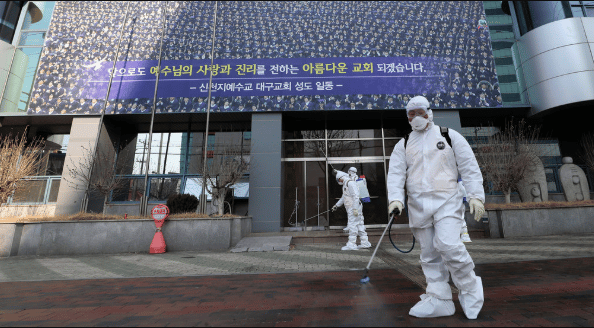

You’d think people would be used to it by now. Every couple of years the world is thrust into hysteria by the latest virus that is threatening to wipe out a significant portion of the population. Whether it’s SARS, Dengue, Ebola, Swine Flu or the Coronavirus, fear becomes the default emotion while States and their confederate agencies appear do everything they can to stoke them. The press appears to almost celebrate such panics because the population flocks to their reports in anticipation they will deliver them the information they need to survive. One wonders why people still trust the media with their history of getting stories wrong.

It is common among individuals to see the reports of a “super-flu” spreading and default to the most debilitating of emotions — especially when it comes to liberty — that being fear. But most people don’t go further and ask the question; “What exactly are people afraid of?” Is it death? Of course, that Is mankind’s greatest anxiety, especially for those who have children. Is it civil unrest? Could the threat of mass illnesses shutting down industries, thereby making certain items of necessity scarce, cause people to loot not only stores, but their neighbor? Or could it be another fear?

Most Americans feel the dread in knowing that getting sick and not being able to work for an extended period of time can put them out on the street. There are a couple stats that should be looked at, as well as a factor that some people don’t know about, and one most don’t want to hear.

The Ratio of Work to ‘Thriving’

A formula often overlooked when examing your personal economy is the ratio of “work to thriving.” How many weeks of the year do you need to work to pay for the basics? In a February 27, 2020 CBS article, Aimee Picchi writes, “The typical male worker must now work 53 weeks — or more than a year — to make enough to cover what American Compass Executive Director Oren Cass calls the annual “cost of thriving,” the earnings required to pay of a basket of essentials such as health care and housing. By comparison, in 1985 that same typical employee needed to work 30 weeks to cover those same costs, found a recent analysis from American Compass, a newly formed conservative economic think tank.”

When it comes to female workers the number is even more alarming, “Women these days need about 66 weeks — or 13 more weeks than men — to afford the same basket of basics, given that they on average earn less than men. But like the typical male worker, they’ve also lost ground since 1985, when the average female employee could cover her basics after 45 weeks of income.”

Many people are familiar with the term “cost of living,” but the “cost of thriving” would be a better gauge to follow considering American culture. Cass explains,” “The cost of living is the standard measure that gets talked about a lot, but there is a difference between living and thriving… thriving implies a richer conception of what we believe we are achieving, rather than just living.”

Picchi notes, “The Consumer Price Index — a standard measure of inflation — focuses on the cost of food, clothing, housing and other basics that families require. But that doesn’t necessarily reflect the challenges of paying for things you need to flourish in American society today, such as the ever-rising cost of keeping a roof over your head or going to college.” Picchi explains the criteria for the cost of thriving index, “Instead of using a broad range of basics, the Cost of Thriving Index focuses on four components: the cost of a three-bedroom house, health insurance for a family, one semester at a public college and the expense of operating a car.”

“Those costs have become “difficult for a household budget to accommodate,” Cass said.”

One Paycheck Away

When you take into consideration that most people are one paycheck away from homelessness, it’s easy to understand why many Americans have taken to advocating for an expansive Scandinavian-style welfare State. In January of 2019, Forbes writer Zack Friedman wrote, “according to a 2017 survey, CareerBuilder, a leading job site, found some startling statistics related to debt, budgeting and making ends meet;

- Nearly one in 10 workers making $100,000+ live paycheck to paycheck

- More than 1 in 4 workers do not set aside any savings each month

- Nearly 3 in 4 workers say they are in debt – and more than half think they always will be

- More than half of minimum wage workers say they have to work more than one job to make ends meet

- 28% of workers making $50,000-$99,999 usually or always live paycheck to paycheck, and 70% are in debt

The survey also found that 32% of the nearly 3,500 full-time workers surveyed use a budget and only 56% save $100 or less a month.

