Bitcoin and cryptocurrencies are headline news again. DeFi—Decentralized Finance—tokens like LINK and others have exploded in recent weeks, capturing speculators’ imaginations.

But more importantly, given the day-to-day fragility of the capital markets and the political reality they reflect, governments are scrutinizing cryptocurrencies harder.

From the U.S. to China to Russia, governments are drafting laws and rewriting rules to disadvantage the use of cryptocurrencies. This is the main argument against them by hard money advocates and others who maintain that all that has to happen to destroy bitcoin is for the governments to make them illegal.

If that were to happen bitcoin would drop to $10 overnight, they say. I can’t tell you how many times I’ve heard this coming from the mouths of men who, honestly, should know better.

Because I have three words for you that blow open big gaping holes in that argument.

The Pirate Bay.

Can’t Stop the Music

For twenty years peer-to-peer networks have been the bane of the digital entertainment industry. Fire and brimstone have been hurled at the bittorrent community for more than a decade. However, a quick perusal of the major torrent sites reveals that everything the big media companies want you to pay top dollar for is still available.

Slap all the warning labels on the blu-rays you want. Redefine ‘victimless crimes’ in ways that do violence to not only language but the very concept of property rights but it doesn’t matter.

People, always, respond to incentives and the internet, which is vital to the state’s ability to maintain any semblance of control, was built to resist control.

All governments can do is put up artificial barriers to commerce to direct people differently, create perverse incentives and raise costs.

Has that truly ever worked? Has raising the cost of cigarettes stopped people from smoking? No. Health education has. All the taxes did was make government more powerful to feed the dominant political religion of the age, technocracy.

Look around the cryptocurrency space today. Look at the tax code in the U.S. and soon to be Russia, with the pending version of the Digital Currency law.

Classifying cryptocurrencies as property places it in the most disadvantageous category of asset for tax purposes imaginable except for where gold is.

It means every transaction in bitcoin is tracked for capital gains taxes, necessitating filing a 1099-B just like any stock trader, calculating cost basis for every single purchase you make with them.

Buy a candy bar with bitcoin, pay capital gains tax on top of everything else.

If you don’t think that’s tantamount to making it illegal to transact in bitcoin then I really think you need therapy, because it is. It is the ultimate perverse incentive to hold bitcoin rather than spend bitcoin.

This is the reason why Amazon doesn’t take Bitcoin, even though before the IRS classification it was experimenting it. It’s the reason why it doesn’t circulate.

Gresham’s Law is quite simple. Overvalued money (the dollar) drives undervalued money (bitcoin, gold) out of circulation. And, no Martin Armstrong, it is just as true today as it was when money was coins.

And that feeds the next bad argument from those who are smart enough to know better. Driving an asset underground only raises its price rather through a shortage of liquidity and hoarding rather than lowering it.

Liquidity and access to a commodity drives prices down, not up. It’s that pesky free market thing.

Bitcoin v. Gold – False Choice

Today’s bitcoin and cryptocurrency markets operate in an environment that is designed to keep normies out of them. And yet the prices of these assets keep rising and explosively.

So, that also drives those demand for them as stores of value. Remember, all government edicts do is misdirect capital flow to the nearest substitute, not quash demand for the thing.

The counter argument to bitcoin is, of course, gold. “Buy gold not bitcoin,” say these monetary Luddites. Gold is real, bitcoin isn’t. And I agree with them, buy gold.

But, remember, gold is taxed as a collectible in the U.S. This is as disastrous a classification as you can get and yet, the hard money guys keep telling you to buy gold, even though the tax rate on selling gold is 28% rather than bitcoin’s 12% on capital gains.

No one in this community says not to buy gold then? 28% taxes on capital gains is as perverse an incentive as one can get.

Gold you can’t spend in the real world is, in effect, no more a ‘real’ money than a ‘digital’ bitcoin you can’t spend in the real world. Men whom I respect greatly fail to see this basic point that it the issue isn’t reality vs. digital.

The core argument is counter-party risk. That’s what drives demand for these assets. People demand things without counter-party risk during times of chaos.

And that is why the governments are in a classic Catch-22 and are only delaying the inevitability of their currencies’ demise. Everything government does increases counter-party risk while simultaneously driving up demand for assets without it.

I don’t believe for a second that this time around governments banning or outlawing gold will do anything. In fact, they won’t ban gold again not when they can simply, like with bitcoin, raise captial gains taxes to the point where there is almost no incentive to sell it.

Banning them is tantamount to admitting failure. Governments ban things to stifle competition and maintain its power. Banning bitcoin will only increase marginal demand in the long run, increasing the available capital for the cryptocurrency advocates to build systems resistant to the next phase of government intervention.

So, to recap so far.

- Peer-to-peer networking is government intervention proof.

- Bitcoin and gold have been driven underground by rules and tax schemes which make it prohibitively expensive to do anything other than buy and hold them. This, by the way, perfectly satisfies Gresham’s Law.

- This dries up available supply making marginal demand ever more price inelastic. Low supply amid a marginal uptick in demand equals explosive price moves.

- Bitcoin and gold are in the early stages of massive price appreciation.

