Yesterday the Federal Reserve raised interest rates and projected two more rate hikes by year-end.

The stock market’s reaction was muted, but silver and gold firmed up after the news and are ticking up this morning.

At some point, the FOMC is going to pause on its interest rate hikes as we are approaching the end of this fight tightening cycle.

I talked with Jim Goddard about this and what it means for all markets in this interview:

The coming Fed rate hike pause will come once it manages to hike two or three more times or if the stock market dips ten percent first.

And that announcement is going to fuel the next giant rally in silver and gold.

But silver and gold may actually begin to move into that news.

Silver, in particular, is in a position where it could just breakout and run this summer and even this month.

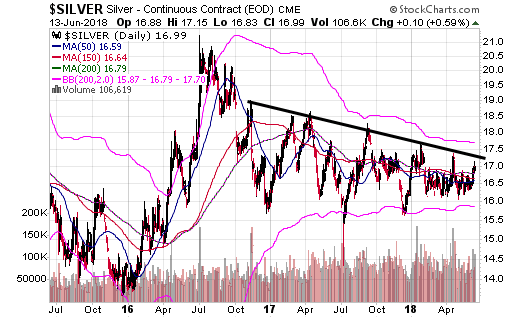

Silver has a simple consolidation triangle pattern with resistance below $17.50. A close above $17.50 will spell the completion of this pattern and signal the start of a new rally.

I talked about why I believe that both gold and silver have a great entry point from an investment standpoint in detail in this PDF report:

http://wallstreetwindow.com/reports/thebestinvestmentnow.pdf

Now once the Fed decides to pause on interest rate hikes as I talked about yesterday Jerome Powell is going to one day announce a sudden new Federal Reserve theory to justify ignoring low unemployment figures that decades of Fed orthodoxy claim create inflation.

I don’t know what that theory is going to be, but the reality is that low headline unemployment figures are not creating higher wages.

One reason is that the figures don’t factor in people who are jobless and have been unemployed for longer than 15 months.

If you factor them in real unemployment is around 8%.

But another big reason is that the Labor Department expects that more people are going to enter the workforce in the next eight years.

These people are not going to be immigrants.

And they aren’t going to be the young.

They are going to be people over 60 who are desperate and need a job, because they have no retirement, no savings, and are on the edge of poverty.

And those who reach the age of 70 are expected to flood the workforce in by 2020.

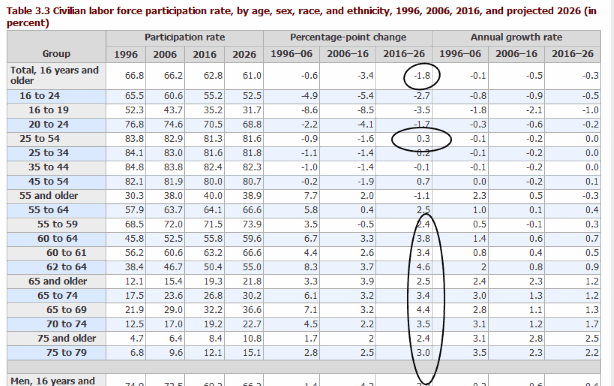

Look at this table from the Labor Department with their projections on how the American workforce is going to grow in the next few years.

Notice what age groups it is going to grow in:

You can see more of this table here on the BLS website.

According to a CNBC article most people between the ages of 54 and 64 today only have $120,000 in savings.

And people younger than that have even less.

So the government sees a flood of people who will have no resources for retirement hitting the job market in the coming years.

Ten years ago if you when you went to McDonald’s you’d see a lot of teenagers working there.

Now when you go you see just as many people over 60 as you do over 20 behind the counter and in five years all of them will be older folks.

You can consider them to be victims of the 2008 crash and economic malaise that has continued ever since.

And what is worse so many of them are fully invested in both the stock market and bond market so risk getting totally wiped out on the next downturn.

They need to own gold and silver, but most refuse to do so holding on to a belief that the only thing they can do is be fully invested in the stock market and hope it goes up enough for them.

So many refuse to diversify or do the work needed to learn how to manage their money better.

And if you try to warn them that we are now facing the biggest bubble in human history in the bond market they just say you are “fake news” – which has become a mantra on both sides of the political spectrum used to shut off thinking.

All too often people make investment decisions based only on fear.

So they fear moving some money out of stocks and into something like silver, because they could “miss out” if the DOW goes up a few more months without them.

But good decisions aren’t based on fear, but on looking at opportunities and measuring risk.

And if precious metals are going to go up in the next cycle buying it isn’t about fear, but about opportunity.

The best times to invest in something are when the masses are totally asleep on it.

-Mike Swanson

Recent Writing in Defense of Free Immigration

"The Trumpian Ice Age: The Frigidity of Collectivism" "Immigration Policy in an Nth-Best World" "Free Movement Increases Wealth" "Static Analysis Clouds Immigration Debate" "More on Immigration and Public Property" "Immigration Control Threatens the Rule of Law"...