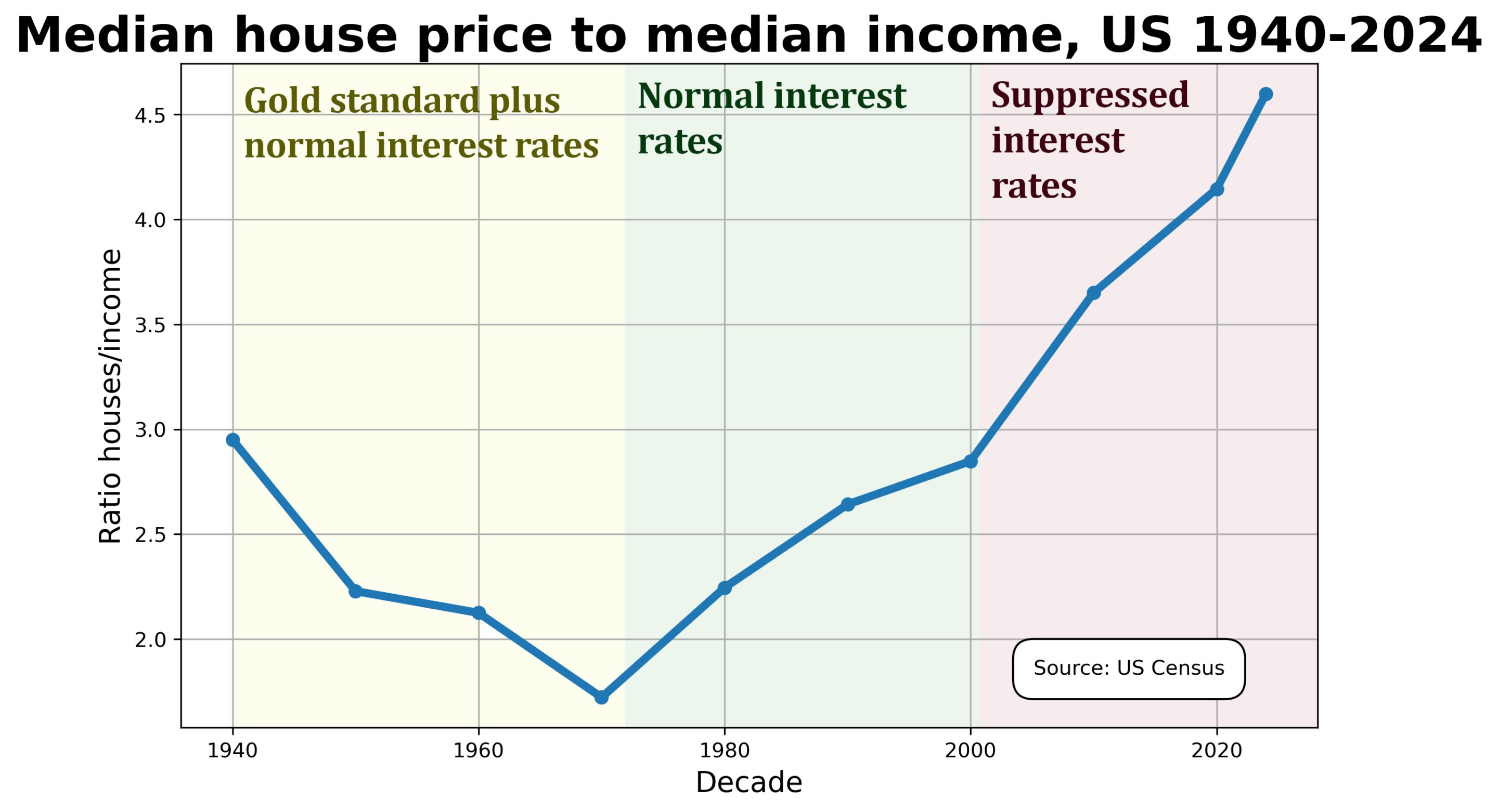

Everybody knows housing unaffordability and home sticker prices peaked at all-time highs in 2023, even higher than the peak of the 2007 real estate bubble in real terms. Both sticker prices and median mortgage payments for homes remain today at among the most unaffordable levels in U.S. history.

