Saturday, October 17, 2009

How “Justice” Operates Under A Criminal Regime

Thieves for their robbery have authority when judges steal themselves. —

Shakespeare, Measure for Measure, Act II, scene 2

It’s time to play that time-honored children’s game, “One of These Things is Not Like the Others.” In this case we’re going to examine three case histories of people accused of a supposed offense called “tax evasion.”

“It’s all in the wrist”: Treasury Secretary and Goldman-Sachs bagman Timothy Geithner demonstrates his technique for picking the taxpayer’s pocket.

Our first example involves Mr. Timothy Geithner, who refused to pay Medicare and Social Security taxes for several years — despite the fact that his employer would have reimbursed him for the tax expenditures. A 2006 audit revealed other irregularities in Mr. Geithner’s tax history, including dubious dependent-child deductions.

Despite these, ah, irregularities, Geithner was confirmed by the Senate as the Secretary of the U.S. Treasury, which collects tax revenues for — among other things — redistribution to Geithner’s colleagues and former co-workers on Wall Street.

Sure, tax revenues are spent on other purposes, such as interest payments on the federal debt and killing harmless foreigners. But since the Congress made the Treasury Secretary the de facto economic dictator a year ago, servicing politically connected Wall Street criminals has become that department’s primary mission, one that has devoured trillions of dollars in wealth.

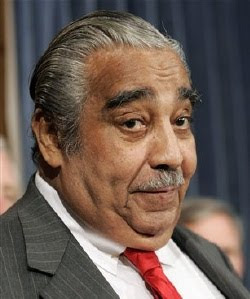

Next, we turn to the case of Mr. Charles Rangel, a resident of New York, who refused to pay taxes on $75,000 in rental income from properties he owns in the Caribbean.

Rangel’s first impulse was to share — no, to give outright — most of the blame for his tax evasion to his wife, Alma, who manages the family finances.

With equal generosity he tried to cut in the Spanish-speaking tenants of the property for a slice of the blame as well: “Every time I thought I was getting somewhere, they’d start speaking Spanish,” he insisted.

Rangel’s problems continued to accumulate when it was pointed out that his tax evasion was undertaken in order to facilitate other forms of fraud: He couldn’t accurately report his Caribbean income and qualify for “hardship”-case rent controls on properties he maintained in New York City, or the special “homestead” tax exemption he claimed on his property in Washington, D.C.

Despite those infractions, and others involving congressional financial disclosure rules, Rangel has retained his job as a New York Congressman and, more importantly, chairman of the House Ways and Means Committee, which is where tax laws that govern other people are written.

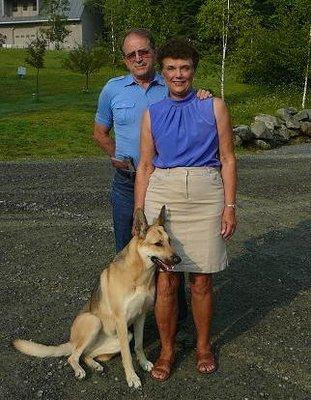

The third case we’ll examine is that of New Hampshire residents Ed and Elaine Brown. Convicted of “tax evasion” and “resisting arrest,” Mrs. Brown, 68, has been sentenced to thirtyfive years in federal prison — an effective life sentence.

Her husband’s sentencing has been deferred until he has undergone a “psychiatric evaluation”: As was the case with political prisoners in the former Soviet Union, Mr. Brown is suspected by state authorities of being clinically deranged because of his eccentric political views. Chances are pretty good that if he avoids prison, Ed Brown may be institutionalized for the rest of his life.

Obviously, the case of Ed and Elaine Brown is different from those of Geithner and Rangel, since they’re not part of that sanctified stratum of society entitled to live at the expense of the rest of us. They, like most of us, belong to that class of people whom the law fails to protect, rather than the class that the law fails to restrain.

Unlike Timothy Geithner, the Browns aren’t involved in stealing huge sums of money. Unlike Charlie Rangel, they’re not involving in imposing “laws” that justify the pilferage of privately earned wealth.

The Browns stole from nobody, inflicted no harm on anybody, and spent most of their lives (with the exception of one matter discussed below) providing honest services to other people in mutually beneficial transactions. None of this is true of the likes of Geithner and Rangel, for whom plunder has proven to be a lucrative and respectable career.

Like Geithner and Rangel, Ed Brown — as a very young man — once tried to enrich himself through theft, only to be caught, tried, and imprisoned for that crime. In 1976, Brown was given an unqualified pardon for that crime, which he committed as an 18-year-old. He then built a business as an exterminator.

For her part, Elaine built a large and successful practice as a dentist. Neither one of them lived at the expense of other people; they were producers, not parasites. In 1996, the Browns decided that they wouldn’t permit the likes of Geithner and Rangel to continue stealing from them in order to enrich political favored cronies and constituents. So, like Geithner and Rangel, the Browns stopped paying their taxes.

