It may be the most successful financial swindle in human history, one more than a dozen times bigger than Bernie Madoff’s $65 billion swindle. By suppressing interest rates using federal Treasury bills, the Federal Reserve Bank has managed to deprive the Social Security OASDI trust fund of more than $900 billion in interest payments since 2001.

And it’s just getting started.

It’s long been a truism among libertarians that because the Social Security program is force-based from taxation, it’s therefore anti-social. In addition, the line goes, there’s no security in it, they’re not worthy of your trust, and there are no funds left.

On the left, the instant response is always a passionate defense of the crown jewel of the New Deal: “This is not true! The trust fund is vested in U.S. Treasury bills, backed by the full faith and credit of the U.S. government, earning interest for the Social Security program!” It springs to mind among the oldsters Vice President Al Gore promising how Social Security funds would remain in a “lockbox,” as satirized back in the year 2000 by “Saturday Night Live.”

There was for a long time at least a hint of truth to this defense of the New Deal. The Social Security Administration brags in its press releases that “A market rate of interest is paid to the trust funds on the bonds they hold, and when those bonds reach maturity or are needed to pay benefits, the Treasury redeems them.” And indeed, the federal government does keep a ledger of how much interest this trust fund earns in Treasury bills.

In 2022, the Social Security Administration recorded the Social Security trust fund as possessing a $2.829 trillion surplus in its OASDI trust fund (the main Social Security trust fund), earning more than $66 billion in interest on those trust fund reserves. That $66 billion amounted to a 2.8% interest rate.

That sounds good.

But after an 8.0% Consumer Price Index increase that year, the real interest rate in 2022 after inflation was negative, -5.2%, representing a $147.1 billion loss in real dollar terms that year alone.