The free market has failed American homebuyers by not building enough homes Americans are willing and eager to buy, the official narrative goes. Vice President Kamala Harris told Stephen Colbert, “We don’t have enough housing. We have a housing shortage.” Harris has therefore promised to build three million new homes as a key campaign plank.

It’s just a simple matter of supply-and-demand that explains why housing prices are so high and why the market has not provided sufficient supply. Therefore it’s incumbent upon the federal government to provide this unmet need. Right?

Hold that thought—the popular narrative is flat-out wrong. And I’ll demonstrate that with hard numbers.

Another, related, but slightly more free market-oriented theory is that the unaffordability of housing is a result of NIMBY (Not In My Back Yard) local regulators denying building permits, along with costly state and national safety codes. While regulations and NIMBY attitudes do raise housing prices, there’s no way they explain the current trend toward housing unaffordability in the past few years. There has been no giant wave of new restrictive regulations by a majority of local governments that could possibly explain a national housing shortage.

A third theory circulated by conspiracy theorists is that housing prices are rising because Blackrock and other Wall Street giants are buying up residential real estate properties for unstated nefarious purposes. But Blackrock only owns shares in 80,000 homes, among more than 146 million homes nationally, or 0.05% of houses nationally. They can’t have made a significant impact on national prices, even if they hold them out of the market (which they aren’t doing).