In January 2007, the Browns were “convicted” of the supposed crime of tax evasion and invited to turn themselves in for imprisonment. They impudently scorned that generous invitation, choosing instead to barricade themselves inside the home the Feds planned to steal from them and letting it be known that they would use lethal force to defend themselves against any federal aggression.

The Browns’ Plainfield, New Hampshire home — invariably referred to as a “compound,” the preferred description of any dwelling in which live people the government intends to kill — was surrounded by paramilitary troops from the U.S. Marshals Service.

In short order the home also became a focal point for armed private citizens who intended to support the Browns in the event of an armed assault and, more importantly, to be on-scene witnesses to help deter any potentially murderous aggression by the Feds.

While the Browns were occupied at their home, a small army of heavily armed federal agents seized Elaine Brown’s dental office — an act of felonious armed robbery. Unfortunately — albeit predictably — the throng of Brown supporters was seeded with paid federal informants, two of whom, posing as supporters, gained access to the home and arrested the middle-aged couple without incident.

Put on trial for eleven felony weapons and “conspiracy” charges, the Browns were found “guilty.” That is to say, the court demonstrated that the Browns threatened to use the same means to defend their lives and property that were to be employed by those seeking to deprive them of the same.

The Browns had assembled an enviable arsenal of firearms, ammunition, bullet-resistant clothing, and homemade explosives (or, as the federal prosecution insisted on describing the pipe bombs, “improvised explosive devices” — a term intended to evoke the image of “terrorists” detonating hidden weapons while fighting U.S. troops in Iraq).

Assistant U.S. Attorney Arnold Huftalen, who presided over the prosecution, initially sought a prison sentence of up to 44 years for the Browns. Holding aloft one of Elaine’s handguns, Huftalen simpered that “This was not a small, dainty, self-defense handgun,” describing it instead as a heavy weapon “designed to kill 17 people without reloading.”

Given the indignation with which Huftalen invested every lisping syllable of his presentation, one might think that the weapons possessed by the armed federal agents surrounding the Brown home were designed to tickle people. But Huftalen, as a servant of a criminal regime, assumes that only the state has the right to use or threaten lethal force, and that its victims commit some variety of terrorism when they arm themselves with implements of self-defense more effective than Q-tips or Nerf balls.

“Mr. and Mrs. Brown did not engage in a principled dissent against laws they felt to be unjust,” pronounced federal Judge George Singal as he imposed the sentence. “Let us not be fooled. The conduct engaged in by Mrs. Brown was purely criminal.”

To be “criminal,” conduct has to inflict demonstrable harm against an identifiable victim.

Neither Huftalen nor Singal can describe a single instance of palpable harm that resulted from the refusal of the Browns to pay income taxes, or from their acquisition of the means to defend themselves and their home from the criminal syndicate bent on stealing their property and, if necessary, murdering them.

Even if we were to accept the premise that tax “evaders” injure the “public good” by withholding their wealth from the public fisc, how can it possibly be a greater crime for the Browns to deprive the Feds of a couple of hundred thousand dollars, while the unpunished tax “evader” Timothy Geithner shovels out hundreds of billions of dollars to con artists on Wall Street?

Yes, the Browns threatened to shoot or otherwise kill anybody who tried to harm them. This, coupled with the presence of a large number of witnesses, is probably the only thing that saved their lives.

Thus it is of some interest that Huftalen (as reported by the Nashua Telegraph) chose to seek a life sentence for Elaine Brown — despite the fact that she had never harmed a living soul, and despite the fact that there was no physical evidence linking her to the explosives in the Brown household — “in order to deter Brown supporters [and, presumably, other Americans] from engaging in similar conduct.”

It’s worth remembering that tax evasion, far from being a crime of any sort, is among our nation’s oldest and most sacred political traditions. The War for American independence from Great Britain was carried out by people who engaged in exactly the same kind of “criminal” conduct for which Elaine Brown will spend the rest of her life in prison, and for which her husband may end his days in the American equivalent of the Soviet psihuska.

Sure, the government ruling us — the same one that not only countenances, but promotes, the monumental criminality of Geithner, Rangel, and their ilk — calls tax evasion a “crime” when it is carried out by people outside of the privileged caste.

Real crimes involve some variety of force and fraud to deprive someone of something to which he is entitled. Nobody is entitled to take the property of another through taxation, even if such pilferage is “authorized” by a majority of 300,000,000 to 1. The course pursued by Ed and Elaine Brown may have been unwise, but it neither picked my pocket nor broke my leg.

Pocket-picking and leg-breaking are the veritable job descriptions of those who seized the Browns’ property, kidnapped them, and are preparing to detain them for the rest of their lives. This is how “justice” operates under the Robber State that afflicts us.

Don’t forget to listen to Pro Libertate Radio each weeknight from 6:00-7:00 Mountain Time (7:00-8:00 Central) on the Liberty News Radio Network.

Available at Amazon.com

Dum spiro, pugno!

Content retrieved from: http://freedominourtime.blogspot.com/2009/10/how-justice-operates-under-criminal.html.