California’s catastrophic wildfires have become an annual tragedy. Beyond the devastation they bring to communities and ecosystems, these fires are a powerful metaphor for the unintended consequences of human intervention in natural systems. A primary culprit in California’s wildfire crisis is the state’s stringent environmental regulations, which often prevent the clearing of deadwood and other combustible materials. By not allowing these natural fuels to be managed by interested private companies, the state creates the perfect conditions for devastating infernos.

This dynamic offers an instructive analogy for understanding economic crises and the government’s role—or lack thereof—in managing them. Just as deadwood must be cleared from forests to prevent wildfires from raging out of control, economic downturns must be allowed to run their course to purge inefficiencies and allow for renewal. The contrasting approaches of Presidents Warren G. Harding and Herbert Hoover provide a case study in how interventions—or the lack of them—shape the economic landscape.

In 1920, the United States faced a severe economic downturn. Wartime inflation had ballooned, credit was tightening, and unemployment surged. The economy contracted sharply, with wholesale prices dropping by over 30% in a matter of months. By the standards of what would become orthodox economics, this should have been a catastrophic depression, requiring massive government intervention to stabilize the economy.

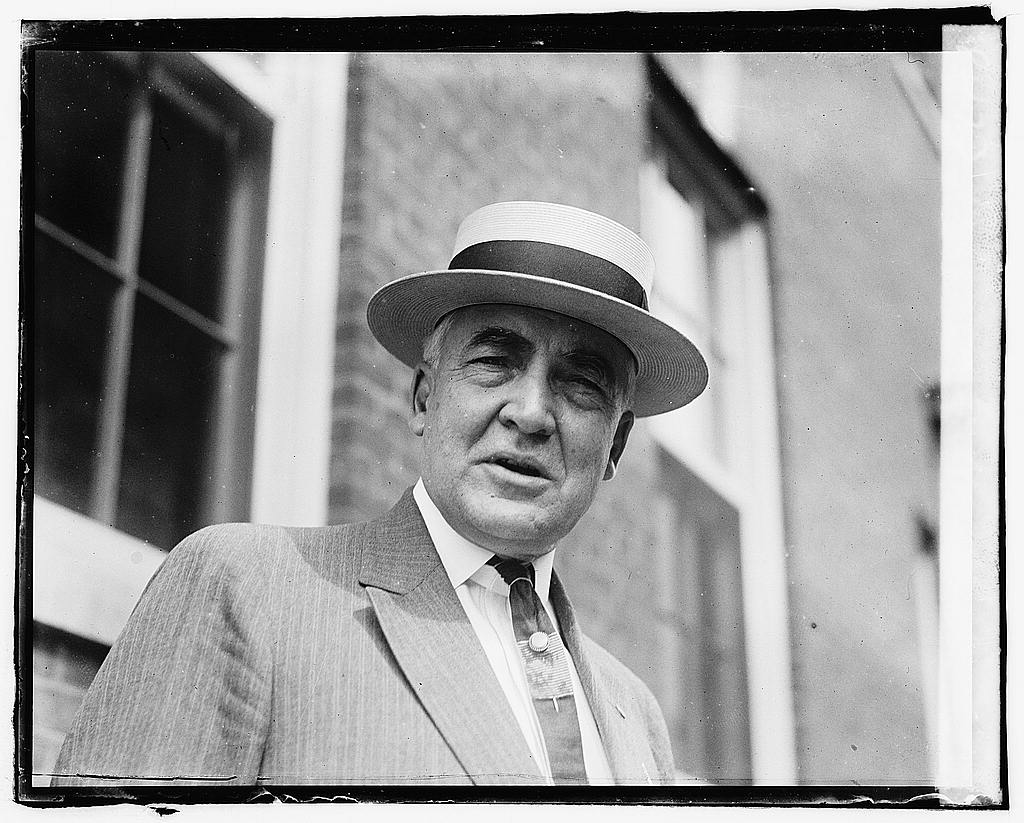

Yet Warren G. Harding, who took office in March 1921, chose a different path. Rather than intervening aggressively, he trusted the resilience of the free market. Harding reduced government spending by nearly 50%, cut taxes, and allowed businesses to fail. While painful in the short term, this approach cleared away economic “deadwood”—inefficient enterprises and misallocated resources that had grown during the excesses of the postwar boom.

The result? By mid-1922, the economy had fully recovered. Unemployment dropped from 11.7% in 1921 to 2.4% by 1923. The rapid recovery demonstrated that markets, when left to their own devices, could recalibrate swiftly and effectively. Harding’s hands-off approach kept the downturn from metastasizing into a prolonged crisis.

Contrast this with the response to the economic collapse of 1929. Herbert Hoover, who became president just months before the stock market crash, rejected the laissez-faire approach of Harding. Instead, Hoover expanded government intervention, signing the Smoot-Hawley Tariff Act to protect domestic industries and initiating massive public works projects. Despite his reputation as a champion of limited government, Hoover’s policies were anything but hands-off.

Franklin D. Roosevelt’s New Deal only intensified this interventionism. The government instituted a vast array of programs to manage prices, wages, and production while creating make-work programs to address unemployment. These policies prolonged the Great Depression by stifling the natural corrections of the market. Businesses that should have failed were propped up by government largesse, preventing resources from flowing to more efficient enterprises.

The Great Depression lasted over a decade, with unemployment averaging 17% throughout the 1930s. Economists have since argued that government interventions—whether in the form of Hoover’s tariffs or Roosevelt’s regulatory schemes—distorted market signals and prevented the economy from recovering as swiftly as it had in 1921.

The analogy to California’s wildfires becomes clear. Just as forests accumulate deadwood without proper management, economies can accumulate inefficiencies—poorly run businesses, speculative bubbles, and unproductive investments. In both cases, the failure to address underlying problems creates the conditions for catastrophe.

When governments intervene to prevent economic corrections, they allow “deadwood” to pile up. Policies that bail out failing businesses or artificially prop up prices might seem compassionate in the short term, but they prevent the economy from purging inefficiencies. The longer these interventions persist, the more severe the eventual crisis becomes.

California’s refusal to allow the clearing of deadwood doesn’t stop wildfires; it makes them far more destructive when they inevitably occur. Similarly, government intervention in the economy doesn’t prevent downturns; it often makes them deeper and more prolonged.

Harding’s approach in 1921 was not without its critics. Allowing businesses to fail meant short-term pain, with unemployment temporarily spiking and bankruptcies rising. But this pain was necessary to lay the groundwork for a robust recovery. The same principle applies to forest management; controlled burns and clearing deadwood might be disruptive in the short term, but they prevent far worse destruction down the line.

By contrast, Hoover and Roosevelt’s policies sought to alleviate immediate suffering but created long-term stagnation. The interventions of the 1930s disrupted the market’s natural ability to recover, just as California’s regulations disrupt the forests’ ability to maintain their natural equilibrium.

As policymakers grapple with economic challenges they would do well to remember the lessons of Harding and the 1920-1921 depression. Interventionist policies might win political points in the short term, but they often exacerbate underlying problems.

California’s wildfires and the Great Depression share a common moral: systems, whether ecological or economic, must be allowed to correct themselves. Clearing deadwood is essential to maintaining balance and preventing catastrophe. As Harding demonstrated a century ago, sometimes the best course of action is to step back, endure the pain, and let the system heal itself.