The same cohort of Democrats who championed the slogan “save democracy” this past year, fresh from having their national party tank the process of “fair” primaries for the third presidential election in a row, are now in a snit over Donald Trump trying to impair the “independence” of the Federal Reserve Bank.

Federal Reserve “independence” has these days taken on an almost religious fervor in some sectors, as if creating an unconstitutional fourth branch of government immune from the voters and the officials they elect was a mandate of heaven. A lot of this is driven by zombie partisan politics. President Trump wants to fire Federal Reserve Open Market Committee Chair Jerome Powell because he’s reluctant to lower interest rates, so Democrats (being the reactionaries they are) feel obligated to defend the “independence” of the Fed.

Certainly, the central bankers love “independence” this way. They loved pumping up the housing market with below-market interest rates in the early 2000s and letting President George W. Bush and his Republicans take the blame at the polls for the resulting financial crash. Likewise, they had no problem increasing the supply of money in circulation by 40% in 2020 and 2021 and letting President Joe Biden and the Democrats take the blame in 2024 for the inflation that resulted.

We voters can “throw the bums out” every time, and still have the same economically disastrous policies enacted by the same central bankers. And most voters will never be the wiser, because they will be living inside the shallow and fake partisan paradigm.

The central bankers and their apologists will dutifully tell you, if questioned, that they are the economic guardians on the wall, protecting against the market chaos that would result from political control of the Fed—or worse, abolition of the Fed. They are America’s “Night’s Watch,” and Jerome Powell is our Jon Snow (of Game of Thrones), protecting us against the Night King of recessions and depressions. They constantly guard the wall against economic recession in a non-stop vigil with their number-crunching dork underlings who know what’s best for the economy. The last thing we need are meddling politicians messing up the economy.

At least that’s the official story.

But America had a long history of economic development before the Fed was created in 1913. The Congress—those meddling politicians—managed the money supply from 1836-1913 without a central bank. What does the historical data say? Is there really any evidence in the form of data that the Fed has helped guard against economic chaos and helped the country grow faster?

Let’s consider the first part of that question, as the official narrative goes something along the line of: “There were a lot of severe recessions in the period before the Federal Reserve, and there have been a lot fewer of them since the Fed was created, and most of them have been much more mild.”

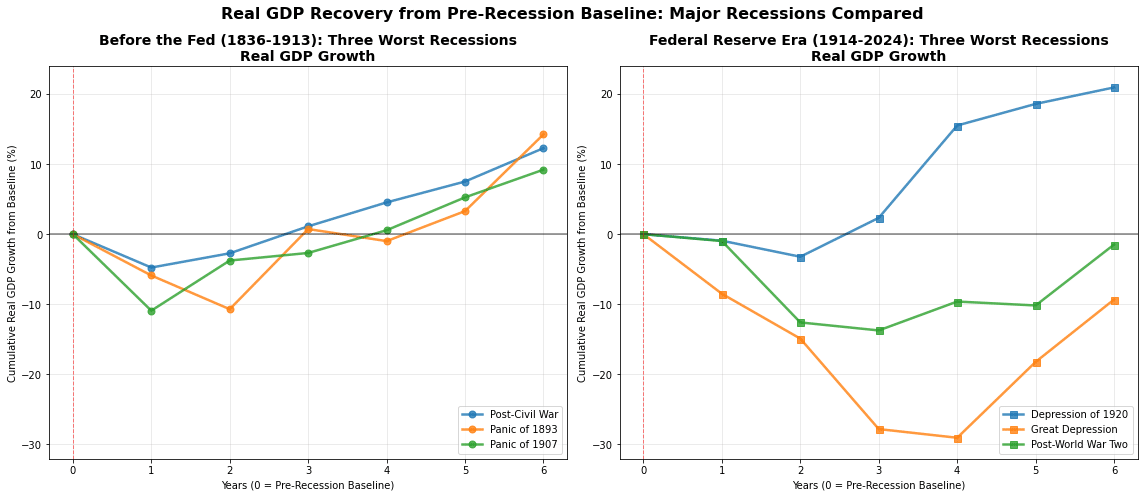

We can fact-check this statement by looking at the real (inflation-adjusted) GDP numbers from both periods and checking the worst three recessions in the 1836-1913 period (between the end of the Second Bank of the United States and creation of the Fed) and 1913-to-present. The U.S. Bureau of Labor Statistics has published economic data on GDP going back to 1800. And what we find by checking that data is that the pre-Fed era only once had sequential years of negative GDP growth, the two years of 1893-1894, while the Fed-era twice had recessions of three years of consecutive negative economic growth. The pattern is clear; the economy experienced longer recessions/depressions under the Fed and recovered from recessions faster during the pre-Fed era than under the current Federal Reserve era.

