The Government’s COVID-19 response was met with the obvious effects like the lockdowns that decimated the lives of millions to little to no effect on mitigating the spread, mask mandates, or even vaccination mandates. But underlying all of the obvious issues was that of economic destruction being laid down before the American people in the form of the Federal Reserve’s response to the economic collapse caused by lockdowns. The Federal Reserve has laid down a suicide path for the United States’ economy.

The money supply is created in part by the private banks making loans and the Federal Reserve monetizing the debt, as well as allowing banks to transfer funds between one another. During the shutdown of the country, the Federal Reserve took unprecedented steps to allow the easy flow of credit, in a sour attempt to prop up the bubble economy. Much like after the 2008 housing market crash, the Federal Reserve slashed the Federal Fund Interest Rate to near 0% in 2020. The Federal Funds Rate being the minimum interest rate that banks must charge in transactions of reserves between one another. This rate affects most consumer interest rates that will result in credit flowing to the economy. This allowed the economy to brace for its immediate collapse that followed the popped bubble. Furthermore, the Federal Reserve, in March of 2020, dropped Reserve requirements (the required percentage of deposits it is legally supposed to retain in reserve), to 0%. By dropping them to zero it allows banks to continually loan out the money deposited to them, retroactively increasing the monetary supply (as depositors work under the illusion that the money loaned out is still in their accounts).

These low interest rates and lack of reserve requirements laid the path for ruin, as banks have the ability to loan out mass amounts of credit and got the economy drunk on easy credit. As described in Austrian Business Cycle Theory, when mass amounts of easy credit floods into a market, malinvestment occurs alongside inflation. When the malinvestment is realized, because of project failures or the supply of credit being tapered, a crash occurs. Federal Reserve policies involving easy credit led to the Great Depression and the 2008 Housing Crash and subsequent Great Recession.

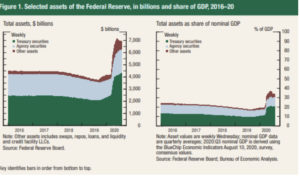

In 2020 the Federal Reserve expanded the monetary supply by exponentially increasing the balance sheet, and subsequently pumping that money into the economy.

In 2008, when the Federal Reserve slashed interest rates to deal with the recession, they had the ability to slash up 5% of the Federal Funds rate, and following the shutdown, only 2.5%. With the housing market being impacted by only a rise of 0.25%, the collapse will only come sooner than before, and much less rate slashing room is available to the FED. The fall to the bottom will hurt far more than in previous business cycles, and it will only be through self repair that the market would be allowed to repair itself.

In fact, in the bonds market, the yield curve inverted, with two-year bond yields topping ten-year bond yields. This is often a signal of a coming recession.

Ultimately, it is time for Americans to brace for an economic collapse. The Federal Reserve’s attempt to hike interest rates will pop the new bubble economy and lead to a collapse in every industry dependent on easy money. How will the Federal Reserve respond to the recession? Likely by slashing interest rates once more, but the dollar is unlikely to survive. Americans had better brace for the fall and little false help that the Government can try to provide.