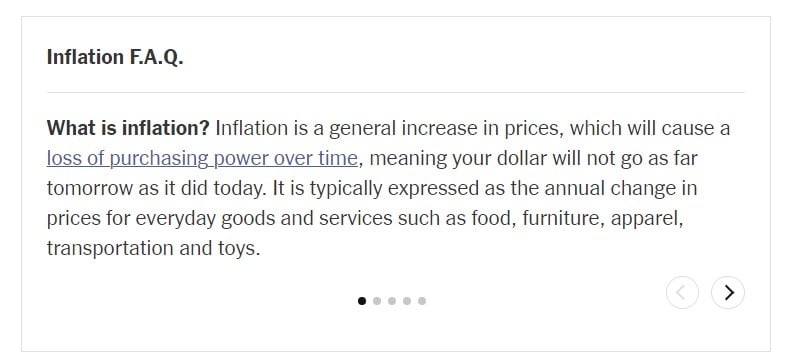

Perusing New York Times articles directly related to the topic of price inflation, one can find an “Inflation FAQ” purporting to explain what inflation is and what causes it.

As an example, a February 29 article by Jeanna Smialek titled “A Key Inflation Measure Moderated in January” featured the FAQ below a lead paragraph claiming that “price increases are coming back under control”.

Naturally, there is no explicit acknowledgment from the Times that the price inflation occurring after the implementation of COVID‑19 lockdown measures was a consequence of the monetary “stimulus” used to pay the costs for the government’s lockdown madness.

This, of course, is because the Times was a cheerleader for the lockdown insanity and is a steadfast cheerleader for the Fed’s inflationary monetary policy.

For humorous illustrations of how the Times serves the propaganda function of manufacturing consent for Fed policy, see my book Ron Paul vs. Paul Krugman: Austrian vs. Keynesian Economics in the Financial Crisis.

As a reminder, in mid-2021, Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell described the inflation resulting from the Fed’s “stimulus” as “transitory“, yet here we are still in 2024 reading apologetic news articles about how “price increases are coming back under control”.

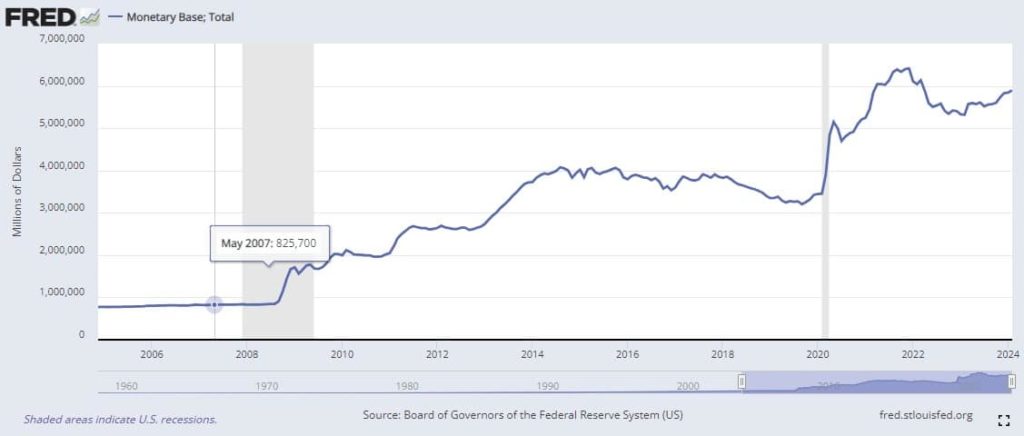

To remind you further of the context, the Federal Reserve by June 2022 increased its balance sheet by nearly $5 trillion, from about $4 trillion up to $9 trillion:

Here is the resulting increase in base money supply, from about $3.5 billion to $6.5 billion:

