The Terrorists Among Us

“If it were up to me, I’d line ’em all up against a wall and shoot them.”

Such was the sentiment expressed by one of Richard Yancey’s supervisors during his brief and robustly unpleasant stint as a collection officer for the Internal Revenue Service. Yancey has recounted his experiences in exquisitely revolting detail within the pages of his book, Confessions of a Tax Collector – which, given the rapid approach of Tax Day, is seasonally appropriate reading.

Why in the name of all that is rational are people afraid of al-Qaeda and remote Jihadists of a similar stripe when the IRS runs rampant within our borders, marinating its personnel in murderous hatred of the agency’s victims?

“This is war,” Yancey was told by a superior early in his 13-year career. “Surely this simple truth has occurred to you at some point in the last six months. You are at war.”

“The language of war and the culture of conflict are the only means to prepare us for what is expected of us,” Yancey recalls in his memoir. “How else could they [those at the top of the agency’s criminal hierarchy] demand what was expected of us? You can’t take [taxpayers’] life savings, their car, their paycheck, the roof over their head and the heads of their children, without dehumanizing them, without casting yourself in a role that by necessity makes them the enemy.”

Those who are educated in the IRS’s training madrassas are required to dehumanize the taxpayer. They are likewise taught to believe that the State – that holiest of institutions — is never wrong.

On one occasion recorded by Yancey, he and other trainees were informed that the IRS had no use for agents “who anguished over each closure, as if their decision meant life or death for the taxpayer.” When one trainee objected that this often is literally the case, the trainer replied that the agency’s role has nothing at all to do with “doing the right thing for the taxpayer”; it was simply that of “protecting the government’s interest.”

“But what if the government’s interest is wrong?” objected the blessedly obtuse trainee.

“Our interest is never wrong or right,” responded the trainee. “It just is.”

Some dare call this nihilism.

Former IRS District Chief David Patnoe has admitted that his agency specializes in terrorism: “More tax is collected by fear and intimidation that by the law. People are afraid of the IRS.”

To which Yancey adds that the agency uses terrorism to cultivate informants: “No one likes to hear this, but your neighbor is not your friend. All I had to do was flash my commission and I’d have your life story…. Your neighbor is going to tell the IRS where you work, what kind of car you drive, what kind of jewelry you wear….” And so on. Not content with compiling a financial profile, IRS investigators will squeeze from neighbors and associates whatever potentially compromising details they can find regarding the target of an investigation: “Drink a little too much? Seeing a psychologist? Had an abortion? Faking a disability? We’ll know. And most of the time, we won’t even have to ask.”

What can’t be wrung from human sources, the IRS will obtain through data-mining by way of the Integrated Data Retrieval System, the agency’s proprietary database. Through IDRS, Yancey notes, he could learn, almost instantly, more about taxpayers “than they know themselves.”

Yancey, incidentally, was referring to an information system he first used in the early 1990s, which is practically the Pleistocene Era where computer technology is concerned.

(For more about Yancey’s book, please see my article “Repackaging the IRS,” originally published two years ago in The New American and now available at The Right Source.)

One of Yancey’s most interesting observations is that IRS collection agents generally avoid going after organized crime figures – the case of Al Capone being relatively exceptional. This aversion is born out of understandable fear of violent retaliation, but also reflects the fact that the typical gangster, unlike the law-abiding taxpayer, enjoys political protection of some kind.

In every particular, the IRS is a criminal syndicate operating under color of positivist “law.” A federal lawsuit in Las Vegas – the city built by organized crime – is testing whether the federal Racketeer Influenced and Corrupt Organizations act (RICO) can be used against IRS agents, federal prosecutors, and police officials who participated in an unnecessary armed assault against a businessman in 2003.

The plaintiff, Robert Kahre, runs a construction business in which all of his workers are independent contractors paid in real money – gold and silver, issued by the US Mint, rather than the State’s fraudulent scrip. As ICs, the workers are responsible to pay their own taxes.

