“The inflation tax, while largely ignored, hurts middle-class and low-income Americans the most,” Ron Paul wrote back in 2006, concluding that “Federal spending, deficits, and Federal Reserve mischief hurt the poor while transferring wealth to the already rich.”

A friend of mine from Venezuela told me an extreme example of how inflation transfers wealth, which I’ve told before. This Venezuelan saved up a down payment and bought a home for about 300,000 Bolivars in 2007 (roughly $25,000). After five years of payments, he still owed far more than half the principal, but his monthly payments had fallen from more than $100 to less than $1 because of hyperinflation in Venezuela. My friend—by then living in the United States—paid off the entire mortgage (which should have been well over $10,000) for less than $130, not even one day’s wages as a laborer in the United States.

The corrupt Venezuelan government had basically gifted my friend the property through the mechanism of inflation. But the bank was not cheated; they still got their six percent (or whatever interest rate they charged).

So who was cheated?

The people who got cheated were the bank’s depositors, poor and middle class workers depositing their wages and small businessmen depositing their receipts that had become virtually worthless. Thus, it’s not surprising the middle class has been wiped out in Venezuela and extreme poverty has increased, as it has in every country where inflation has careened out of control.

“Sure,” one might argue, “that has happened in Venezuela with its extreme hyperinflation. But America’s inflation is much more moderate. Surely, this wealth transfer from the poor to the propertied doesn’t happen in America!”

Yes, it does, only at a bit slower pace. And that pace can be quantified with some very simple math.

Let’s say a real estate developer starting out in business buys a rental property worth $1 million with a 20% down payment. It doesn’t matter if that million dollar property is a residential rental property like a one-bedroom apartment on Beacon Hill in Boston, Massachusetts, a large three-family in the outskirts of Biloxi, Mississippi or a small commercial storefront in downtown Bakersfield, California. The principal here is the same.

