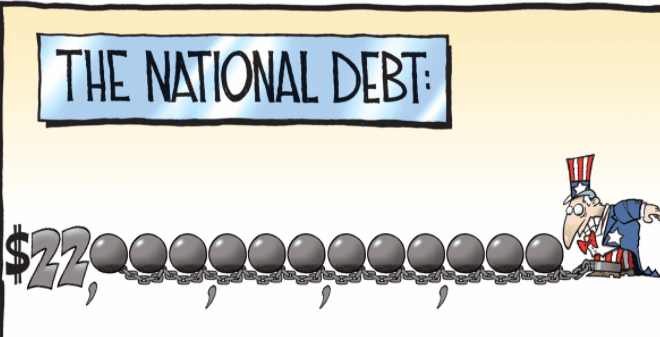

With the U.S national debt currently sitting a little above 23 trillion, there is still a lot of debate about how we got here and whether or not this accumulation is sustainable. Most people in Congress responsible for the matter see it as a problem, stating that “we don’t have the money to pay back our debts.” Though their instincts are admirable, their rational is based off the false idea that taxes fund government spending in our current economic-political enterprise.

When governments issue a sovereign currency, backed by nothing, they will always be able to pay their bills, even if their tax revenues fall short of their expenses. This has been the fiscal reality for most of the world’s governments since Nixon closed the gold standard in 1971.

Federal governments (there is more nuance with state & local) are able to do so because taxes are simply used as the mechanism that gives sovereign currencies value. In this system, sovereign nation’s money is limitless and no more than a key stroke on a computer; it is merely an accounting manuever. Citizens need to accumulate their specific currency to pay their taxes (or else) which creates the demand for it. To acquire the currency, citizens labor to receive a wage or receive a payment directly from the government. Once received they pay back their tax to the currency issuer and that issuer shreds the money. A sovereign currency issuer does not need it’s own money back to spend once more.

The idea that debasing a currency would cause hyperinflation is a presumable counter. There is not a fixed amount of dollars however, so even though the value of a dollar may be decreasing, fiscal, monetary and legislative manuevers can be taken to stabalize prices and increase the purchasing power of citizens.

This video created by one of the thought leaders of this concept, Warren Mosler, describes how the British used this concept to fully employ their coffee plantations in Africa. To get the local population to work for them, they assessed a tax on their huts. If the local population did not pay their tax they would burn their huts. This incentivized the locals to work for the British because they needed to acquire the British currency to pay their tax and prevent them from burning their homes..

Mosler claims that this was great for the local population. The money that was not taxed back was used to develop an economy and everyone was employed. Perfect right?

Well this is the nuance and ultimate question — is this a moral system? The local African population was conquered and then controlled by a more powerful people’s wrath and fiscal policy. Did the local African population have a say in how the government spent, who the government gave the money to, and how the local population would be taxed? The video did not get into that, though it certainly raised these questions.

This misunderstanding of our current fiscal system stalls human progression because it leaves legislatures and the people they represent misinformed and therefore misguided in their policy desires. If they understood that currently taxation is not used to fund government, maybe they would question the ethics behind it. If they understood that governments can and will spend on whatever they want, with as little interference in social and fiscal policy as possible, maybe they would desire a whole different type of political, fiscal and monetary system.

Now Hobbesians will say that humanity cannot break this reality. That there must be an all-powerful ruler deciding how the rest of the majority of human beings will live, but the Hobbsian view is fallacious. Humanity almost committed omnicide during the Cold War with this ideology. It is not sustainable.

Like all systems, the more de-centralized and liberated it is, the more equality, peace and prosperity it will enjoy. If we adopted such a character in our political and monetary livelihoods we could escape this tyrannical conundrum.

Competition among currencies can solve this by creating a marketplace for the most honest and advanced currency. Fixed commodity based currencies could compete with ones who have a subscription, or “tax” and that can be endlessly created. To this author it seems that encouraging our lawmakers to allow this competition with their monopoly currencies is the quickest and most non-violent way to restore honesty and morality back into our socio-economic-political systems across the world.

Maxwell is a freelance writer who works in Finance and is currently pursuing his CFA.