The Dollar Strikes Back

This week the Fed put out its June meeting minutes and that gave markets an excuse to sell off, extending the weakness in the precious metals and capping the breakout in bitcoin above $12,000, which right now seems to be the latest Maginot Line (see chart above).

At some point you knew the Fed had to counter market expectations that they wouldn’t defend the dollar. They weren’t sufficiently dovish and that was all the markets needed to take some profit off the table.

I’ve been very clear in recent posts (here, here and here) that this weak dollar wave was being exploited for political advantage as much as anything else.

And I never wavered in thinking it was anything more than a counter-trend rally due to end when the reality of a sick global economy made its way back into the news.

Friday’s big news is that Europe’s economic rebound hit a snag. It won’t help that its political leadership are hellbent on locking their economies down to extend the fiction that COVID-19 is still a thing to cower in abject fear to.

That sent the euro down below $1.18 and it looks like the rally’s best days are behind it. Watch for a daily close there below $1.1722 for a sign of further weakness into September.

Because the dollar is still the U.S.’s most powerful weapon and the Fed will move to defend it for as long as it can. And that is the weapon they will use to break gold and bitcoin, not the legal system.

The Revenge of Logic

There are two further contradictions between the argument that governments can simply kill bitcoin by outlawing it.

The first is simple. It is predicated on the idea that government edicts are all-powerful. They are not. If they were then the Pirate Bay wouldn’t still be a thing and gold would still be $35 per ounce, per the Bretton Woods agreement.

The same people who argue for the beauty of competition and free markets and who embrace technology obviating out-dated systems refuse to accept that those same basic economic principles can be applied to money.

They want to fall back on tradition, gold, while denying that technology may have a better solution to the problem of government-issued credit.

Second, they argue for gold as a safe-haven asset which calls the bluff of central planners and technocrats. They also agree that we’re in a phase of the cycle where faith in governments is failing which is why gold is rising.

But they still cling to the idea that all governments’ have to do is point guns at us and we’ll stop being bad. They can decree a thing verboten and it will become so.

I guess their argument is that gold has magic fairy dust and bitcoin doesn’t. Or maybe, just maybe, they don’t understand the technology anymore than the people in charge do.

And that is why they fail.

Look, I know that the State is scary and, right now, awesome in its power. I have no doubt that it will do anything and everything to protect that power. We’re seeing that play itself out daily in our ridiculous media-frenzy-driven, hyperbolic politics.

But that, like so many things, is a short-lived, meta-stable state of being. The transition state from the current monetary system to then next will be messy.

Big Bitcoin

But taking a step back and looking at the bigger picture of Bitcoin today I see something that dwarfs that transition state, because, as a technology it portends a very different future.

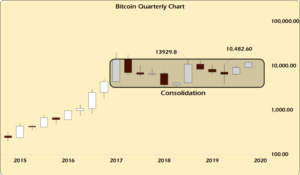

If bitcoin closes Q3 above $10482.60, the Q4 2019 high, that’s a two-bar reversal of a three quarter shallow downtrend within a three year consolidation pattern. It sets up a Q4 move toward the 2019 high around $14,000 and a break above that starts the move to $100,000.

Even if $14,000 holds for another two to three quarters, bitcoin’s base only gets stronger, not weaker. And with demand far outstripping available supply, the probabilities are higher for a move sooner rather than later.

We are three years into one of the most explosive consolidation patterns ever. The last one of this length saw bitcoin rise two orders of magnitude.

With Stock to Flow rising, meaning the rate of inflation is falling while the total hoarded pile is rising, marginal demand can easily push prices to levels that make even the most ardent bitcoin bull blush.

Governments are, as I said earlier, in a Catch-22. If they ban bitcoin demand goes underground, people simply buy and hold it. They acquire it however they can and new technologies come in (decentralized exchanges) come in to replace current ones (Coinbase).

If they don’t ban it then they allow the demand for it as a store of value and financial asset to flourish. It exists in a gray-area where you can use it but you really don’t want to. That allows another relief valve for capital to exit the dying debt-based system and wait for the storm to pass.

Either way, bitcoin and cryptocurrencies win.

Breaking the Law!

There is no upside in banning it because then governments can’t take some advantage of the situation, i.e. collect taxes in a time when tax hunting is the raison d’etre of broke governments.

So, to conclude Bitcoin has already beaten The Man. What happens next is exactly what is just beginning to happen now and what happened in gold in 2011 and Bitcoin in 2017. They will manage the price rise of them while the crisis they can’t avoid unfolds.

This will slowly build into a speculative mania in all of these assets, far above any sustainable supply and demand fundamental.

Then they will change the rules to trap late-comers filled with FOMO in unprofitable positions as they break the market in the short-term. This is what happened in gold in 2011 when they created a $500 billion central bank swap fund and in 2018 when cash-settled futures began trading on the COMEX.

Notice how neither time they changed the law, just the rules of the financial system.

And when that next break in these markets comes, which it will, they will collect obscene taxes when a lot of folks are forced to sell.

But the war for monetary independence will continue until they are no longer relevant.

This article was originally featured at the blog Gold Goats ‘N Guns and is republished with permission.