in the regularly published minutes of the Federal Reserve’s meetings:

The Fed will “conduct overnight reverse repurchase agreement operations at an offering rate of 0.8 percent and with a per-counterparty limit of $160 billion per day,” and further “engage in dollar roll and coupon swap transactions as necessary to facilitate settlement of the Federal Reserve’s agency MBS transactions.”

Mm-hm. Yes. Indeed—perfectly clear.

Translated: the Fed intends to “buy and then sell back at a set date and price any qualifying security from any qualifying corporation or institution,” essentially, a futures contract meant to help operations that are either illiquid or overleveraged stay in business; and, further towards that end, the Fed intends to “continue to sell short various portions of its now nearly $3 trillion in mortgage backed security holdings,” again in an effort to help illiquid or highly levered dealers and traders of these securities stay liquid.

That Fed Speak elides more than it illuminates is, of course, intentional and operates on a number of levels: first, no ordinary person understands any of this; second, those who do understand benefit from these arrangements, i.e. the major banks, and consequently love it and have lobbied for it; and, lastly, the above combination along with their desire to pass the buck to anyone else means your congressional reps have no interest in intervening with the Fed’s activities, even when it blatantly violates the rules Congress put in place when it set the Federal Reserve up—all Fed purchases having been statutorily mandated to occur in the “open market,” that is at market prices (i.e. not executed as futures contracts).

Lev Menand’s latest book, which I reviewed last year, for all its sympathy for the Federal Reserve’s activities (having been himself an employee), could not avoid deeming the Fed completely out of control, acting since 2008 and through COVID without any bounds at all: an exploding balance sheet, unlimited credit facilities for troubled banks—this is not “Free Market Capitalism,” but rank corporatism, and a major reason young people increasingly view socialism or populist conservatism as preferable alternatives.

For, much like the national security establishment, it isn’t as though these gross violations of the principles of liberal, capitalist government have even produced any notable successes: quite to the contrary, they have produced little but abject failure.

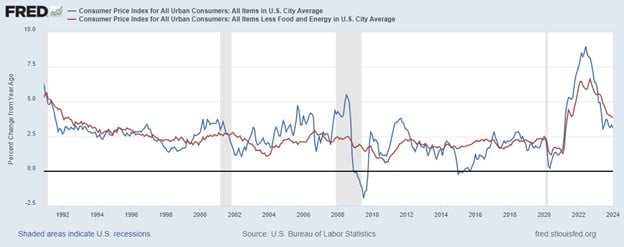

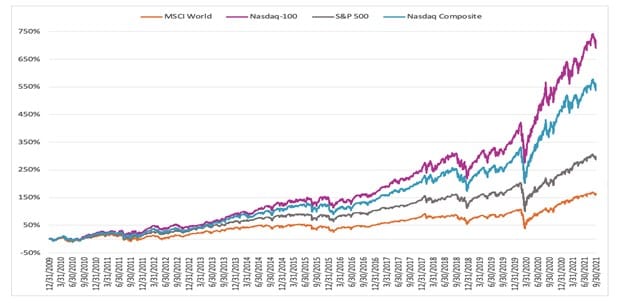

Consider, first, its primary mandate, price stability. Even if you buy the argument for the Fed’s inflation targeting (macroeconomic voodoo), as should be clear by the Fed’s own tracking of its expansion of the money supply and concurrent inflation measures, including not just consumer and producer price indexes but also asset price inflation, it has been running the money printer at a far higher clip than the 2% they claim to be the annual target (see graphs below—and note that the Nasdaq, the index most heavily skewed toward non-dividend paying, high-growth potential technology companies grew the fastest and the most since 2008, a consequence of the lower discount rate the Fed’s looser monetary policy preferences required).

Further, even assuming the Fed hits their 2% annual target, everyone who has seen the infamous graph illustrating the loss of the dollar’s purchasing power since the Fed’s inception will no doubt be aware that by the turn of the next century the value of a dollar in the intervening seventy-plus years would have been further halved.

As far as its second mandate, full employment (yet more macroeconomic voodoo), unless you want a McJob or other insecure work in the so-called “gig economy,” the Federal Reserve’s market distortions have played a central role in undermining investment in the real, rather than the financial, economy.

Whether like Friedrich Hayek you believe currency of choice, the denationalization of money, is the answer, or like Ron Paul believe it is time to simply End the Fed, it is beyond time for public debate to pull back the curtain on the Fed’s language games and call a stop to the inflationists’ game.