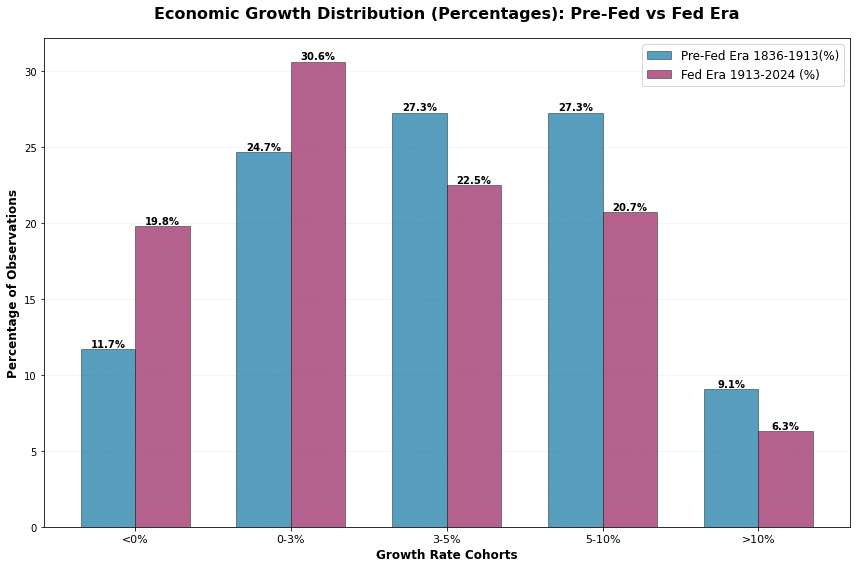

Nor has the Federal Reserve guarded against more recessions. The period under the Fed has resulted in more frequent recessions (more often experiencing years of negative economic growth), and fewer years of stronger economic growth.

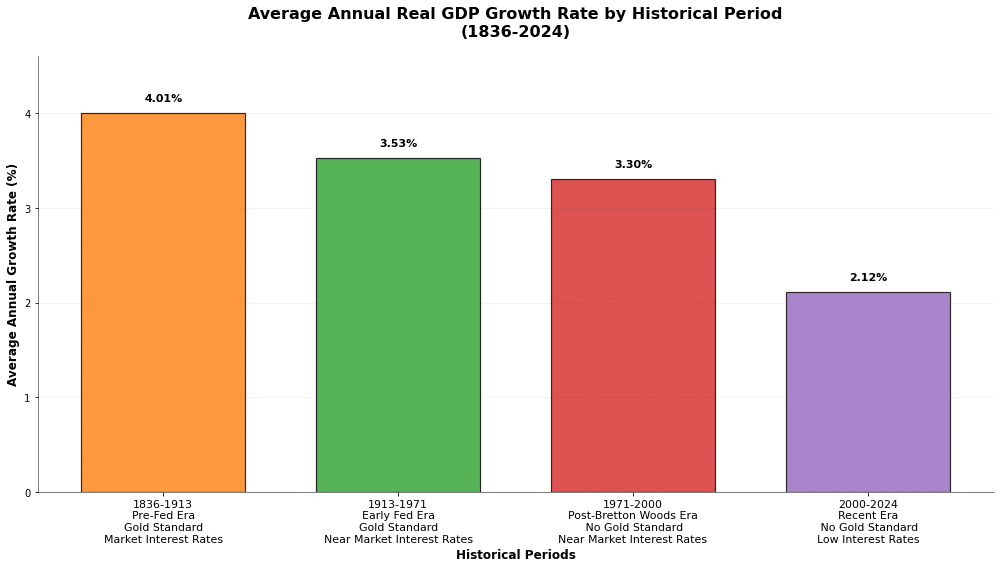

And the Federal Reserve’s performance, while always worse than the period before there was a central bank, has worsened over time as the Fed has abandoned the gold standard for inflation and market interest rates for below-market interest rates.

