Since the EU’s debt crisis over Greece in 2009 and the subsequent problems with Italy, Spain, and Portugal, eurozone banks have dedicated their balance sheets to financing government deficits. At a cost to the commercial banks’ own cash flows, negative deposit rates at the ECB have ensured that no material losses have arisen from holding short-term government bonds on their balance sheets. And the only other beneficiaries have been the large corporations which through bond issues have managed to lock in zero or even negative interest rates on their debt.

Officially, this has not been the reason behind the ECB’s monetary policies. The stated objective has been to kick-start the EU’s nonfinancial, nongovernment sector into economic growth, a policy that has not succeeded and has merely increased unproductive debt at the expense of predominantly German savers. But the problem ahead will now be the ECB’s ability to sustain the government bond bubble.

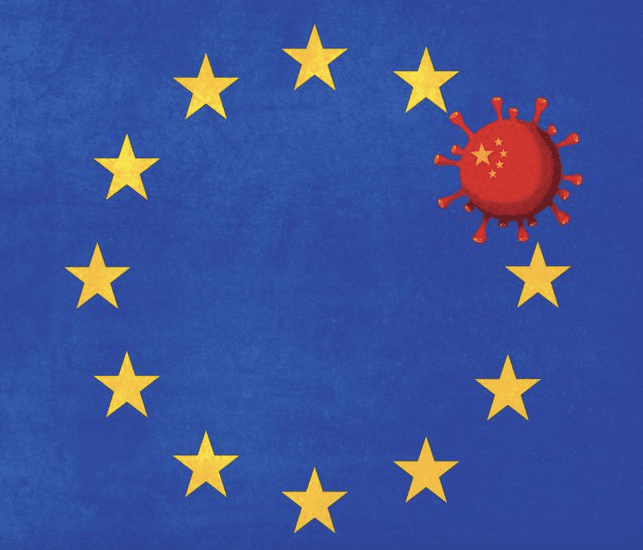

The coronavirus will make this more or less impossible, because productive output in the real economy is now collapsing. The implications for government borrowing are extremely worrying. All those debt problems of eleven years ago will resurface. This time Greece’s debt-to-GDP starts at over 180 percent, compared with 146 percent in 2010; Italy at 135 percent (115 percent); Spain at 95 percent (60 percent); Portugal 122 percent (96 percent); and France 98 percent (85 percent). And that’s what is on balance sheets. The situation is simply unsustainable given the combination of a new systemic crisis and likely shutdowns due to coronavirus.

Not only will banks face a rapid escalation of nonperforming loans and payment failures, but the bland assumption that the Eurosystem with its TARGET2 imbalances guarantees that the debt rating for Italy or Greece is similar to that of Germany is sure to be challenged. That being the case, not only the commercial banks but the ECB itself will have to contend with substantial losses on their bond holdings from widening spreads.

Nor is the eurozone immune to developments elsewhere. US Treasurys are wildly overpriced when a realistic rate of price inflation is taken into account instead of the goal-sought 2 percent approximation of the Consumer Price Index (CPI). With foreigners and the hedge funds liquidating dollar exposure as the Fed begins to lose its grip on the US’s financial markets, US Treasury bond prices are set for a significant derating and eurozone bond markets are sure to be adversely affected.

The scale of banking difficulties already in the pipeline but catalysed by the coronavirus are immense. There are bound to be squabbles over whether to bail in, as the law now requires, or to bail out. The possibility of bail-ins is bound to scare bank bondholders into selling out of all bank-issued bonds and preference shares, spreading a systemic crisis more effectively than traditional bailouts, which protect bondholders, ever could.

Whichever way you analyse these dynamics, the eurozone’s bond bubble with its negative yields has almost no further upside and like Icarus is bound to crash, taking not only the Eurosystem and the TARGET2 settlement system with it, but the currency as well.

The Demise of the EU

The euro is not the only currency whose future is tied to financial asset bubbles. For a brief period, the euro should rally against the dollar, if only because foreigners and speculators are up to their necks in dollars and short of euros, positions that will be reversed as the fx (foreign currency) swap market implodes. It will be after that imbalance has worked its way out that the euro will be in freefall against sound money, which is gold, and to everyone’s surprise its purchasing power, measured in basics, such as food, energy, and commodities, will begin to slide.

For now, the Brussels machine is ploughing on regardless. As the nation-states take the brunt of their economic collapses on the chin, they will begin to realise that the EU superstate is little more than an obstructive and costly irrelevance. Brexit will increasingly be seen as the precedent for others to leave the sinking ship.

One needs to have little sympathy with the spendthrift member states, whose finances will irretrievably collapse. The former members of the Soviet Union which are now EU members will have lost their subsidies and will observe comparative monetary stability in a gold-centric, resource-rich Russia and conclude that for them it has been out of the frying pan and into the fire. But the greatest disappointment will be in Germany, suffering her third currency wipeout in a hundred years.

It is very likely that Germany will seek to restore its own currency, utilising her gold reserves in some way. Doubtless she will attempt to reclaim the gold she reallocated to a failed ECB, but none of it is located in Frankfurt. Even without it, she has sufficient gold reserves at home in Frankfurt to turn a future mark into a proper gold substitute. And importantly, there are a few old-school operators at the Bundesbank who understand the importance of an enduring monetary reset.

That will be primarily for Germany, but some other EU member states in the north that have reasonable fiscal control could join them, establishing a new Hanseatic League based on sound money. But it cannot happen while they remain members of a failed European project.

Reprinted from The Mises Institute.