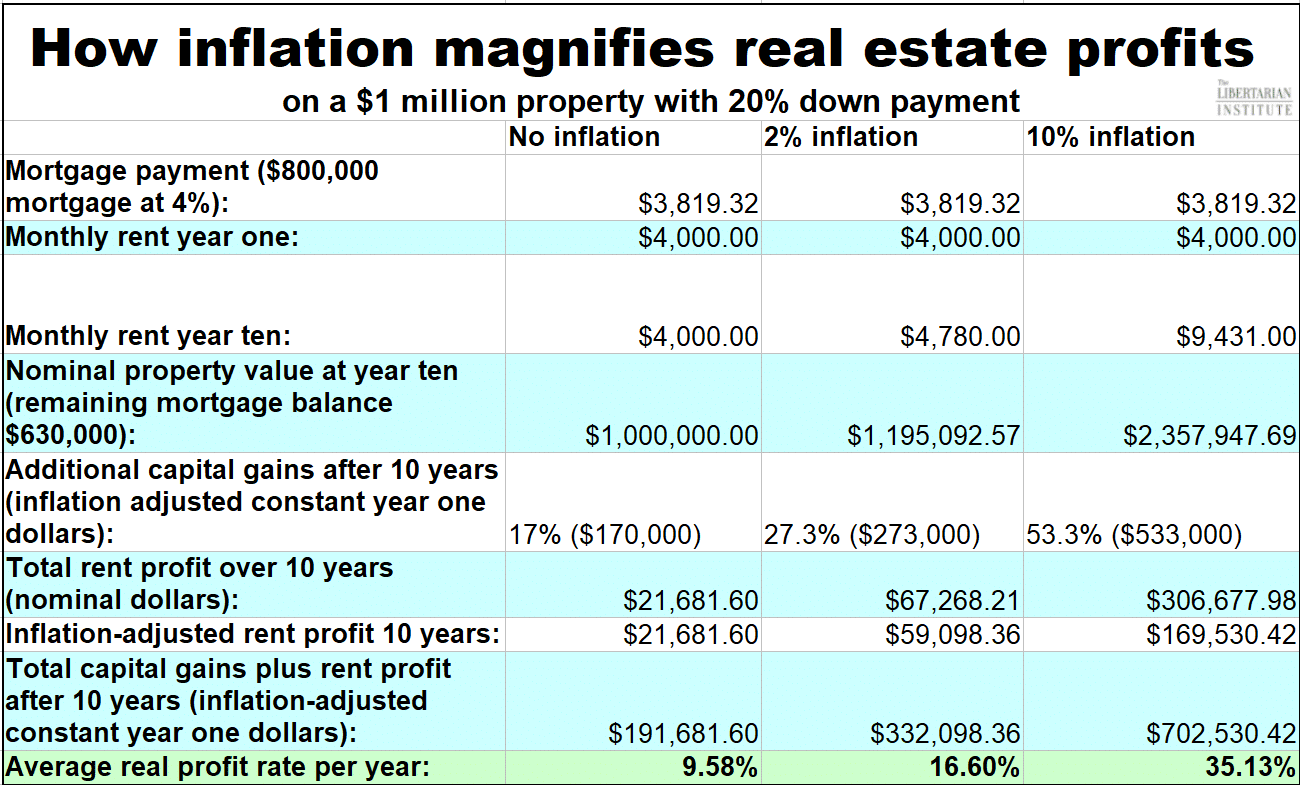

In my chart (below), I’ve assumed real numbers from an $800,000 mortgage at a 4% fixed rate and assumed these properties can gain rents of $4,000 per month. And let’s track three people buying a $1 million property with only one difference: the general inflation rate. Each of the three has no worries about tenants and all the bills of upkeep, and assume taxes and insurance are included. One is investing in a zero inflation market, the second in a 2% annual price inflation market, and the last in a 10% annual price inflation market.

In a normal free market situation, the zero inflation market, the new landlord can get renters to pay him enough to cover his expenses plus a bit of spending money. Over time, the landlord will also gain equity in the property as he pays off the principal on the mortgage. After ten years, between the profit in rent and the added equity in the property, he has nearly doubled his initial $200,000 investment. And he will be able to live off the rent in retirement after thirty years when the mortgage is completely paid off.

Few people object to this kind of capitalism; nor should they.

Now let’s look at how price inflation (which is created by real inflation, the increase in the quantity of money in circulation) impacts the landlord’s rental profits and the equity gained in the property over ten years.

Inflation creates a situation of generally rising prices, including rents, even while the mortgage is fixed at $3,819 per month. Over time, rents increase in tandem with the general price levels, as do nominal property values. And perhaps not coincidentally, these are the two main sources of real estate developer profits.

As the above chart shows, the landlord buying a house in a 2% annual inflation market gains triple the rent profits and half again the real capital gains of the landlord in the zero inflation market. His overall profit is almost double that of the person in the zero inflation market, more than an additional $140,000 for just 2% inflation. And the greater the inflation, the greater the profit margins for the real estate developer. The landlord in the 10% annual inflation market has nearly double the profit of the person in the 2% market and more than triple that of the landlord in the zero inflation market. And the landlord in the 10% inflation market makes more than $500,000 extra compared to the no inflation market—on a single rental unit!

Inflation magnifies real estate profits when the property is purchased on credit. It’s important to point out that the property itself does not increase or decrease in real value, as in all three scenarios it’s the same property with the same upkeep. No amount of inflation can add or take away even a penny of value from any tangible asset—whether landed property, a yacht, a classic car or a rare coin or a painting. But inflation does directly impact dollar-denominated assets, like mortgages, because inflation lowers the value of the dollar.

The chart above probably very significantly underestimates the additional profit in the inflationary real estate market among professionals. Standard procedure in the real estate industry is to pull equity out of houses over 20% and reinvest them in new properties. While at year ten, the landlord in the zero inflation market doesn’t quite yet have the extra 20% equity to buy a second property, the landlord in the 2% inflation market has more than enough to purchase a second property, and the landlord in the 10% inflation market has enough equity to purchase two additional new properties. So the landlords in the inflationary markets would already be making profits on multiple properties by the tenth year, further increasing their gains (again, these gains are not measured in the chart above).

Also, it should be stressed that the above profits assume the counter-factual assumption that property values and rents will only rise in tandem with other prices in the economy. The suppression of interest rates by the Federal Reserve Bank below the market interest rate can have the impact of doubling the value of housing over time, over and above inflation, as happened between 2000-2022. And this bloats real estate profits even further by increasing the equity obtained and the ability to reinvest in additional property units.

