We saw a lot of stocks go up huge in May and then have key reversal days on June 9th on high volume.

NVDA for instance went up over 68% in less than six weeks.

Then it had a big down day.

That action looked like the makings of a potential top or the start of a healthy consolidation pause that could last for months.

But now NVDA is back up on it’s high.

It’s hard to expect a stock that went up 68% in such a short-term amount of time to immediately begin another big run like that.

But some stocks are in a position where they look like they could take off into bubble top runs.

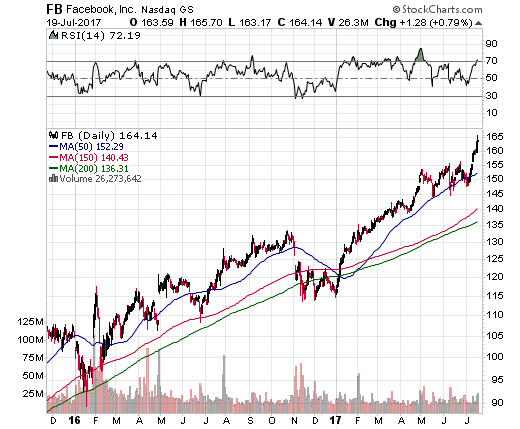

FB is one example.

Take a look at this technical analysis chart.

As you can see FB has been going straight up at an 85 degree angle for the past ten trading sessions.

An advance at that angle is not sustainable forever.