For the past few weeks stock market investors have been expecting a resolution of the Trump tariff negotiations, with expectations growing that some sort of deal would be settled by the end of this week.

Last week Trump officials such as Larry Kudlow even made positive statements saying it was coming.

But this weekend Trump tweeted threats to increase tariffs by Friday – which is throwing markets in the dumps this morning as it shows that all of the positive trade talk hopes were misguided and the talk of an easy deal was misleading.

That is the real implication of the tweet – it doesn’t mean that the trade talks are off yet. It does mean an easy deal that would have given Trump everything he wanted was not happening. That’s why he is trying to put pressure on China with the tweets.

It may or may not work.

However, today’s gap down in the markets is unlikely to lead to the start of a big drop like what happened last Fall when the S&P 500 went down 20% by Christmas, because typically stock market tops form over a few months and not just on one news item.

If you can recall last year the DOW also made a fast 10% drop in February after stalling out from a wild overbought condition that coincided with a collapse in several short VIX ETF’s.

Last week when the market dipped on the Fed news I posted that the stock market was so overbought that any dip could have come no matter what the Fed did.

The same is true now. I haven’t been calling for big stock market drops lately, but I haven’t been that excited about doing much in the market until it pulls back or consolidates due to the extreme overbought condition.

Today shows why.

Now people who bought at the highs or went into VIX short ETF’s or the triple ETF’s are trapped this morning.

That’s what causes panic selling off of a high.

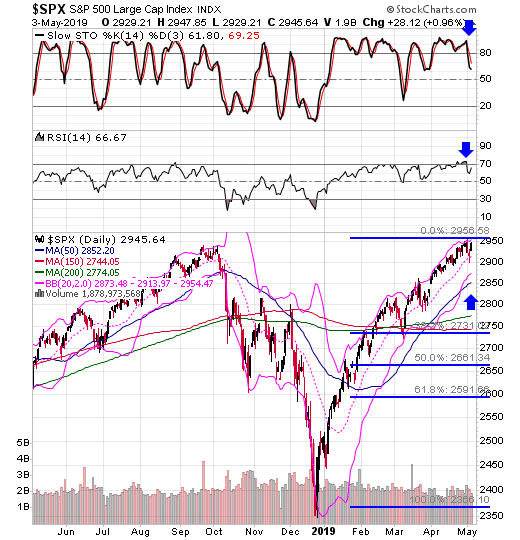

Notice how on the S&P 500 the RSI went above 70 – that’s an extreme overbought reading for this indicator and oddly the daily stochastics actually gave a sell signal last week even though the market ended up on Friday.

Now we must eye these support levels on the S&P 500.

The real support level now is 2850 on the S&P 500, which is the point of its 50-day moving average and is only about 100 points from its most recent high.

After that support is in the 2744-2774 area of the S&P 500, which is the point of its 150 and 200-day moving averages and is the 1/3 retracement level of the December low and recent high.

I am not buying today, but may but more soon as I do not see this as market going straight down to the lows, but one where one of these support levels will hold.

Inside the private Power Investor group we have been looking at a big potential trade that I’m aiming to put 1/7th of all of my money in. This is a huge setup if it hits.

If you take advantage of my special book giveaway offer for my classic book Strategic Stock Trading you’ll also get into my private trading group.

I got a box of books and I’m selling each copy I have until they last at cost. I’ll even pay the shipping for you so it costs you practically nothing to get started.

To get started just go here:

http://wallstreetwindow.com/strategic-stock-trading-book-offer

-Mike