This happens across the economy in financial markets. The value of hedge funds globally has increased from a little over $100 billion in 1997, where it was a negligible outlier in the global economy to more than $5 trillion in 2024, a more than 4,200% increase. This increase is not a result of free market forces in operation, but is instead at least partly a result of inflation adding a soft back-stop to losses. Knowledge is power, and if you know asset prices are going to go up consistently, and interest rates are near zero, you can leverage that knowledge into financial gain.

From whom are these massive increases in profit for debt-based industries—real estate, banking, hedge funds and the financial industry—coming from? Who’s paying it?

Inflation rewards debtors like the real estate developer owners of mortgaged properties, but it punishes creditors who are owed cash-based assets and those holding cash by making those assets worth less. There is approximately $27 trillion in cash, savings, and checking accounts in the $29 trillion U.S. economy, and wages are about $12.5 trillion of that economy. And all of the wage proportion of the economy is cash-based, meaning that wages are one of the prime sources from where these gains are extracted—just like the wage-earning depositors being cheated in my Venezuelan example.

In America today, the working poor and the middle class are the ones subsidizing rich real estate developers and hedge fund shareholders with their wages and checking account deposits.

Federal Reserve Bank Chairman Jerome Powell and the Federal Reserve has said, “Inflation has made further progress toward the Committee’s two percent objective but remains somewhat elevated.” Telling Americans that they only want to give working people a two percent wage cut next year on top of this year’s three percent wage cut—but it looks like working people’s pay cut may be more than two percent this year anyway—would be too obvious and generate a political revolt. But the latter would be a more honest way of saying it.

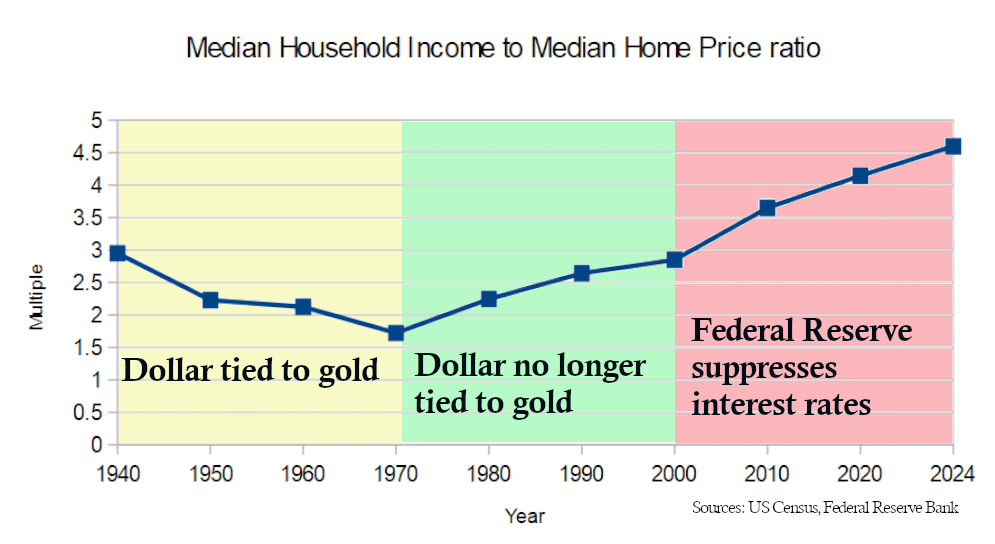

Some people in the middle class lie to themselves thinking they are benefiting from inflation because of the mortgage on their home. But the reality is the opposite. Middle class families only “benefit” from inflation during that time the outstanding balance of their mortgage exceeds their salary, which in ordinary times is not more than fifteen years over a forty-five-year working career. But because inflation (especially since the end of the gold standard in 1971) suppresses salaries and the Federal Reserve Bank’s interest rate suppression spikes housing prices over-and-above inflation, that appears to be a longer period of a middle class family’s life.

