It doesn’t get any more pathetic than this. The Fed cuts the absurdly low money market rate by another 50 basis points at 10AM and before noon the Donald is banging the podium for more.

So if you ever needed a final warning to get out of the casino, today’s back-to-back eruption of financial insanity from the two most powerful economic actors on the planet should be it.

Even then, we might be inclined to give the Donald a tad bit of slack. After all, he’s an absolute dunderhead on economics and spent a lifetime as a leveraged real estate speculator, where, in fact, lower rates are always, but always, to be welcomed when you’re rolling the dice with other people’s money.

Still, it doesn’t get any more primitive or dangerous than the Donald’s current conviction that the price of money should be graduated lower based on the current year international league tables of GDP growth or the level of presidential braggadocio, as the case may be.

Effectively, however, the tiny posse of fools who run the ECB and the BOJ are burning down the financial foundations of their own economies. So the Donald insists we burn down ours, too.

Folks, that’s the sum, substance and full extent of his “thinking”:

“As usual, Jay Powell and the Federal Reserve are slow to act. Germany and others are pumping money into their economies. Other Central Banks are much more aggressive,” Trump said, referring to the Fed chairman.

“The Federal Reserve is cutting but must further ease and, most importantly, come into line with other countries/competitors. We are not playing on a level field. Not fair to USA. It is finally time for the Federal Reserve to LEAD. More easing and cutting!”

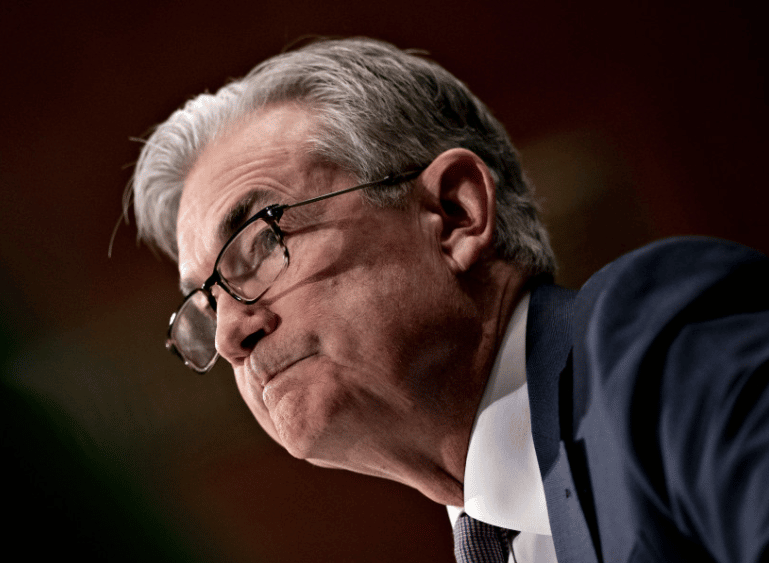

By contrast, the empty suite and sniveling coward who announced today’s emergency 50 basis point cut deserves no quarter whatsoever. The man is so petrified of a hissy fit by the boys, girls and robo-machines in the trading pits that he has just plain abandoned any pretense of rational financial thought.

In fact, you could dismiss his meandering comments at the post-announcement presser as risible drivel and be done with it.

Except, except….Powell and his merry band are so drunk with financial power that they now believe any ragged, threadbare, illogical excuse to display their muscle and placate the crybabies and bullies of Wall Street is all that’s required. That is, there are no trade- offs, no risks—just cut and print, rinse and repeat.

Thus, spake Pusillanimous Powell, averring that the central bank’s action would provide–

“….a meaningful boost to the economy” by loosening financial conditions and shoring up business and household confidence.

“We saw a risk to the outlook for the economy and chose to act,” Powell said, noting the impact on tourism and travel and on company supply chains. “I do know that the U.S. economy is strong…I fully expect that we will return to solid growth and a solid labor market as well.”

“We do recognize that a rate cut will not reduce the rate of infection, it won’t fix a broken supply chain; we get that, we don’t think we have all the answers,” Powell said. Still, he said, it will help support “overall economic activity.”

