Fueled by panic over a weak July jobs report and a one-day crash in global stock markets, an unstoppable growing chorus arose among the political establishment calling for the Federal Reserve Bank to cut interest rates.

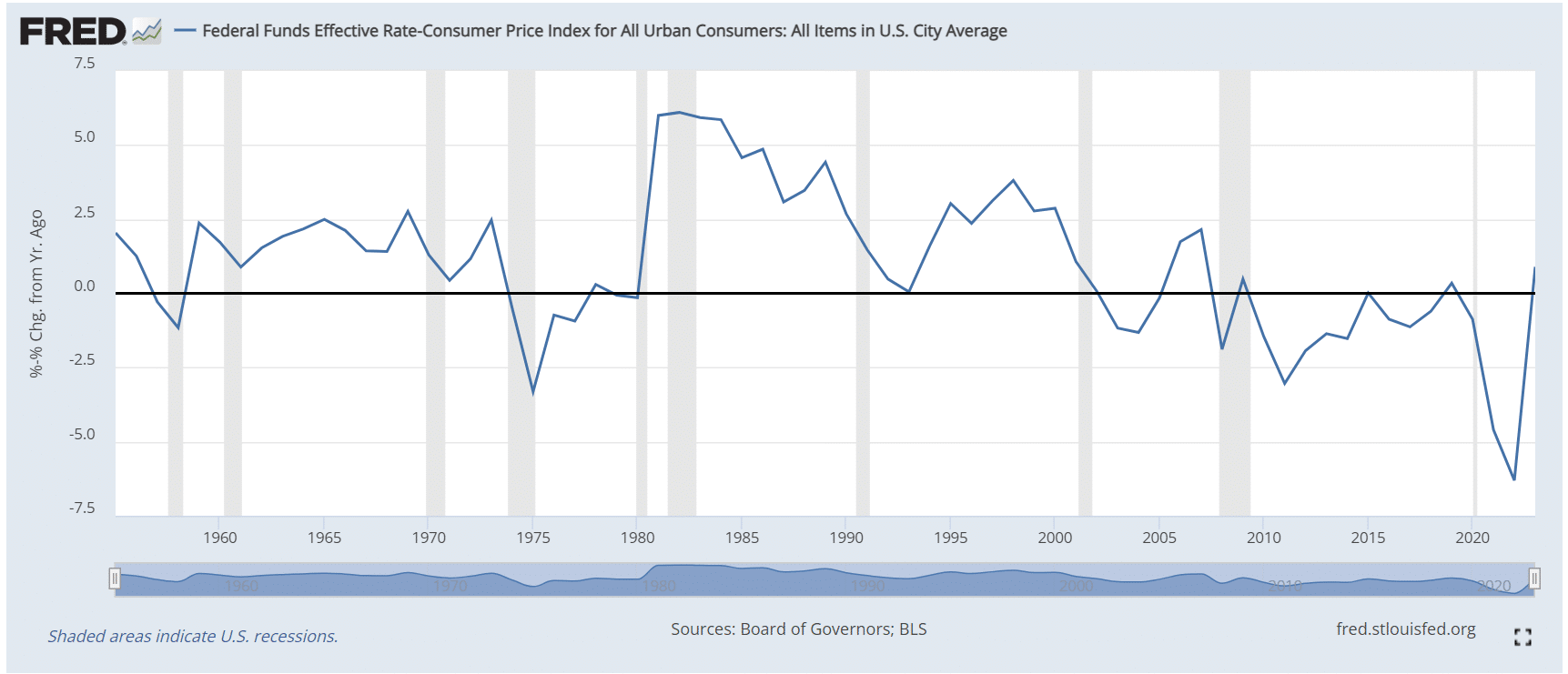

The reality is that interest rates, as represented by the Federal Reserve’s Federal Funds Effective Rate to banks, have been at historic lows since 2001, with real rates rarely even being positive. Today’s 5.00-5.25% rate in real terms is only about a positive 2% after accounting for inflation.