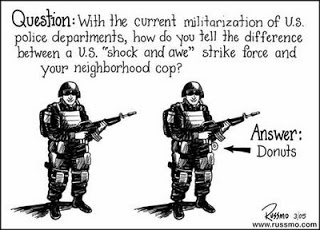

In May 2003, Kahre’s business sites were hit with – what else? — a paramilitary raid by SWAT teams working in tandem with federal personnel. About fifty agents armed with submachine guns invaded Kahre’s offices, confiscating papers, computers, and – of course – cash.

More than 20 employees and members of Kahre’s family were handcuffed and held at gunpoint; the detainees included an 85-year-old man and a 14-year-old boy. Some of the victims of this act of State terrorism were held outside, in direct sunlight and 106-degree heat, without water, for hours at a stretch. One site was reportedly searched without a warrant. Kahre himself was arrested on a state warrant by an IRS agent, who didn’t have jurisdiction over the matter.

The prosecutor at that trial will be Assistant U.S. Attorney J. Gregory Damm, who is the lead defendant in Kahre’s RICO suit, as well as a separate civil rights action.

Damm has attempted, without success, to have the civil rights lawsuit (which was filed immediately after the raid) dismissed. In October 2004, Federal Judge Philip Pro ruled that Damm is “not entitled to absolute immunity for claims that he planned every phase of an unlawful raid.” In March 2005, an appeal by Damm and IRS agents was rejected by the 9th Circuit Court of Appeals.

Three weeks after losing that appeal, Damm secured the first tax indictment against Kahre.

“Wouldn’t you like to indict the person who just sued you?” commented San Diego attorney William Cohan, who is representing Kahre, to the Las Vegas Review-Journal.

Now that Damm is the defendant in two federal lawsuits filed by Kahre, he is ethically required to recuse himself from the case against the businessman. Yet he is still, as of now, scheduled to be the lead prosecutor when the trial begins on May 22.

Clearly, there was no justification for the armed raid in May 2003. Damm could very well lose the civil rights case, or be forced to settle it; in fact, the Feds might well do this in an attempt to pre-empt the RICO action. And it’s difficult to see how a reasonably competent defense attorney could fail to persuade at least some jurors that the indictment against Kahre was an act of cynical retaliation by a petty, corrupt, and incompetent prosecutor.

Did someone say “incompetent”?

Roughly a year ago, a $14 million securities fraud case Damm built against a clique of shady attorneys – people accused, plausibly, of defrauding investors out of their money, which (unlike violations of the IRS code) is an actual crime – was thrown out of court because he refused to turn over more than 600 pages of discovery materials to the defense.

When James Mahan, the Federal District Judge at the trial, confronted Damm about this omission, the prosecutor replied with such flippancy that the Judge reportedly threatened to have him “spend the evening with the marshals” unless the materials were provided immediately. Among the facts Damm and his associates attempted to conceal was the fact that several prosecution witnesses who had already testified had struck plea bargain agreements.

How far down in the Great Chain of Being does this Damm guy have to be in order to earn a slap-down from a trial judge, after enduring one from the appellate judge to refused to dismiss the civil rights suit?

It would be easy for a defense attorney to portray Kahre as the victim of an incompetent legal bureaucrat looking to take out his frustrations on a helpless citizen – and that approach would probably play in Vegas. So as I lift my aquiline nose to the wind, I catch the faint scent of settlement offers in the clouds gathering over this case.

In addition to the Damm problems with this case, it’s interesting that his supervisor, until less than a month ago, was Daniel Bogden, one of the eight US attorneys removed in the White House-orchestrated political purge. Perhaps the Feds will conclude that they have trouble enough in that US Attorney’s office without pursuing the case against Kahre.

Then again, the Leviathan might want to make an example out of Kahre, and spare no expense to do so. In either case, the chief objective will be to do whatever is in the best interest of the apparatus of fraud, plunder, and terror of which the detestable IRS is a representative component.

Arm yourself to do battle with the Leviathan: Visit The Right Source for news, commentary, Kevin Shannon’s talk radio show, and Tom Eddlem’s “The Right Action” — a freedom-centered program for activism.

Content retrieved from: http://freedominourtime.blogspot.com/2007/03/terrorists-among-us.html.