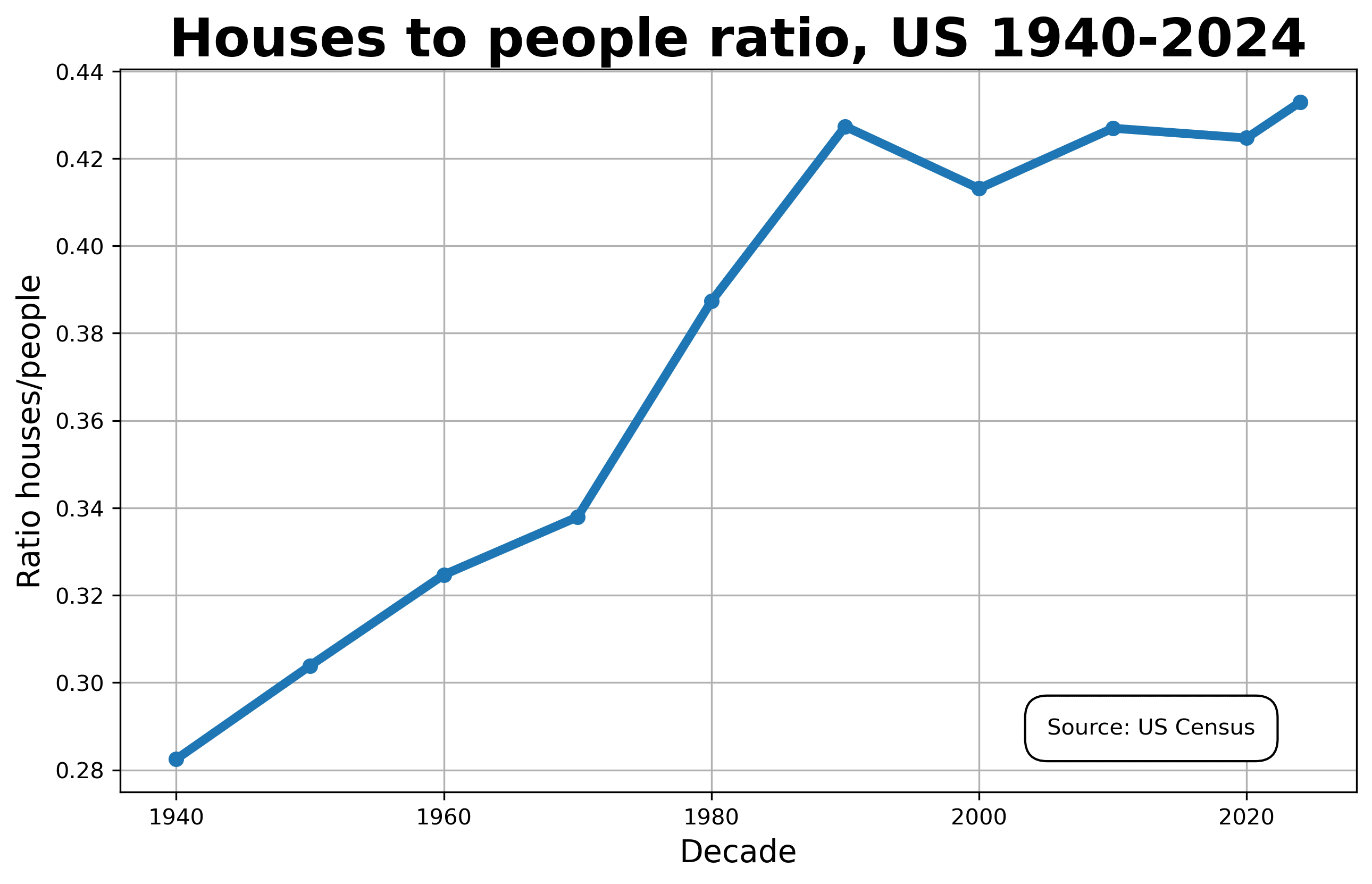

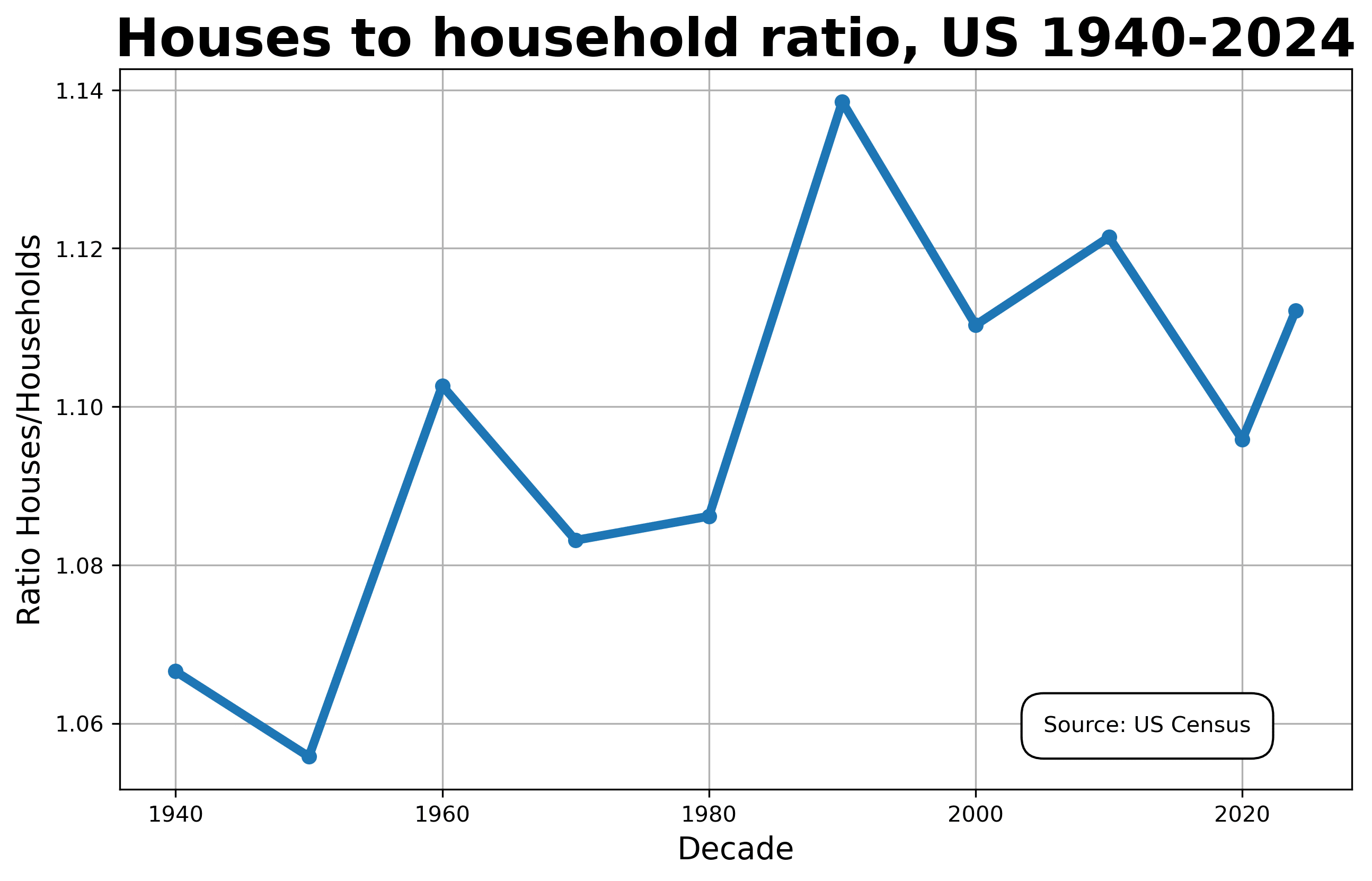

The truth is there’s no national housing shortage in the United States. The number of houses has increased both in real numbers, and in per capita terms over the decades.

With smaller on average American family sizes, there arguably could be a housing shortage if the per capita numbers remained constant. But there are also more houses per household than there were back in the 1950s, 1960s, and 1970s when housing prices were cheap and those prices were actually falling in proportion to median family incomes.

So if it’s not housing supply that’s the problem, then why are prices still through the roof?

There is a shortage of supply of housing on the open market. But that’s very different from a shortage of supply of total housing in the United States. And there’s a very good reason for the record low proportion of housing on the open market today, which requires a little background explanation.

The key affordability measure for real estate is not the sticker price, but the mortgage payment amount. The simple reason for this is because housing is one of the few commodities almost never purchased with cash and almost always purchased on credit, even by people with the means to purchase properties with cash. This means the monthly payment, which involves a combination of both the sticker price and the interest rate, is the key metric for housing affordability.

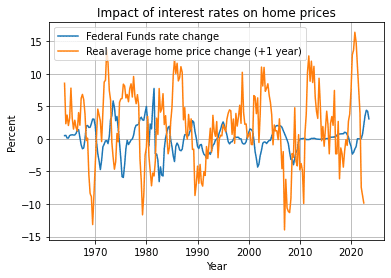

And there’s lots of data to buttress this idea that interest rates impact sticker prices to keep the monthly payment at a market equilibrium. The Federal Funds rate charts interest rates (as shown in the chart below), and changes in the Federal Funds rate has a dramatic inverse impact upon the change in prices of homes the following year.