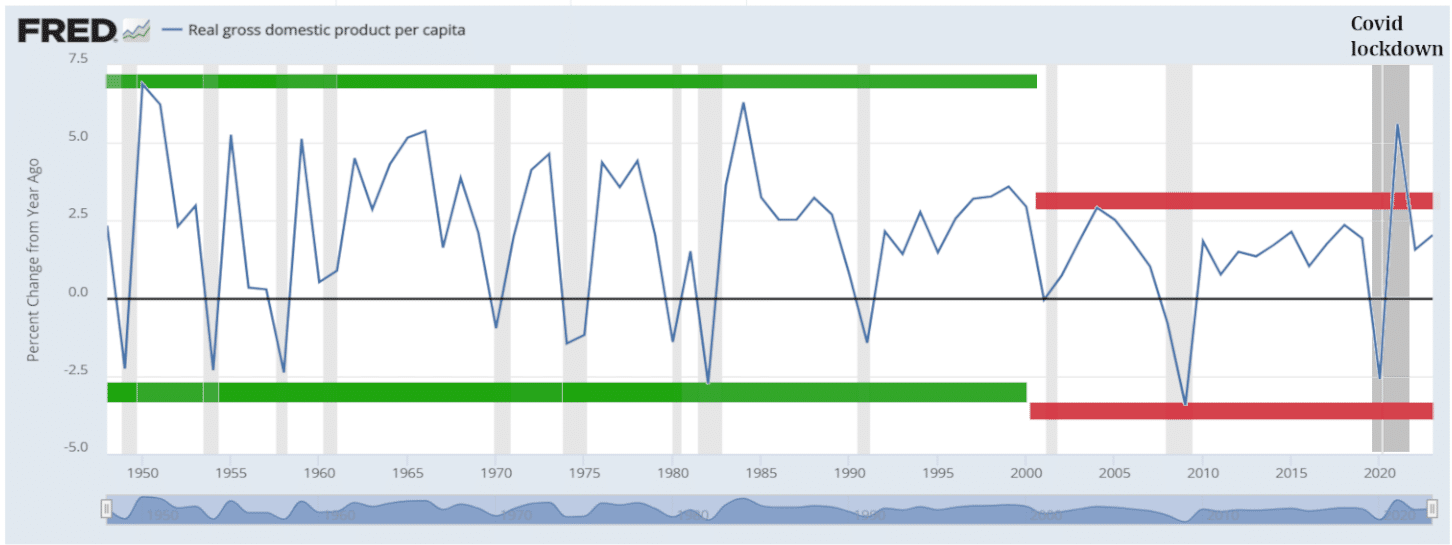

And these lower rates have not brought stimulus to the U.S. economy, but economic stagnation instead. Average per capita GDP growth rates in the United States have been cut nearly in half since the year 2000, when the Federal Reserve Bank chose to “stimulate” markets by suppressing interest rates to historic lows. From 1948-2000, the average per capita GDP growth rate was 2.3% per year, but since 2001, that growth rate has been cut to less than 1.3% per year.

People not familiar with how numbers work might quibble, arguing that a 1% lower increase per year isn’t very much. But the reality is that the losses and gains are cumulative, and Americans would have a GDP income more than a quarter larger without those losses. Nationally, it’s more than $6 trillion lost. Or, you can think of it this way: Say your family takes home $80,000 per year in income. If interest rates had not been suppressed, your family would likely be taking home $100,000 per year instead.