At this point some may assume that this article is only about looking to external factors to find fault with. Yes, they exist, but this is specifically about two factors: one that the individual has control of, and another that no president or politician has been able to solve in the last century even if they wanted to.

The Dreaded Federal Reserve System

The negative implications of having a government controlled central bank are too numerous to list in an article, but one of them is that your spending power is diminished. As Henry Hazlitt explained in his 1951 Newsweek column (reprinted at Mises.org), Inflation for Beginners;

“When the supply of money is increased, people have more money to offer for goods. If the supply of goods does not increase—or does not increase as much as the supply of money—then the prices of goods will go up. Each individual dollar becomes less valuable because there are more dollars. Therefore, more of them will be offered against, say, a pair of shoes or a hundred bushels of wheat than before. A “price” is an exchange ratio between a dollar and a unit of goods. When people have more dollars, they value each dollar less. Goods then rise in price, not because goods are scarcer than before, but because dollars are more abundant.”

Since 1991 the supply of U.S. dollars has grown beyond what most people realize. According to the Federal Reserve bank of St. Louis, in January of 1991 there were approximately 283 billion dollars in circulation. As the 90s progressed and the government instituted the blockade in Iraq, the Kosovo conflicts and various skirmishes, by November 2000, that number climbs to 576 billion, more than doubling.

Now we come to post 9/11. On September 12, 2001, the money supply was at 613 billion. On March 19th, 2003, dollars in circulation were at 683 billion. Jumping to the start of the Iraqi surge in January 2007, we are now at 801 billion.

Fast forward to soon after the 2008 financial crisis and the picture gets bleaker. What has come to be known as QE1 was started on 11/26/08. It began with the Federal Reserve (FED) buying 600 billion in mortgage backed securities. By its end in June of 2010, the FED raised the money supply from just under a trillion dollars to 2.1 trillion. QE2 lasted seven months between November 2010 and June 2011. Starting with 2 trillion in circulation, it was raised to 2.6 trillion. Less than QE1, but still a bigger jump than was seen all through the 1990s and most of the way through the 2000s. QE3 was implemented in September of 2012. By the end of 2013 the money supply had been increased to 3.6 trillion dollars. On 9/11/01 the money supply was at 613 billion dollars. Twelve years later, because of preemptive wars and government interference in the market, the money supply was increased by 250%.

What does this look like in the real-world using home prices as an example? In 2017, CNBC reported, “If you want to buy a house this year, you may well be paying around $199,200, the median price for a home in the U.S., according to Zillow.” Compare that coming forward from the start of World War 2, “In 1940, the median home value in the U.S. was just $2,938. In 1980, it was $47,200, and by 2000, it had risen to $119,600. Even adjusted for inflation, the median home price in 1940 would only have been $30,600 in 2000 dollars, according to data from the U.S. Census.”

No one would argue that homes have in fact increased in value. Atlanta added 75,000 to their population in 2018 alone. If the supply of housing stays static, or doesn’t keep up with the added numbers, prices will increase. This is common in most major metro areas. But the increase in the money supply has caused prices to skyrocket beyond what the law of “supply and demand” would dictate.

Take Some Responsibility

When it comes to this part of the discussion the reader may start to bristle. Setting aside for a moment the facts laid out about the Federal Reserve System, everyone knows someone who is more prepared than most. Many people know the “prepper” who has 6-months’ worth of food stashed. How many people know the person who has 6-months’ worth of income put aside to cover their bills in case of emergency?

Sure, the Federal Reserve can be blamed for causing the increase in prices in essentials due to their policies, but is that really an excuse? In 2016, the average American was carrying $16,061 in credit card debt alone. Assuming an 18.9% interest rate, paying $640 per month, it would take 15 years and 4 months to pay off that debt. And that’s taking into account no further charges being made.

The simple fact is that most people, even libertarians who know the system is rigged, live beyond their means. When you add up a mortgage or rental payment, a couple car payments, money shelled out for the 2.4 kids and the aforementioned credit card payments and even smart people are a couple paychecks from disaster.

Using the scare of the Coronavirus an example, it is easy to see that not only is the fear of death a motivating factor when it comes to the inevitable panic associated with a potential “pandemic,” but even the fear of losing a few weeks at work can have people on edge. As discussed, there are barriers to keep one from being secure in their possessions that are beyond their control, but there are also common-sense ways to combat obstacles even as great as a government-rigged money system. Hopefully people will see fit to prepare for such setbacks in the future as history has shown that this will not be the last impending “catastrophe” to derail us from our lives.