What would you do if the government came to you and said your family owes it $75,000 this year, and every year, adjusted upward for inflation?

You might respond “I can’t afford it.”

Don’t worry, you are already paying that.

That’s the price the average American household is already paying (or borrowing on behalf of) your government. You read that right, the average family.

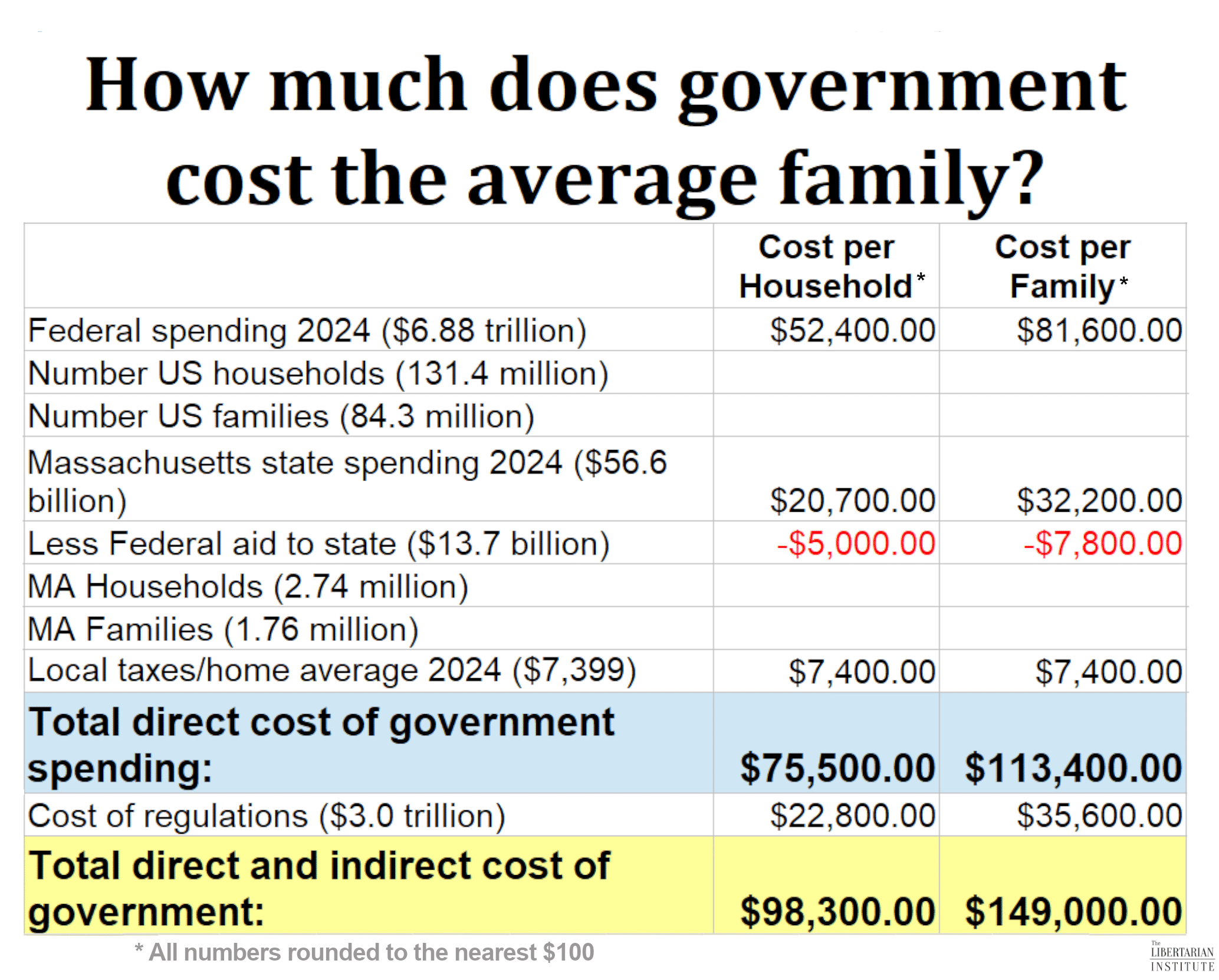

According to the Congressional Budget Office, the federal government will spend $6.88 trillion in fiscal 2024 (which ends October 1), including $1.99 trillion in deficit spending. The U.S. Census bureau says there are 131.4 million households or 84.3 million families in America, using 2023 (the latest) numbers. I’ve recorded both for the chart below, and the differences between the two are that “family” is defined by the U.S. Census as “two or more” people related living in the same household, but “household” is simply all the people (including roommates, dormers, foster children, etc.) living in the same place. Household is more numerous largely, but not only, because it counts people living in a home alone.

So the cost of the federal government per household is about $52,400 and per family it’s $81,600.

The Commonwealth of Massachusetts, where I live, will spend $56.6 billion this year, including $13.7 billion in federal aid.

The U.S. Census records 2.74 million households in Massachusetts. I wasn’t able to find Census numbers on the number of families in Massachusetts, but if it holds to the same proportions as at the federal level, there are 1.76 million families in Massachusetts.

This makes the cost of the state government to the average household about $20,700, minus $5,000 in federal aid, and $32,200 per family, less about $7,800 in federal aid.

The Commonwealth of Massachusetts reports that the average property tax in 2024 will be $7,399 (property tax is generally the only significant tax localities impose, though most also impose an excise tax on automobiles and boats which I don’t count here). Note that Massachusetts is the eighth most expensive state in terms of state and local expenditures, so it’s above average, but it’s not quite the Tax-achusetts I grew up in.

Add these together and you get the total direct cost of government (taxes and borrowing) of about $75,500 per household (or $113,400 per family).

This doesn’t count the indirect cost of government through regulations, which the National Association of Manufacturers estimates costs more than $3 trillion annually. Regulations add several tens of thousands of dollars in cost to American homes, in the form of lost economic activity and income not earned in the first place.

At this point, we come to the sum total cost of government per household at $98,300 (and $149,000 per family).

Now, the question I have for you is this: Are you getting value for what government is taking from your family?

Don’t answer. The question was rhetorical. You know your family is not getting your money’s worth.

And it’s not even close.

That’s one of the reasons why I’m a libertarian.