Most non-Austrian school economists buy as a base assumption the Keynesian/Modern Monetary Theorists’ line that suppressing interest rates is “stimulative,” at least in the short-term. Even Chicago school economists—normally free market economists—argue “research from Chicago Booth’s Yueran Ma and Frankfurt School of Finance and Management’s Kaspar Zimmermann…suggests that high interest rates can discourage companies and industries from investing in technology, leading to a slower pace of innovation that can limit economic growth.” But the above research referenced doesn’t actually measure real-world GDP outcomes. There’s never been any evidence suppressing interest rates is stimulative to an economy, even in the short term. I’ve written about this with my research for the Foundation for Economic Education back in 2017 using international data, and the data consistently shows the reverse: Any country whose central bank suppresses interest rates also sees slower economic growth rates, both immediately and in the long-term. I’m not the only one. More recent studies have shown higher interest rates are correlated with higher economic growth.

One of the excuses for suppressing interest rates is that lower interest rates stimulate the economy in a recession and make the recessions less severe than they otherwise would have been. This, MMT advocates desperately argue, is the reason high interest rates are correlated with faster economic growth: When interest rates are high, the economy is already growing and when interest rates are lowered, the economy is already collapsing. Dimestore financial advisors continue to peddle the conventional wisdom that rates need cutting as the economy heads into recession: “When a recession sets in, the Fed may reduce the federal funds rate in order to spur economic growth,” SmartAsset suggested last year. And the economic ignoramuses of the political left are making hysterical calls for rate cuts with the vain hope that these cuts will stimulate the economy enough for the Democrats to survive in November. “Fed Chair Powell made a serious mistake not cutting interest rates,” Senator Elizabeth Warren (D-MA) tweeted in a panic after a weak jobs report on August 2, “Powell needs to cancel his summer vacation and cut rates now—not wait 6 weeks.”

Warren’s political opponents should be chuckling at the futility of her pleas. I’d argue that burning incense to the flying spaghetti monster in the hopes that he will save the economy would have the same effect, but the flying spaghetti monster won’t stunt economic growth like artificially low interest rates will. The economic reality is that the downside of severe recessions have not been prevented by lowering interest rates, as 2008-09 proved. I controlled for “the economy was already growing when interest rates were raised and already falling when they were cut” argument in my 2017 study. The countries that did best in 2008-09 were countries like Australia, whose central bank kept interest rates comparatively high throughout the crash, encouraging higher savings rates.

The real impact of long-term under-market interest rates has been to eliminate explosive growth in the recovery stage of the business cycle. The below chart from FRED, with my added lines showing the upper-and-lower limits of per capita GDP growth before and after 2000 (exempting the COVID lockdown snap-back), show this trend clearly:

In the 1948-2000 period, real per capita GDP growth exceeded 3.0% in 21 of those 53 years—40% of the time. Since the Federal Reserve began keeping real interest rates near or below zero in 2001, real per capita growth has not even once attained that level, excepting only the year of the COVID shutdown snapback.

Austrian school economists know interest rates show the price of money, and suppressing the price of money creates a bad signal in the economy that leads to malinvestment. And that malinvestment multiplies in the recovery period every bit as much as during a recession.

Yet the Federal Reserve Bank is primed to “stimulate” the economy into a series of recessions and sluggish recoveries once again anyway, as two rate cuts (and possibly an “emergency” cut before this article is published) are already planned for this year.