Needless to say, this is group think run amuck. There is apparently no longer a single Fed head who understands that interest rates are not merely one-way control dials, which exist solely to enable the FOMC to fine-tune the path of the nation’s $22 trillion GDP.

Somewhere over the last decades of Keynesian central banking, the truth that savers are being harmed every time the Fed pleasures Wall Street speculators with another rate cut has been lost completely. So has the notion that rate signals intended to encourage homeowners to buy a house or businesses to build a plant also foster ever more carry trade speculation on Wall Street and reward C-suites for investing in Wall Street pleasing buybacks and M&A deals, not productive investment in plant, equipment, technology, intellectual capital and human resources.

Accordingly, we have now reached the point were the Fed is no longer even in the business of safeguarding sound money and financial system efficiency and stability. Instead, it’s morphed into a grand macroeconomic underwriter, purporting to insure the US economy against any and all bumps in the road, regardless of their origin.

We already had them insuring against the Donald’s Trade War madness with 3 rate cuts last summer. Then with their repo facility madness in the fall, they were essentially insuring against the adverse rate and growth impacts of Washington’s borrowing binge.

And now they are throwing the untoward impacts of plagues and flood onto their underwriter’s table. So presumably anything could be next—even a mass outbreak of hangnails and toe fungus.

In fact, the true nature of central bank intervention in financial markets is just the opposite. To wit, tampering with asset prices is the most dangerous and potentially destructive thing any agency of the state could undertake because it fuels greed, recklessness, speculation, malinvestment and economic errors throughout the length and breadth of the system; and, to paraphrase Keynes’ famous observation about inflation, in ways that not one in a million could possibly comprehend.

In other words, what was announced this morning had nothing to do with central banking by any even loose historical definition of the term. It was actually another, even more over-the-top exercise in monetary central planning of the GDP and all that is subsumed under its $22 trillion girth.

But why in the world would anyone—even arrogant, self-regarding Fed heads—believe they can comprehend the infinite complexities and feedback loops of the GDP? That is, the $22 trillion here and the $85 trillion worldwide economy in which it is intricately and intimately intermeshed.

Yet if you presume to know that a 1.05% money market rate rather than a 1.55% rate will produce optimum economic outcomes under the shadow of Covid-19 uncertainty and disruption, then you positively do need to comprehend all the highways and bi-ways weaving through $22 trillion of input/output tables that only crudely comprehend the blooming, buzzing mass of activity which is actually the US economy.

Self-evidently, the Fed heads no longer even try to explain the macroeconomics of rate-cutting when they are cheek-by-jowl with the zero bound. They just assert ex cathedra that it will do some good—and not even from the actual quantitative flow economics that the Fed historically avowed.

That is, back in the day, if credit was not flowing to homeowners because high rates made borrowing prohibitive, it turned the rate dials lower in order to reduce bank disintermediation and thereby give S&Ls the means to lend, home-buyers the incentive to borrow and home-builders a boost to their order books.

And, by contrast, if rates got so low as to cause building activity to skyrocket, thereby fueling rampant wage, lumber and building lot inflation, they proceeded to dial up rates to cool things down.

We think the powers of the free market were always up to the task of credit flow regulation on their own: Freely mobilized interest rates always clear markets and bring forth more savings if needed, and more credit demand where economics require.

So central bank regulation of credit flows was never really necessary, but here’s the thing: In the present regime of massively subsidized and mispriced capital which the world’s central banks have fostered, there simply isn’t any credit flow channel to regulate.

Debt capital has become virtually unlimited and tantamount to free so there simply are no interest rate or credit supply barriers to spending and investment.

Likewise, the world economy has become so over-invested and malinvested in physical production capacity that the old-fashioned “demand-pull’” inflation just doesn’t happen. Or at least until now it hasn’t because the subsistence rice paddies and villages of the developing world had not yet been drained of cheap labor.

