Earlier today we discussed a report by Goldman Sachs which, when summarized, suggested that unless something significant changes in the coming years, the current US fiscal policy will lead to a debt catastrophe. In an unprecedented warning, the bank which spawned Trump’s chief economic advisor Gary Cohn, ironically the architect behind Trump’s fiscal strategy, warned that “the continued growth of public debt raises eventual sustainability questions if left unchecked.”

It is worth highlighting that for Goldman to warn that the US fiscal and debt trajectory is unsustainable is quite unprecedented, especially since it is the bank’s former President and COO who has put the US on that path.

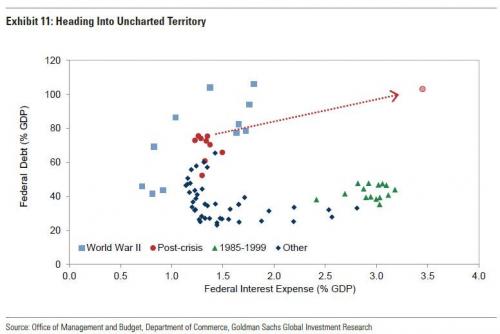

And while we urge readers to get acquainted with Goldman’s list of concerns, all of which are very troubling, there is one specific chart which lays out clearly why the US is now headed for “banana republic” status amid developed economies when it comes to US debt sustainability, or in this case lack thereof.

That chart is below, and it shows total projected US Federal Debt on one axis, and US interest expense as a % of GDP on the other. The result is the red dot in the top right.

This is how Goldman puts it:

The US appears to be headed into uncharted territory—at least for US fiscal policy—regarding the relationship between interest expense and the debt level.

As shown in Exhibit 11, interest expense considerably exceeded the current level during the late 1980s and early 1990s, though the debt level was moderate. By contrast, the debt level was slightly higher during and just after World War II than it is today, while the level of interest expense was similar.

However, we project that, if Congress continues to extend existing policies, including the recently enacted tax and spending legislation, federal debt will slightly exceed 100% of GDP and interest expense will rise to around 3.5% of GDP, putting the US in a worse fiscal position than the experience of the 1940s or 1990s.

While Goldman is absolutely correct, all else equal, we doubt all else will be equal in a few years when US debt is well above 100% of GDP, and the blended US interest expense is the highest it has ever been in US history. As we noted earlier, while a sovereign debt crisis appears inevitable under the conditions laid out be Goldman, the only loophole is “if the Fed proceeds to monetize the deficit once again as it did in 2009-2015, sending yields plunging as the next and final episode of QE is unveiled.”

Which, we concluded, “is precisely what will happen, and is also why Goldman is already starting to load up on all Treasuries it can buy.”

And while the next episode of QE will in no way resolve the looming US debt crisis – and in fact make it even worse eventually – it will at least again kick the can for a few more years, something in which the Fed has demonstrated a remarkable effectiveness time and again. Meanwhile, as even Goldman now admits, the incremental debt incurred as part of the next episode of debt monetization “would put the US onto an even less sustainable long-term trend.”

Who knows, maybe one of these days Goldman will even start pitching cryptocurrencies. After all, as Deutsche Bank already wrote, “If Trust In Monetary & Political Stability Were Lost, People Would Turn To Cryptocurrencies.” And if there is one thing an unsustainable long-term trend for the US means, it is the guaranteed loss of “trust in monetary and political stability.”

This article was originally published at Zero Hedge. Reprinted with permission.