The Cambridge economist Joan Robinson (1903-1983) wisely said, “The purpose of studying economics is not to acquire a set of readymade answers to economic questions, but to learn how to avoid being deceived by economists.”

Excellent point, though I would both broaden and narrow her category of suspects. I would include most politicians, bureaucrats, pundits, and social-science and humanities professors in the suspect group. And I would exclude the economists — spoiler alert: primarily those of the Austrian school, although others stand out — who paint a much more realistic picture of the world than the others do.

For the record, Robinson was sympathetic to John Maynard Keynes and, later in life, communist China’s Mao Zedong, and North Korea’s Kim Il Sung. Obviously, her study of economics did not teach her how to avoid being deceived by all who represented themselves as economists. (I heard once that Che Guevera became head of Cuba’s national bank in 1959 because when Fidel Castro asked his cadre, “Who here is a good economist?” Guevara, thinking he heard, “Who here is a good communist?” raised his hand. But that’s apparently apocryphal.)

At any rate, mankind would have been spared a good deal of misery had people learned at an early age to engage in the economic way of thinking. If I were to sum it up in a short phrase, I would say: in a world in which the law of identity, causality, and scarcity rule, you can’t do just one thing. Human action has consequences. This apparently is also the first law of ecology, but oddly, environmentalists (as opposed to humanists) seem ignorant of it.

The point is that all human action has rippling consequences across society and across time. The economist who called his textbook The Economic Way of Thinking, the late Paul Heyne, wrote, “All social phenomena emerge from the choices of individuals in response to expected benefits and costs to themselves.” (Happily, Peter J. Boettke and David L. Prychitko keep updating the book. It’s in its 10th edition.)

Heyne’s maxim applies to the choices of politicians and bureaucrats also. So before proposing or endorsing a government policy, one ought to wonder about the social phenomena that are likely to emerge from it. Economics is an indispensable tool in this respect.

Henry Hazlitt’s classic, Economics in One Less, is a great way to get started. Hazlitt wrote, “The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups.” Hazlitt’s book elaborated an important message of his intellectual ancestor, Frédéric Bastiat, the 19th-century French laissez-faire liberal, in the classic essay “That Which Is Seen and That Which Is Unseen.”

Individuals who adopt this way of thinking are better equipped to judge the promises of politicians, etc. who support taxes, minimum-wage laws, rent control, general wage-and-price controls, and the rest of the program of political authority over contractual freedom and other peaceful conduct. Even well-intended regulations will have unintended bad secondary consequences. Good intentions are never enough.

Any good introduction to the economic way of thinking will introduce readers to concepts like opportunity cost, the unseen, sunk costs, the margin, and tradeoffs. Most people seem to intuit some of these in their own lives. But they fail to do so when it comes to society as a whole. They are encouraged by politicians and pundits to think that common sense in private life does not apply to the big picture.

Opportunity cost refers to the fact when you choose a course of action, you necessarily foreclose another course of action. The true cost, then, is the (subjectively judged) next-best choice forgone. If you buy something for two dollars, your cost isn’t really two dollars. It’s what you regard as the next best use of those two dollars — the future not chosen. You might decide afterward that you made a mistake: “I could’ve had a V-8!” Good economists do not regard people as omniscient robots.

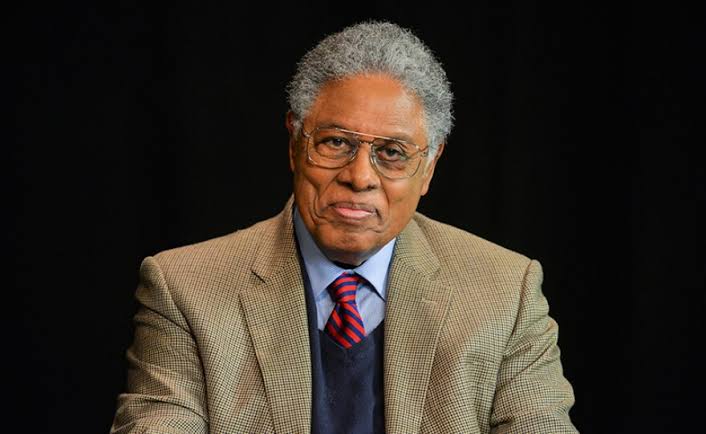

Opportunity cost is another way of looking at trade-offs. If you do or choose A you can’t do or choose B. Thus you trade B for A. Trade-offs are inescapable. Thomas Sowell, for whom the word genius is woefully inadequate, dramatically drew attention to this feature of life when he wrote, “There are no solutions. There are only trade-offs.” Today’s problems, he adds, may well be the result of yesterday’s solutions. We’d do well to bear this in mind, especially in deciding what the government should be doing (if anything).