That’s why today’s monetary central planners don’t even talk about credit flows to the main street economy any more. There is no problem there for their ministrations to solve.

Instead, they talk about “easing financial conditions” and “supporting financial confidence”. That is to say, monetary policy is no longer even about money or credit; it’s an exercise in state-directed psy-ops.

And when you look into the real purpose of Fed psy-ops, which was the explicitly acknowledged purpose of today’s emergency rate cut, you quickly come to understand why Wall Street has morphed into a casino and the Fed its dutiful handmaid.

To wit, “easier” financial conditions mean low credit spreads and high stock prices or “risk on”. By contrast,”tighter” financial conditions are defined by widening credit spreads and falling stock prices and PE multiples and “risk off”.

Needless to say, in today’s debt-entombed main street economy, the Fed’s psy-ops with respect to “financial conditions” are neither here nor there. No wannabe homebuyer is influenced by the Fed’s psy-ops and no businessman stocks or destocks inventories or adds or subtracts from CapEx budgets based on whether the casino has been coaxed into a temporary risk-on or risk off mood by the Fed heads.

Stated differently, Fed policy is now almost exclusively about keeping stock prices high and rising, and nipping any even half-assed effort at correction in the bud, and violently so.

Self-evidently, today’s grand exercise in psy-ops failed spectacularly and like never before. The casino shifted by 1200 Dow Points between the post-cut announcement high and the intra-day low. And in the wrong direction!

Moreover, that bust comes on top of the 4800 Dow point plunge from the February 19th high to the February 28th intra-day low, which was followed by a 2000 point rise from last Friday’s low to Monday’s insane closing high.

In other words, the Fed long ago exited the sound money business. After the great financial crisis and its balance sheet pumping spree thereafter it also existed the credit flow control business.

And with today’s monumental error, it has now, apparently, euthanized its psy-ops tool, as well.

In the days ahead we will elaborate on the truly dangerous new financial world that now exists in the wake of the Fed’s self-defenestration. But in the meanwhile, Gary Kaltbaum captured the madness now loose in the land in his trenchant commentary issued immediately after the Fed’s announcement:

Powell lowered rates in the past few minutes because the market was heading lower today. He wasn’t going to make the move today until he saw the DOW down 300 early. This is not about a virus. This is not about an economy. This is about the markets…AGAIN! This is about the Bernanke, Yellen, Powell, Kuroda, Carney, Draghi, LaGarde markets that have made markets addicted to their easier money moves with an unaccountable and limitless amount of conjured up money. Do you not think he sees what we have reported to you? That like a well-trained dog, markets react to his every whim?

So what did Powell just do…or at least try to do: He screwed Aunt Mary and Uncle Bob…AGAIN! Yes…how dare you want risk-less income investments! How dare you want a decent money market rate! Screw you Mr. and Mrs. Saver.

The continuation of the asset bubble. (SEE A CHART OF ANY INDEX PAST 11 YEARS) A widening of the wealth gap. Yes…all these politicians complaining about the wealth gap? Look no further. The continuation of the distorting or price and yield in bond markets.

BOTTOM LINE: Another in a long line of moves to stanch any bleeding in the markets. Mr. Powell is easily Mr. Obvious. By the way, do you know how pundits and futures markets give percentage chances of rate cuts in the future? Since we have nailed these rate cuts all the way down, here is our latest.

WE GIVE IT A 100% CHANCE THAT WE WILL NOT ONLY EVENTUALLY BE BACK AT 0% BUT WE WILL EVENTUALLY DO THE NEGATIVE RATE DANCE. BOOK IT NOW!

LASTLY: If we ever get to the day where markets do indeed shoot the middle finger back at these market interlopers…head for the hills. If we ever get to the day where the markets see these moves as desperation…head for the hills. Initial reaction…rally 700 points in minutes…drop 600 points in minutes…rally back 300 points in minutes. Welcome to your central bank markets. He got that last bit right. It may well have happened within minutes after he hit the send button.

Reprinted from The Ron Paul Institute for Peace and Prosperity.