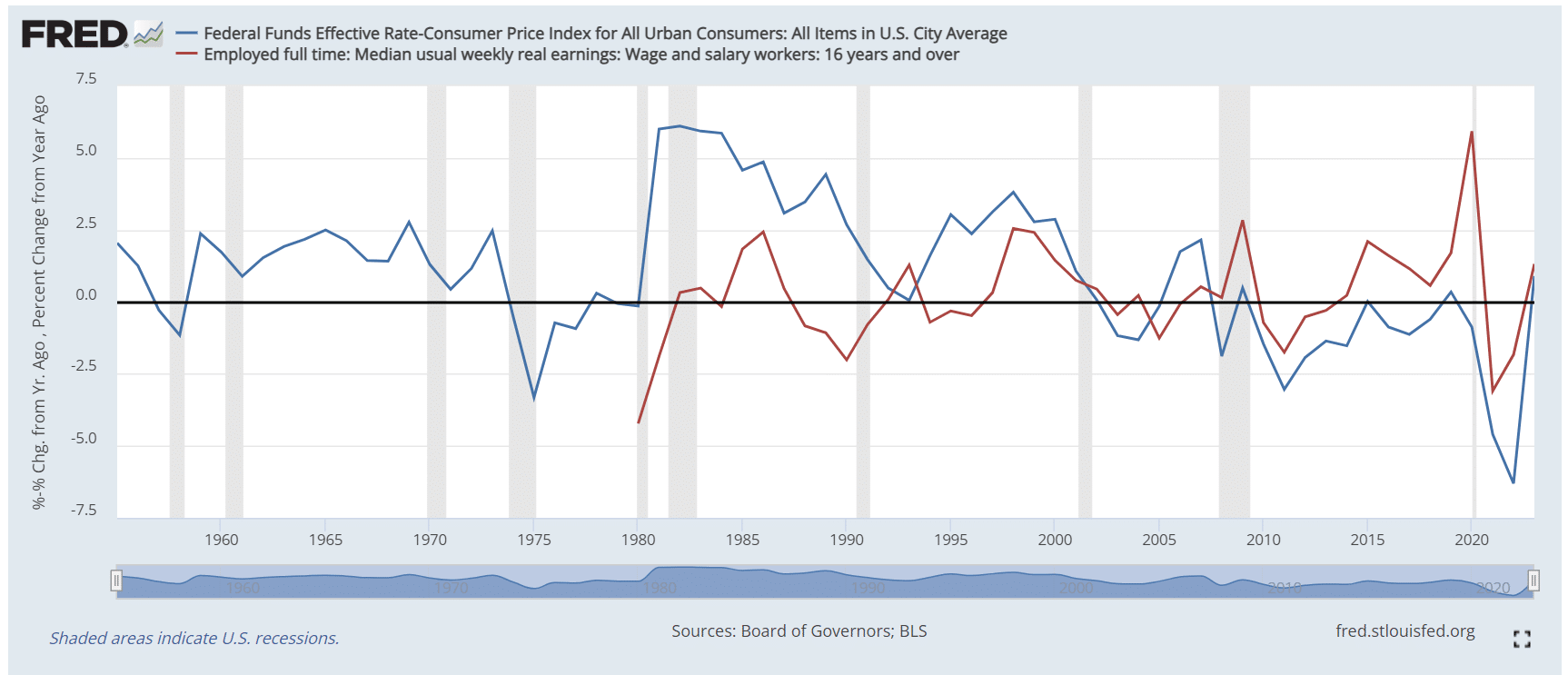

The preening profligate Elizabeth Warren’s cries for lower interest rates also prove she’s more Wall Street than worker, or at best more blue-anon than blue collar. There’s a strong correlation between the real (CPI inflation-adjusted) Federal Funds Effective Rate and wages for median workers in America. The lower the Fed sets its discount rate to suppress interest rates, the lower wages for the middle class go.

While interest rates are by no means the only factor in wage levels (inflation and recessions, for example, also play heavy roles), the above chart shows a strong correlation. The chart above measures both the real (CPI-adjusted) Federal Funds Effective Rate and the change in real median wages since 1979.

And why would low interest rates not lower wages? If low interest rates also suppress economic growth, wages cannot rise. It’s a fundamental law of economics that wages cannot rise in the long term without a corresponding increase in production. Also, if low interest rates creates massive malinvestment into useless sectors of the economy, and it does, it would create an increase in the rate of business failures, leading to more workers starting their careers over at the bottom of the corporate ladder in a new field.

Thus, there’s a certain irony in leading pseudo-progressives like Elizabeth Warren pleading for policies that hurt working people’s wages in a desperate and ignorant attempt to win the next election for her party in November.