The policies of the Federal Reserve have ensured the U.S. economy is growing in this century at about half the pace it grew before the Fed existed. Is this really the guardian on the wall America wants? The data shows the Fed has actually been the East German border guard on the Berlin Wall preventing people from escaping to the prosperity of the West. At least that’s the case for the wage-earner, whose paycheck is depleted by inflation and priced out of the housing market because interest rates have been suppressed (which increases the sticker price and the down payment threshold for a home).

The billionaire class, on the other hand, is doing well under the Fed’s policies of inflating the currency and suppressing interest rates.

Imagine you’re a real estate developer with a net worth of $1 billion who has optimized his holdings 80/20. He holds title to $5 billion in properties, has $1 billion in equity and $4 billion in mortgages. Regular CPI inflation of 3% is a gift of $120 million in mortgage forgiveness every year. But let’s also assume artificially low interest rates by the Federal Reserve from 2000-2023 doubled property sticker prices over-and-above inflation (which they did). Now, you’re a 6X billionaire, as you hold title to $10 billion in properties and have the same $4 billion in mortgage debt. If you re-optimize 80/20, you buy title to $30 billion in properties, have $6 billion in equity and $24 billion in mortgage debt. Regular 3% CPI inflation now forgives $720 billion per year in mortgage debt, and if inflation goes to 8% as it did in 2022, you get $1.96 billion in mortgage forgiveness. All this benefit is for two Federal Reserve money tricks that have nothing to do with working harder or making a better product or legitimate free enterprise.

Remember also that none of this comes for free; there are trade-offs. This near-billion/year gift to billionaire real estate developers is paid for by those young wannabe homeowners who can’t afford a down payment at the inflated real estate prices, wage-earners who can’t buy as much with their wages, and renters who see their rents rise.

They’ll tell you inflation and low interest rates are good and “stimulative” to the economy. They are—to the billionaire’s economy. The data demonstrates the reverse in the aggregate, and especially so for ordinary working people.

This may explain why real estate developer Donald Trump loves low interest rates so much, and therefore wants to fire Jerome Powell; though it’s also possible he has foolishly bought the official narrative that low interest rates stimulate economic growth.

The political left sees the billionaires getting richer during the age of inflation and low interest rates and blames greedy capitalism for the squeezing of the middle class and working poor, rather than the Federal Reserve as the cause. They’ll tell voters the solution is to raise income taxes on the rich, even though billionaire real estate investors and hedge fund managers don’t pay income taxes (they pay much lower capital gains taxes instead).

“Tax the rich” is the siren song of the house-boy left, the group seeking to get the rabble that left the bipartisan paradigm for Occupy Wall Street and the Tea Party movements back into line for the Federal Reserve and the billionaires they serve. They never point to lifting the inflation tax and the interest rate tax that the middle class and the poor pay which keeps them from advancing economically.

Many of us who look at the data and find central banker claims lack data-based evidence and call for the end of the Fed will find the following fall-back rebuttal: “It’s a different, much more complicated world than before the Fed existed, so all the data that says a central bank slows economic growth and lengthens recessions doesn’t count. It all comes from the past.” (As if data could come from the future.)

Of course, this is their unconditional surrender from empiricism (which means measuring by data). If you find someone who makes the argument that you must dismiss all data to determine whether the central bank helps economic growth or limits the damage of recessions because the data is too old, then you’ve found someone who is admitting they have no argument from data that there should have ever been a Federal Reserve Bank in the first place.

There’s another weakness in the above argument that surrenders from empiricism. The unstated assumption in the above statement about the complexity of the modern markets is that the market (or, alternatively, Congress) can’t handle complex sectors like currency, while the government can. One need only contrast the production of home computers and cell phones, which are private and highly complex market sectors doing quite well, with package delivery, a comparatively simple industry where the U.S. Post Office is being out-competed by UPS, Amazon, FedEx and a host of private carriers, to conclude the opposite is the case.

The same goes for the argument against congressional control over the money supply. Often, these are the same people saying Congress should control the health care market (which it, in large part, already does), a much more complex market than currency.

The “complexity” argument is an obviously false and desperate statement.

And the Federal Reserve should, and would, be desperate, but for the zombie partisanship ruling the political horizon today. Some people still imagine they can “throw the bums out” with their vote. They can’t, without major changes in the form of the abolition of the Federal Reserve Bank.