Many people, including some free-market advocates, think Americans are materially worse off today than they were in the 1970s. Some subscribers to that view blame globalization, that is, free trade in goods, which means in labor services.

By any reasonable measure, those people are wrong. Stagnation is a myth. Living standards have never been higher. That goes for an increasing portion of the rest of the world too. After thousands of years, extreme poverty has plummeted to under 10 percent in just a few decades.

This is all well documented. Trade specialist Daniel Griswold writes,

This “nostalgianomics” is misplaced. The American economy is certainly more globalized today than it was decades ago, and just as certainly, most Americans are better off today by any real measure of economic well-being than their counterparts were a half century ago. Increased globalization is one of the main reasons why Americans today have higher living standards than they did in the over-idealized past.

Griswold, whose work at the Cato Institute and George Mason University’s Mercatus Center has focused on this demonstrable human progress, lays out the case in his 2023 paper “The Misplaced Nostalgia for a Less Globalized Past.” (Chelsea Follett interviewed him recently at HumanProgress.org, a Cato project.)

America and the world differ dramatically from the world of a half-century ago. That in itself is not saying much. Since the Industrial Revolution, which was more gradual than we think, change has been the rule. It takes a state to stifle change, and its efforts usually fail, although it can wreak havoc in the attempt. To favor liberty is to favor change, and even though change disrupts patterns and requires adjustments, most people benefit, especially the next generations. Griswold writes:

Along with technological and scientific advancements, the U.S. economy has become far more deeply integrated with the rest of the world. This integration has been driven both by new technologies that have facilitated the movement of goods, services, and people around the world—such as containerization and the internet—and by major trading nations’ concerted efforts to reduce tariffs and other legal restrictions on those same movements.

Unfortunately, trade restrictions are often popular because many people blame the global division of labor for so many ills. Innovation and changing consumer tastes, however, have been more powerful reasons for change. If people are serious about controlling change, they’d have to call on the government to do much more than impose tariffs. Who wants politicians and bureaucrats to regulate science, technology, and consumer choice? Anyone?

Contrary to popular belief, globalization did not “hollow out” the U.S. economy. U.S. manufacturing output has continued to grow. It’s not true that “America makes nothing anymore.” But as Griswold writes, technology enables producers to create more and better goods with fewer people. Robots now perform the drudgery that human beings used to endure. That trend began in the 1950s, not the 1970s. New jobs have replaced the old jobs because consumer wants are unlimited and businesses profit by satisfying them. That governments have often led the way in opening global markets is not an argument against globalization. It’s an argument against government intervention. Politics should steer clear of economics.

What about the alleged wage stagnation? Griswold writes:

Nostalgianomics’ depiction of American “wage stagnation” since the 1970s is fundamentally flawed in several key ways. First, the most typical indicator of such stagnation—U.S. production and nonsupervisory workers’ average inflation-adjusted hourly earnings—relies on an overstated measure of U.S. inflation that makes Americans’ real-wage gains seem smaller over time.

Second, examining only wages excludes nonwage benefits—bonus pay, health insurance, paid leave, contributions to retirement savings, etc.—that have made up an increasing share of total compensation in recent decades.

But hasn’t the middle class been shrinking? Actually, it has—but not to worry:

[T]he share of U.S. households earning a middle-class annual income of $35,000 to $100,000 (in 2021 dollars) did indeed shrink since 1979, from 49.1 percent to 39 percent, but so did the share of households earning below $35,000 (from 30.3 percent to 25.2 percent). By contrast, the share of households annually earning more than $100,000 increased from 20.6 percent to 35.8 percent. Thus, the American middle class has shrunk in recent decades—but only due to households getting richer.

Griswold gives us another way to look at this story.

Even these adjusted income data understate the gains enjoyed by American workers in our more globalized era. In Superabundance: The Story of Population Growth, Innovation, and Human Flourishing on an Infinitely Bountiful Planet, Cato scholars Marian Tupy and Gale Pooley compare time prices (i.e., how many hours people must work on average to acquire various goods and services) across decades and find that American workers have experienced dramatic gains since the 1970s. In particular, they calculate that the number of hours an average U.S. blue-collar worker would have to work to afford a basket of 35 consumer goods fell by 72.3 percent between 1979 and 2019. [Emphasis added.]

That’s a huge increase in real wages.

It doesn’t sound like stagnation, does it? And we haven’t even talked about the quality improvements of products. Americans who aren’t typically thought of as wealthy are richer than the middle and upper classes were in the 1970s. “American workers are better off than in decades past,” Griswold writes, “not only because familiar goods have become more affordable but also because new types of products have come on the market and spread rapidly.” In the 1970s the chairman of General Motors did not have a powerful computer-cum-phone in his pocket. Griswold:

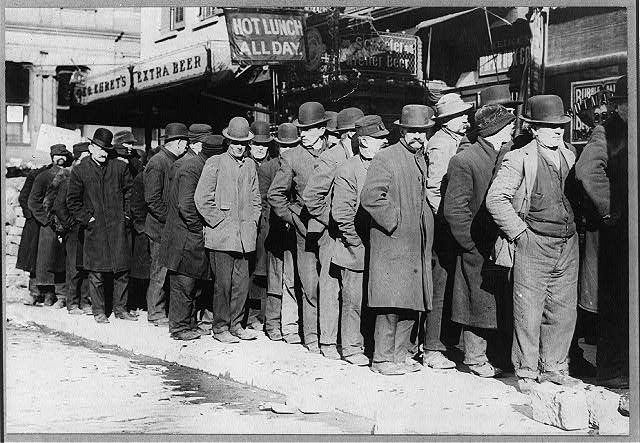

Those who are nostalgic about life in the 1970s would likely have lived without microwaves, personal computers, and the internet. Those looking back to the 1950s forget or ignore the fact that most homes not only lacked air conditioning and color TV but also lacked dishwashers and clothes washers and dryers.

More could be said, but that ought to be enough to dispel the myth of stagnation. (For more, see Griswold’s data-rich paper.) The myth may be oddly appealing to certain free-market advocates because it seems to allow them to say to America’s rulers, “Statism harms the middle class and poor while benefitting the rich!” But whether or not stagnation has occurred is an empirical, not an ideological matter. If market advocates ignore the facts, they sacrifice their credibility.

The fact is that despite government interference and favoritism (such as central banking, regulation, taxes, subsidies, tariffs, etc.), profit-driven, consumer-serving market forces will increase, within limits, general well-being. Sure, we would have been richer without the intervention, but markets, like Timex watches, can “take a licking and keep on ticking.” Acknowledging that we’d have been even better off is not equivalent to saying that incomes have stagnated for the last half-century. That’s nonsense. So is the claim that wages have not kept pace with productivity growth or that labor’s “share of national output” has shrunk. (See Gene Epstein’s lecture at the Mises Institute on these points.)

It’s self-defeating to deny what’s right before our eyes.