If you talk about the markets in any way like I do then you are going to get people telling you that you are wrong all of the time. Even though gold has been going up a lot of people out there still do not believe that the move is real.

This is one such email I got:

” You are far too bullish on metals and commodities. While there is currently a corrective wave higher, the correct analysis should be once the stock market has peaked (we should not be too far from that), most major commodities, metals, and RE will deflate to new lows. During the last recession, silver dropped from $20 to $9. We are about to enter a deflationary period as the debt bubbles begin to collapse. Increase in debt is inflationary (our current situation). Deflation first for several years, then economic inflation. Most people are getting that part wrong.

Regards,

Joel “

First of all, it isn’t necessary for the stock market to go down for gold to go up.

Back in 2002 when I bought my very first gold stock the $300 level was the key long-term resistance barrier just as $1350 has been for the past several years.

When gold went through $300 the big Elliot Wave Theorist was claiming that the move could not be real as he had a prediction that gold had to go to this specific price before it would go up.

He had a massive following of believers. He also claimed there would be a deflation collapse.

But the chart was clear – the trend was up. And all of these people who fixated on predictions about the future missed out on the best sector move for the next five years.

The same is happening now in my view. In that last bear market cycle of 2007-2009, in which there was deflation for about six months the US dollar went up in value so I think a lot of people are expecting the same thing to happen again. But in the cycle before that one the dollar went down.

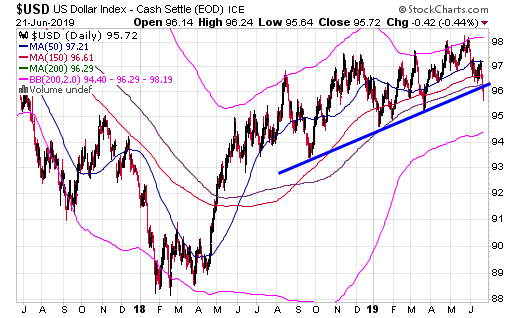

And now the US dollar index appears to be rolling over. It closed last week below its 200–day moving average.

The US dollar index indeed has had a rally since the Spring of 2018, but that rally now appears to be over while gold has broken out. I see no reason to not believe what is happening in front of us in regards to price over a theory about deflation and inflation.

I know there are a lot of people out there that like to talk about deflation. My argument is to not believe in some specific future scenario of how you think things will unfold, but to stick to the charts and trends and react to them if you want to make money in the markets.

Gold broke out last week. If there was this huge deflation bust it would be collapsing right now.

But here is my take on the deflation/inflation debate. In our economy right now there are signs of inflation when you look at the price of housing, rent, health care, and the financial markets. However, there are deflationary when forces when you look at agriculture prices, energy prices, and wages.

People always look back to the last cycle and that is why what happened in 2008 is on people’s minds, but there is no sign at all that the banks are in trouble like they were back then.

Instead of bad debts on bank balance sheets the biggest potential debt bubble program is government debt as the US government’s debt to GDP is now over 100% and it is on track for a trillion dollar plus deficit this year.

Historically when a debt bubble implodes a government deals with it by letting the currency fall in value and inflating away the debts. That’s what happened in the 1970’s in the United States and what is going on at this moment in Turkey.

So if anything if the debt problems you worry about materialize I think the result will be a falling dollar and wild inflation instead of deflation.

I’m sticking to the charts and trends. Because gold has spent so many years below $1350 an ounce very few people are excited about it right now, and the masses have ZERO interest. That will only change as it goes higher.

Another accusation I get from people is that I’m “selling gold” by talking about it. It seems that for some people if you talk about stocks people already own, like say Apple, then they don’t think you are “selling,” but if you talk about things they don’t own they get mad and find a reason to not listen.

Well, I have NOTHING to sell you today, because my Total Gold Trading Program went down Friday night!

What I am trying to get you to do – and everyone reading this – is to not believe in predictions of the future people make, but to focus on the trends and when they change instead.

That’s how we were able to see May as a massive pivot point. I mean when the Fed Fund futures went from pricing in a 50% chance of a rate cut in September to now an over 90% one in July it is going to start to have a new impact on things.

And so gold went up.

At the start of this year I did not predict that gold would breakout in June.

Instead in May I saw the changes lining up.

This game is about watching what is happening and seeing what is important and not about predicting the future!

Also, I’d note during the Great Depression there was massive deflation as the stock market collapsed from 1929 to 1932 – and gold stocks went up during that time to benefit from it. Look into Homestake Mining and what it did during those three years.

Today it is part of Barrick Gold.