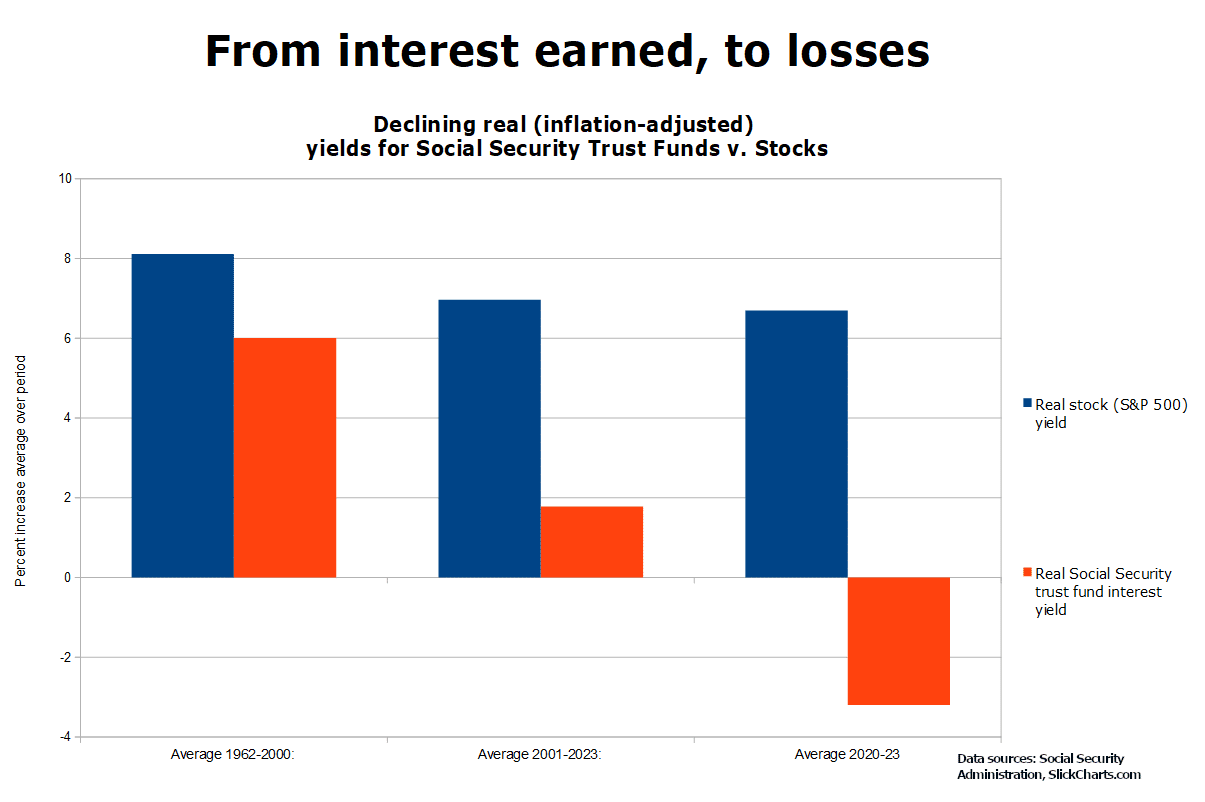

In 2001, the Federal Reserve Bank began its deliberate policy of suppressing interest rates to historic lows, sending real yields on Treasury bills into the basement, cutting in half the real (after adjusting for CPI inflation) interest gains accumulated by the trust funds. Real interest yields for the trust funds fell from an average of 2.8% annually 1962-2000 to just 1.4% since 2001 in the now Fed-suppressed market, thereby taking more than $900 billion in value from the Social Security trust fund since 2001 without anyone even noticing.

And it’s only getting worse. 2024 is shaping up to be the fourth straight year of negative real interest for the Social Security trust fund, with no end in sight. You read that right; the Social Security trust fund has lost value every one of the last four years because of low interest rates artificially engineered by the Federal Reserve Bank.

Ironically, even though the Social Security trust fund is officially losing nearly $50 billion annually (in an amount that’s increasing every year) the annual lost value in the form of lost compound interest would have more than matched losses for 2023 and 2024.

Social Security program’s pay-go system, where current workers pay the benefits for those who retire, is not sustainable in the long-run in an era when the birth rates plummet and people are living longer in retirement. More longevity and going from a baby boom to baby bust explains why Social Security payroll taxes have already increased from the 2.0% in 1935 to some 12.4% today, not counting Medicare payroll taxes. According to the Congressional Research Service on May 23, 2024, “By 2098, the cost of the program is projected to exceed income by an amount equal to 4.64% of taxable payroll (costs are projected to exceed income by about 25%).” That means working people’s payroll taxes are going to go up to pay out the same benefits, assuming they don’t cut benefits by postponing the full retirement age further than they already have.

Interest losses to the trust funds are likely not only to continue, but accelerate as a result of Federal Reserve policies that are expected to continue to suppress interest rates after unleashing inflation with money-printing. The way the Social Security Administration calculates interest received by the Social Security trust fund is to take an average of all U.S. Treasury bills (i.e., T-bills) that mature four years or further in the future. It means that even if the Federal Reserve Bank raises interest rates right now, something they’re unlikely to do, interest earned by the trust fund will remain historically low because the law continues to include T-bills issued twenty and twenty-five years ago into its interest calculation for the trust funds. According to the Social Security Administration:

“The formula sets the rate applicable in a given month to the average market yield on marketable interest-bearing securities of the Federal government which are not due or callable until after 4 years from the last business day of the prior month (the day when the rate is determined). The average yield must then be rounded to the nearest eighth of 1 percent.”