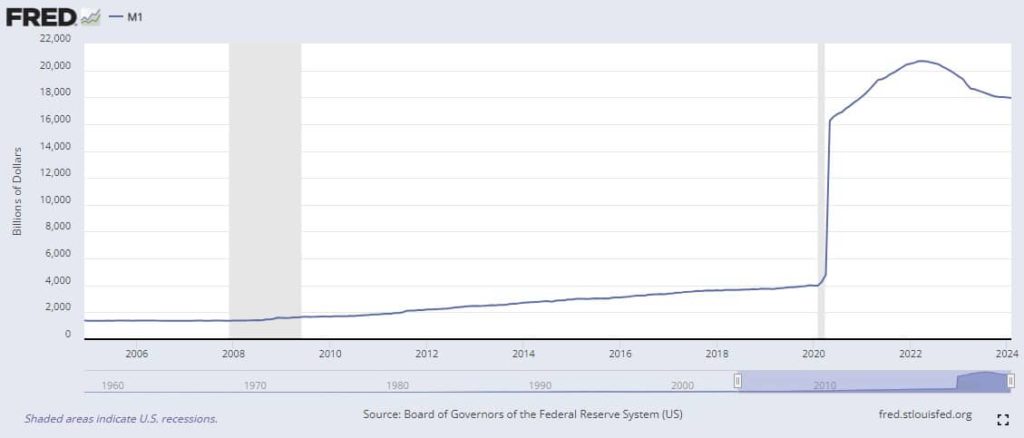

And here’s a look at the “M1” measurement of the money supply showing an increase from about $4 trillion to over $20 trillion.

But never mind all that. Here is the New York Times‘s explanation for what price inflation is and what causes it:

So, according to the Times, price inflation is merely the result of “rising consumer demand” and supply factors. Nothing at all to do with the Federal Reserve and its inflationary monetary policy!

A better way to think about it is that inflation is the expansion of the money supply, which devalues the dollar, the inevitable consequence of which, all else remaining the same, is an increase in the prices that consumers pay for goods and services.

The Times‘s FAQ was featured again in Smialek’s March 29 article, “A Key Inflation Gauge Hovers Above Fed’s Target“, which explains that the Fed “quickly raised interest rates to about 5.3 percent between early 2022 and the middle of last year” and has held them steady since “in an effort to cool the economy and rein in inflation”, but there is again no explicit acknowledgment that it was the Fed’s money printing, which pushes interest rates artificially low, that caused the price inflation in the first place.

A second article by Smialek published the same day and titled “Fed Chair Says Central Bank Need Not ‘Hurry’ to Cut Rates” reiterates essentially the same story, with the FAQ again misleading readers into thinking that the price inflation was somehow just a consequence of the chaotic free market, with the Fed portrayed as some heroic institution to stabilize the economy by correcting the market’s errors.

If one clicks the link in the FAQ to learn more about the “loss of purchasing power over time”, one arrives at yet another article by Smialek, published in January 2022 and titled “Inflation Has Arrived. Here’s What You Need to Know.“

There, under the subheading “What is inflation?”, the Times hints at the cause of crazy prices for consumer goods by noting that the Fed’s target is a 2% annual increase in the Personal Consumption Expenditures Index (PCE), which is the Fed’s preferred measure of price inflation, with a second measure being the perhaps more well known Consumer Price Index (CPI).

But under the subheading “What causes inflation?”, the Times sticks with its claim that Fed policy has nothing to do it, instead blaming high prices on “quirks” like supply chain problems (also a consequence of the lockdown stupidity) and “demand”.

At least that Times article goes on to acknowledge that price inflation disproportionately harms the poor.

Hooray for the lockdowns and central banking!

Cross-posted from JeremyRHammond.com.

![The Kyle Anzalone Show [GUEST] Dave DeCamp: BREAKING: Tucker Carlson detained in ISRAEL! – Trump’s Iran Strategy Exposed!](https://offload-wp-files.sfo3.digitaloceanspaces.com/2026/02/Screenshot-2026-02-27-115531-400x250.png)