Imagine you win your state lottery for $1.1 million. You have the option of collecting the cash prize of $1,100,000 or taking $55,000 per year in twenty annual installments.

Your financial advisor will always tell you the smart move is to take the full cash payout and invest the money in a stock index fund earning interest and dividends. If you do that, you can take out seven percent after taxes in perpetuity with adjustments upward for inflation and on average never lose any principal.

But what if the state lottery came in and changed the terms of the deal? Instead, you have to wait a few years to accept $20,000 per year in $1,700 monthly installments. And if you die, the lottery keeps all the remaining proceeds except a cancellation/consolation payment of $255. And they tell you it’s a much better deal than getting $1,100,000 in cash.

That’s Social Security for the average American worker today.

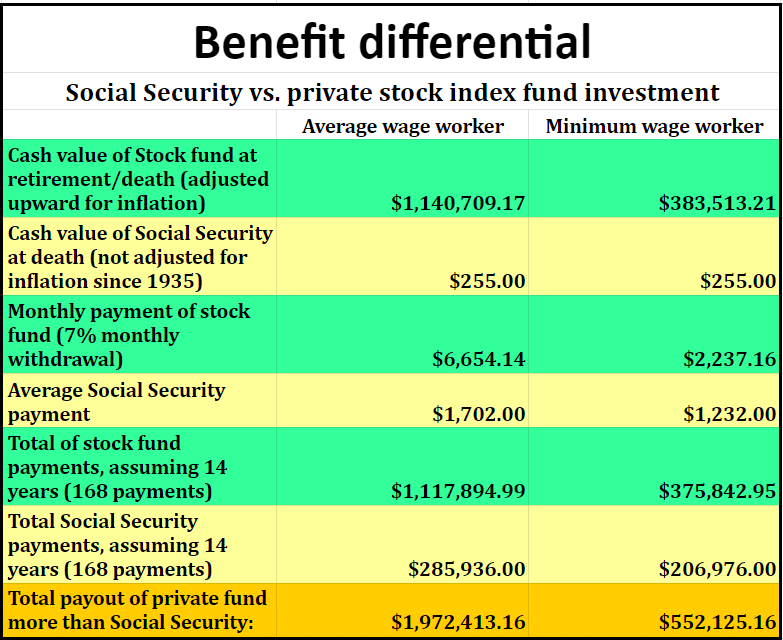

The statistically average American worker retiring this year will have paid out $1,100,000 in the form of a 10.6% payroll tax and foregone compound interest in order to get Social Security today. (Disability Insurance and Medicare payroll taxes are not included for the purpose of this study, otherwise it would be a 15.3% payroll tax.)

Shocking as it may seem, we are living in a time when the federal government’s Social Security program is preventing average Americans from retiring as millionaires.

As a financial move for the average American, it’s a decision several orders of magnitude worse than taking the installment plan after winning the lottery.

It gets even worse than that. The number used above is exceptionally favorable to Social Security. It includes an exorbitant 0.75% annual management fee for managing the stock index fund that matches the S&P 500―several multiples higher than most stock index fund management fees. Use a no-fee fund, and you retire with $1.4 million instead of $1.1 million. It also includes a deduction for a $100,000 life insurance policy to (more than) cover the “survivors” benefit of Social Security. So if you’re single and unattached, you’re going to be able to retire with an extra $131,000 cash without paying for life insurance policies early in your career you didn’t need, a time when you could have been saving more and earning more interest.

The figures assume retirement at age 67 on January 1, 2023, just after 2022’s near-bear market with an 18% loss in value of the stock fund. So the numbers assume retiring after a pretty tough year.

Young people do even worse. Seniors who retired this year started paying less than 6.2% in Social Security payroll taxes when they started working at age 21 in 1977. Young people have only known a 10.6% Social Security payroll tax rate; they are giving away more than a tenth of their paychecks during prime investment years when they could be earning compound interest. They’re giving up an additional $250,000 in their potential retirement nest egg than those who retire this year.

But what about poor people? Doesn’t Social Security help them?

No. They’re robbed blind by Social Security too.

Even the most down-on-his-luck person on a 45-year losing streak, a worker who slaved away at the minimum wage for his entire career, would have retired this year with more than $383,000 in the bank. (Assuming a minimum wage worker from 1977-2022 working 40 hours per week for 50 weeks per year and deductions for the above insurance policy and 0.75% management fee). Assuming a seven percent withdrawal per year, a minimum wage worker could afford to safely withdraw a little over $2,200 per month―much more than the $1,232 they can expect to get from Social Security. And this amount can be withdrawn in perpetuity, with adjustments upward for inflation. Plus, when they die, their heirs will get the inflation-adjusted upward $383,000 fund balance instead of Social Security’s $255 death benefit. And double all those numbers for two-income families, which most minimum wage families are.

There is literally no math where any demographic of retirees benefit from paying into Social Security instead of investing it into a stock index fund. The entire argument for Social Security going forward will be fear-mongering of “Let’s assume a reality that doesn’t exist, and never has existed: What if the stock market crashes and keeps crashing forever?” This worldview ignores reality entirely. Most Americans retiring this year were cheated out of retiring as millionaires. No amount of “what ifs” can erase that reality.

It also ignores the impossible math of Social Security’s pay-go system. Life expectancy has been increasing, and in all probability will continue to increase. That means people are drawing benefit payments for a longer time than in past years and will continue to draw down the trust fund’s resources ever-more heavily. And America is undergoing a birth dearth, where the proportion of young people entering the workforce is decreasing. A pay-go system where an ever-diminishing proportion of workers pays taxes for benefits to an ever-increasing number of retirees is one that is guaranteed to have to cut benefits, either by cutting amounts given to those receiving benefits or by requiring workers contributing to give up more money for the same exceptionally low level of benefits.

Social Security’s supporters will tell everyone that “They’ve been telling us Social Security is going bankrupt for generations. It’ll be fine.” But the reality―based upon the unforgiving math―is that it’s not fine, and the only way it was “fixed” in the past has been to multiply that tax burden carried by working people. Workers in 1955 only paid a 3% payroll tax. It’s now more than triple the rate paid by current workers’ grandparents. And while the cost has more than tripled, benefits haven’t increased―they’ve actually decreased―as the full benefit retirement has been postponed to age 67. That pattern of paying more for less will accelerate under Social Security’s pay-go system and its ever-depleting “trust fund.”

By way of contrast, a retirement system based upon capital saved and compound interest doesn’t care how long benefits are paid out. A fund mimicking the S&P 500 can pay out seven percent of the capital in the fund every year indefinitely, with payments increasing at an inflation-indexed level every year―even if the average retiree lives to 200 years old. Compound interest doesn’t care how long you live, and it doesn’t depend upon new workers entering the market.

Social Security is a financial decision several multiples worse than even the decision to take the installment plan after winning the lottery.

The only people who support continuing the Social Security program as it is for the next generation, and not sunsetting it, are the people who haven’t done the math. And also, probably, the people who take the installment plan on lottery winnings who are likewise incapable of doing the math.

And the politicians. Their “third rail of politics” is ensuring poverty wages for the average American who could retire with a million dollars in the bank and a middle class $77,000 per year annual income.

Given a choice between every American retiring as a millionaire and making the majority of retirees state dependents with poverty-level Social Security handouts, politicians will choose making retirees welfare serfs every time. They seem intent upon validating Harry Browne’s caricature:

“The government is good at one thing. It knows how to break your legs, and then hand you a crutch and say, ‘See if it weren’t for the government, you wouldn’t be able to walk.’”