Opportunity costs and trade-offs are examples of the “unseen,” another important concept in good economics. Bastiat’s fable of the broken window (see link above) debunked the myth that destruction stimulates the economy by prompting spending and thus makes communities or nations as a whole richer. Bastiat showed that a town does not get richer when a store owner has to buy a new window. Sure, he spends money, benefiting some people in town, but wouldn’t he have spent the money on something else? What else? No one knows. It’s unseen. But we know that he and others are now worse off. The owner has the window, but he would have had a window plus whatever he wishes he could have spent the money on. No general enrichment occurs.

Remember that next time a pundit rhapsodizes about the silver lining in earthquakes and hurricanes (“Think of the jobs that will be created!”) or a politician proposes to spend your money. Ask yourself, “What sort of things won’t happen?”

Although many other concepts are entailed by the economic way of thinking, I will mention only one more variation on the unseen. This one has incited ugly bigotry and cost many lives: it’s the concept middleman.

No one has documented this as well as Thomas Sowell, not only its economic dimensions but more broadly as well. As Sowell shows in many works (see, for example, Black Rednecks and White Liberals), middlemen — peddlers, storefront and chain-store retailers, importers, and money lenders — perform an important service in the market by matching up people who would gain from trade but might otherwise have a hard time finding each other. Retailers specialize in matching manufacturers with consumers, sometimes extending credit, while wholesalers match manufacturers with retailers. Money lenders specialize in matching lenders with borrowers. (Estimating the creditworthiness of borrowers is no piece of cake.)

In short, middlemen save us a lot of inconvenience. Free exchange is win-win or it does not take place. If they do their jobs well, middlemen make us richer, which is why they earn profit. If their function were inherently superfluous, they would be driven out of business by better business forms.

Alas, the value produced by middlemen is unseen by the economically ignorant, but it is real. Historically, successful middlemen, even if they were only slightly richer than the people around them, have been despised for their success, especially (but not exclusively) if they had started out poor and were immigrants who noticeably differed racially or ethnically from the majority population. Why? Because the ignorant believed the middlemen were exploiters. They made good incomes seemingly without creating anything. They “merely” moved goods or money around or made them available sooner rather than later — as if place and time were irrelevant. Where’s the value in that?

Sowell’s work shows that this animosity born of economic ignorance and envy is at the bottom of a great deal of the world’s racial, ethnic, and religious bigotry and violence, including mass murder, even when such ignorance is obscured by added rationalizations. (Demagogues often fanned that bigotry for political gain.)

“Middleman minorities” have in fact been the most persecuted groups in history all over the world, Sowell writes. That description might bring the Jews to mind, but Sowell shows that the Jews were far from unique in that respect. His list of chronically persecuted and even slaughtered middleman minorities includes the Chinese in Southeast Asia, Lebanese in west Africa, Indians and Pakistanis in east Africa, Armenians in the Ottoman Empire, Ibos in Nigeria, Parsees in India, and Tamils in Sri Lanka.

The magnitude of that violence, Sowell says, dwarfs that of other violence. Middleman minorities were hated not only for their higher incomes but also for the distinctive cultural traits that made that success possible, among them thrift, willingness to work long hours, strong families, and so on. The majority population often was at an economic disadvantage because of its cultural disadvantage; it wouldn’t or couldn’t compete against the minority, fanning the hatred.

The story is tragically common. Sowell says that while the overseas Chinese and other groups have been called the “Jews of [insert pertinent location],” that could easily be turned around: the Ashkenazi Jews were the Chinese, Lebanese, etc. of Europe.

While emphasizing these beleaguered groups’ commonalities, Sowell does not deny the uniqueness of each group’s story. The Nazi’s unprecedentedly bureaucratized and mechanized elimination of Europe’s Jews, of course, comes to mind. Nevertheless, Sowell writes in Black Rednecks and White Liberals (PDF), “In view of what was actually done to some of these other groups [the Chinese and Armenians, for example], there is little reason to doubt that their persecutors would have used such technological and organizational capabilities [as the Nazis used] if they had them.” Sowell is no ivory-tower, library-bound intellectual. He’s traveled the world more than once for an international perspective on this and related issues.

As I said, mankind would have been spared a great deal of grief — and would have been much richer — had people early on learned the economic way of thinking.