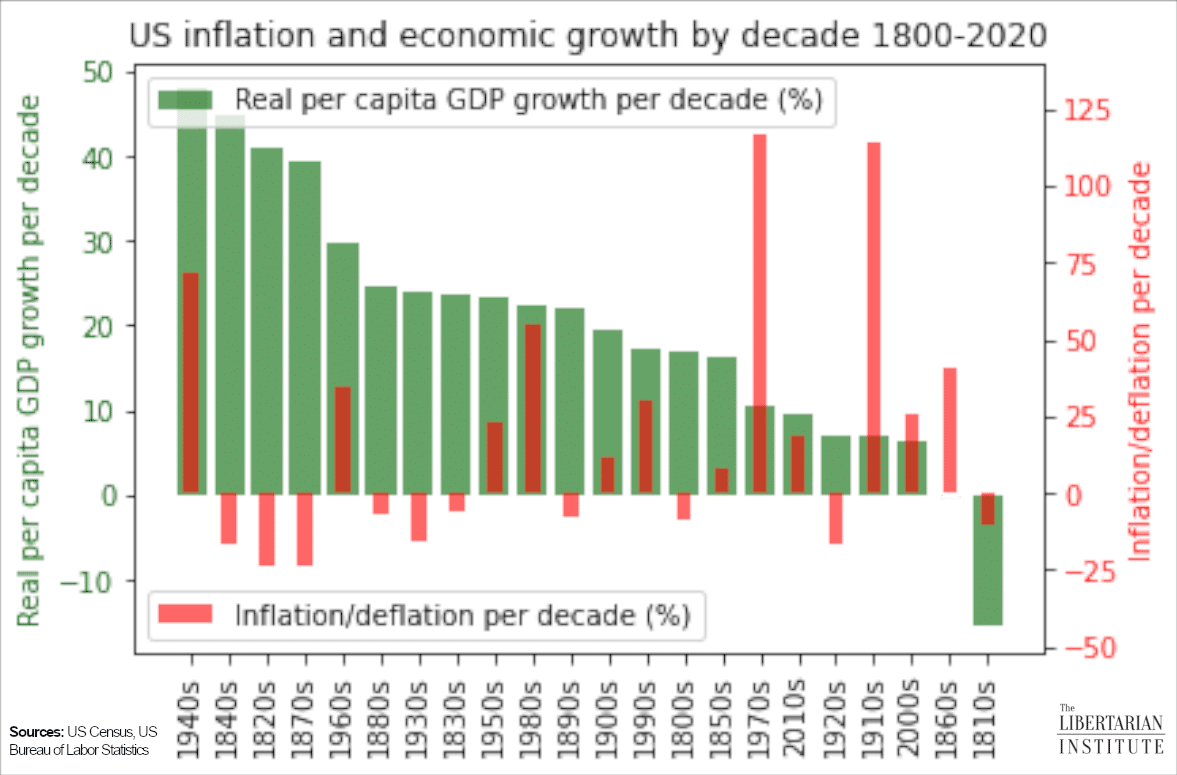

Jerome Powell and the financial elites argue that 2% inflation is necessary for strong economic growth, and that long-term deflation is devastating for an economy. But this argument is a myth invented by the robber barons to keep the grift pipeline from working people to the wealthy ongoing. The argument that low inflation is economically beneficial (other than to the rich who leverage debt) never had any basis in fact, and American history serves as a sharp rebuttal to that propaganda line. Real GDP growth on average has generally been stronger in decades of mild deflation than with mild inflation throughout American history.

It’s important to stress that no group of wage-earning working people ever rallied in favor of inflation or against the gold standard. American working people have traditionally been very free market-oriented. There’s a reason why it was the super-rich banking interests of the Morgans and the Rockefellers that secretly campaigned for and eventually won establishment of the Federal Reserve Bank that’s been responsible for inflation since 1913. It was not working people or union leaders who traveled in secrecy to Jekyll Island to plan the creation of the Federal Reserve Bank, but bankers. Revolutionary communists also favor a central bank (it was the fifth plank in the Communist Manifesto) in an unholy alliance with the money-changers of the financial industry, but working people never sought it.

There are segments of the wealthy elites—only segments, but these are the wealthy elites who control our government—who will never give up on the Federal Reserve Bank and its twin powers of monetary inflation and interest rate suppression because their extreme wealth depends directly upon it.

And only a massive revolt by working people against the Federal Reserve Bank can the very tilted scale of America’s financial system be righted.