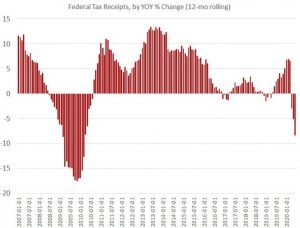

New tax revenue data released by the Treasury Department on Monday shows that tax revenue further worsened in June (compared year over year) from May’s already cratering total.

On the plus side, neither May nor June has returned to April’s historic plunge in revenue.

As shown in June’s Monthly Treasury Statement, June’s total tax receipts were $240.8 billion. That was down 27.8 percent year over year, a decline from May’s year-over-year drop of 25 percent. This was nonetheless less of a plunge than April’s multidecade low in revenue growth, which hit –54.8 percent.

In spite of declining revenue, federal spending continues at a record-breaking pace. Federal outlays surged in June to $1.1 trillion, a remarkable sum for a single month of spending. In recent years, federal spending for an entire year has been between $4 trillion and $4.5 trillion.

With declining tax revenues and soaring spending, the deficit reached new highs in June as well. June’s budget deficit hit $864 billion, a new high. It is now likely that the annual budget deficit will easily top $3 trillion, which will be well above any previous deficits.

The annual deficit reached “only” $1.4 trillion in the wake of the 2008 financial crisis. This moderated over the next eight years, but after years of runaway spending during the Trump administration, the annual deficit again reached $1 trillion in 2019. This was a remarkable feat for a nonrecessionary period, and I warned at the time that this did not bode well for any coming period of economic turbulence. That period has now arrived, and not surprisingly, there appears to be no end in sight to the mounting deficits.

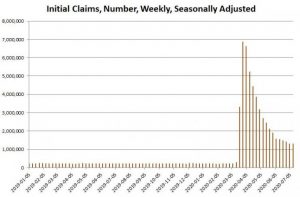

Unemployment Numbers Climb Again

Hopes that the economy might soon roar back and bring some relief from skyrocketing deficits remain unfounded for now.

Today’s new data on initial unemployment claims brought more bad news, as more than 1 million workers filed for unemployment benefits for the seventeenth week in a row. For the week ending July 11, initial unemployment claims totaled 1.3 million, a slight decrease from the 1.31 million workers who filed for new benefits the week prior. That’s in seasonally adjusted numbers. In unadjusted numbers, new claims actually increased from the previous week, rising from 1.4 million the week of July 4 to 1.5 million last week.

Since March, 51 million American workers have filed for unemployment. As of the week of July 4, 17.3 million continue to file for claims.

Moreover, June’s tax revenue suggests that worker income has plunged with employment.

Will earnings and jobs and tax revenue come roaring back in July? This is certainly not a given. After all, many states and jurisdictions are now reimplementing business closures, shutdowns, and other measures which will surely eat away at both jobs and tax revenue. As with the first round of business closures, retail sales and food services are likely to be most immediately impacted.

But underneath those industries are a wide variety of support industries, from janitorial to bookkeeping to commercial real estate, all of which will affect both blue-collar and white-collar hiring.

Tax Hikes on the Horizon?

As earnings and retail sales plunge, the greatest danger to economic recovery lies in the decline of state and local taxes. The threat does not lie with the tax declines themselves, but with the expected policy reaction. As school districts, city governments, and state legislatures face immense shortfalls in revenue, many are now increasingly talking about large tax increases to fill the budget hole. This will be crippling for businesses seeking to come back from the current round of business closures and the collapse in consumer demand for many services and products. Tax increases will cripple the ability of entrepreneurs to shift resources to more in-demand industries and start up new businesses where old ones fail.

Facing uncertainty about both tax increases and the threat of ongoing mandated business closures, many business will wait as long as possible to commit to new staff hires.

This article was originally featured at the Ludwig von Mises Institute and is republished with permission.