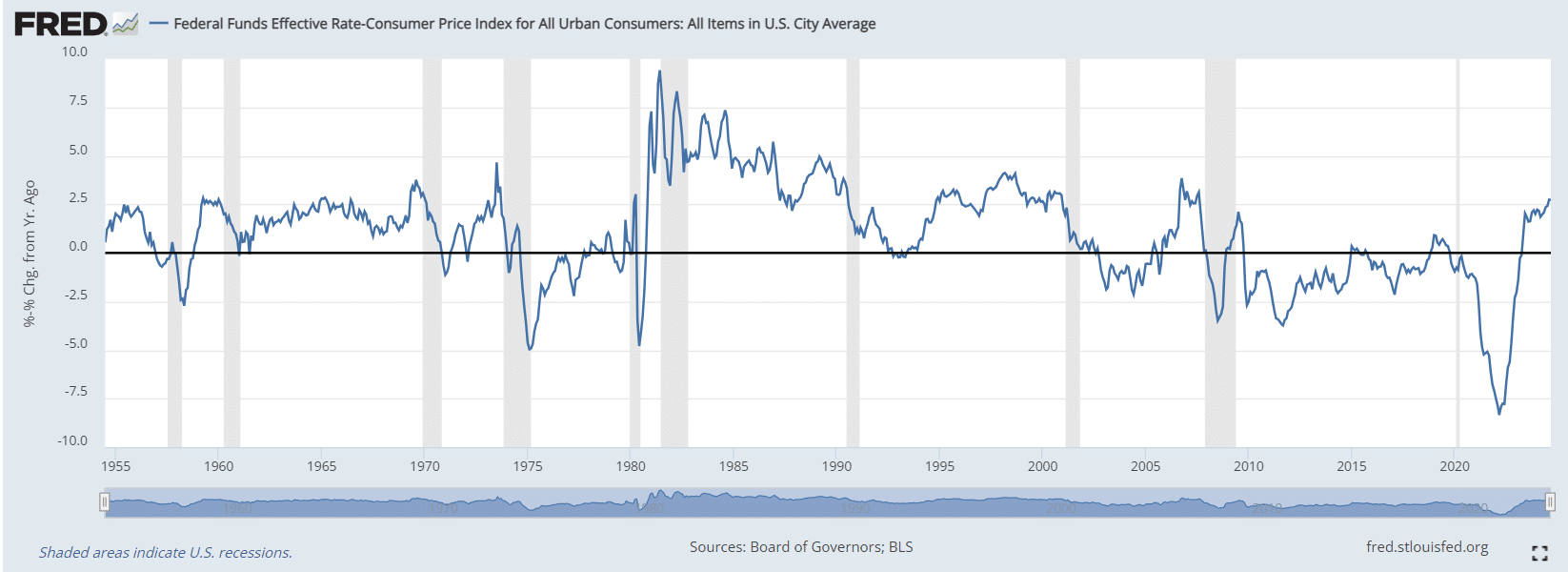

Because real (CPI-adjusted) interest rates were negative for most of the time from 2001-2023 (see the chart from the Federal Reserve Bank of St. Louis below), these under-market interest rates tended to raise the sticker price of homes over the past two decades.

In fact, as I hinted above, average housing sticker prices are currently at an all-time historic high as a proportion of median household income.

But because the Federal Reserve Bank hiked interest rates quickly to nearly six percent in 2023 (near historically normal levels after adjusting for inflation), the sticker price on homes hasn’t yet had time to fall down to the new equilibrium. As a result, monthly mortgage payments on home purchases in 2023 remain through the stratosphere (though a little better this year) in proportion to what they have historically cost in terms of median household income for Americans.

And one of the key factors keeping mortgage payments artificially above the normal equilibrium is that most homeowners purchased their homes during the past two decades when home mortgages could be had for nominal rates of 2.5-3%. To upgrade or move laterally today would require them to finance new home purchases at double those interest rates. That means many people who bought their house at 2.5% in 2020 or 2021 would have had to make payments as much at 50% more if they refinanced in 2023 at an interest rate of 7%—for the same house!

As a result, many homeowners who would have upgraded from starter homes to larger permanent homes have stayed put because they can’t afford to refinance at the new higher interest rates. The large number of homeowners staying put has kept the available supply of homes on the market artificially low, which has (at least temporarily) kept prices from falling precipitously.

But if people aren’t giving up their homes, that means they’re all occupied, and that means there’s a housing shortage of supply because of the high demand, right?

This statistic could mean that, but in this case it doesn’t. Homeowner vacancy rates are at lower than normal historic levels since 2017, but rental vacancy rates are higher than they were just a few years ago, and are higher than they were in the 1970s and early 1980s. If there’s a crush for housing and not enough space to house people, why are there so many empty rental units?

The truth is that new housing starts are well within historical norms even as U.S. population growth is the lowest in history.

The current unaffordability of housing for many Americans is a direct result of two decades of artificial interest rate suppression by the Federal Reserve Bank, followed by the brief return to interest rate sanity in 2023. The Federal Funds Rate cut in September signals that the Fed’s return to sanity is temporary, and that housing sticker prices (currently falling in real terms) won’t be falling back to earth but will instead soon be off to the races again once additional interest rate cuts are implemented.

What this means is that Kamala Harris’ plan for the government to incentivize construction of three million new homes will only bring the ghost cities of China here to America, a government boondoggle that will probably create new homes in the artless, drab Soviet-era Khrushchevka model.

America doesn’t need more homes to be constructed in addition to those already being constructed by the free market. What America needs is for the Federal Reserve Bank to stop fiddling with the dials of market forces with its interest rate manipulations. If you can’t afford a home today, the problem is not the free market, and it’s not even mostly the fault of the annoying local NIMBY government officials denying building permits. Put the majority of the blame where it belongs, at the feet of the fickle interest rate policies of the Federal Reserve Bank!