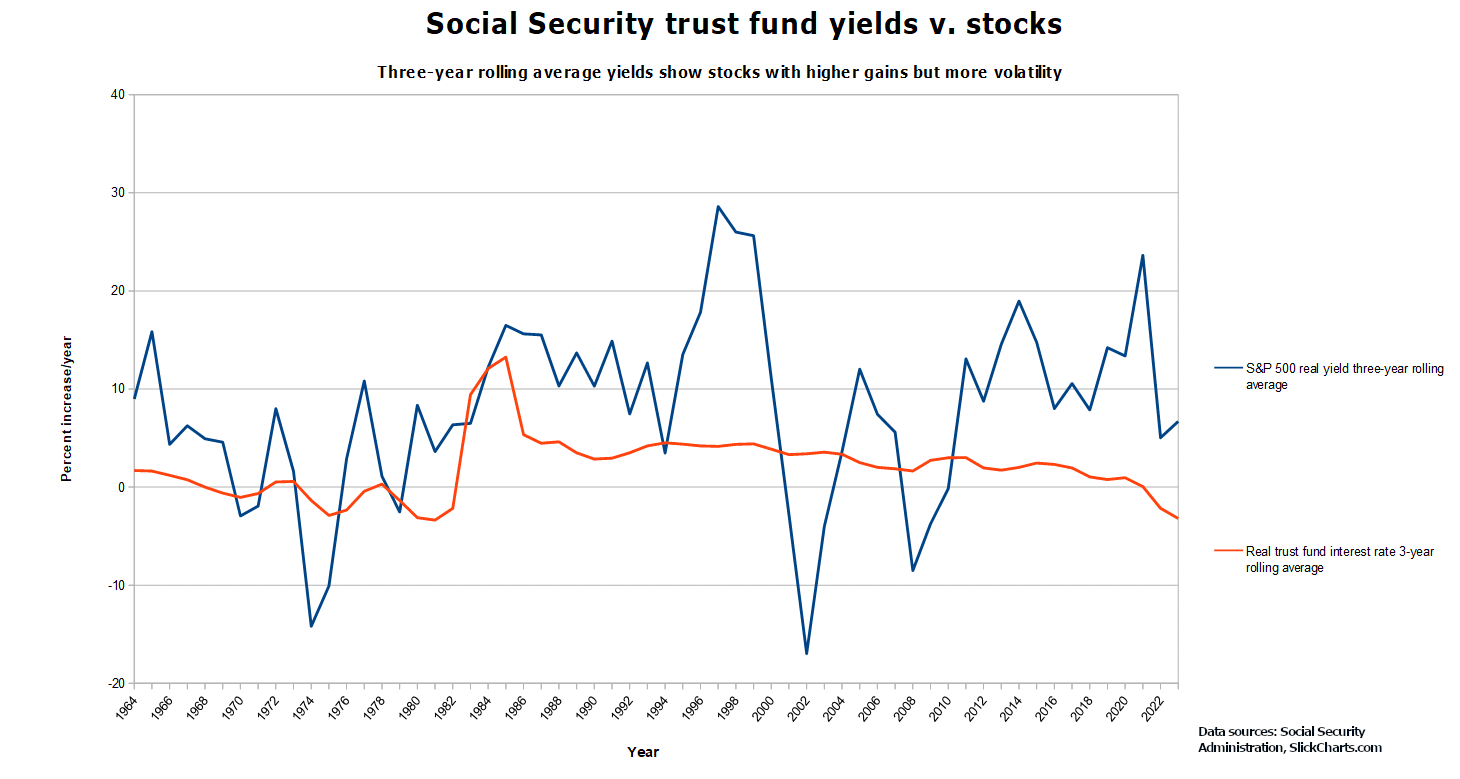

The knock against privatizing Social Security and investing the trust funds in the stock market has always been that investing the stock market was too “risky” and investing the funds in Treasury bills insured against losses. And it’s true that, while yields for the stock market have been consistently higher in the long-term, stocks have shown higher volatility in their gains.

It’s clear, however, that investment in Treasury bills doesn’t insure against significant losses over multiple years, especially during times of higher price inflation. The Federal Reserve Bank’s policies of inflation and suppressing interest rates, and thus yields on government debt, means that losses to the Social Security trust fund will continue for years to come and number in the trillions compared to a free market rate of federal debt. And it will be much more in comparison with stocks or other investments.

Libertarians will probably see a dark irony in that the crown jewel of the progressive movement of 110 years ago bankrupting the crown jewel of the New Deal from ninety years ago.

And the left would probably be mad at the Fed’s naked class warfare against working people…if only they could do math.