This article originally appeared at Anti-Media.

Financial analysts are increasingly pointing out that China has some very grand plans when it comes to petroleum markets, and that if those plans succeed, the U.S. could see the dollar threatened as the top global currency. From CNBC on Tuesday:

“China is looking to make a major move against the dollar’s global dominance, and it may come as early as this year.

“The new strategy is to enlist the energy markets’ help: Beijing may introduce a new way to price oil in coming months — but unlike the contracts based on the U.S. dollar that currently dominate global markets, this benchmark would use China’s own currency.”

While analysts agree that China faces an uphill battle in dethroning the petrodollar — currently used to price two-thirds of the world’s marketed oil — widespread adoption of the “petroyuan” would, as CNBC wrote, “mark a step toward challenging the greenback’s status as the world’s most powerful currency.”

China’s plan is to peg oil to the yuan through crude oil futures contracts — agreements to sell a specific commodity at a specific price and date. The country says its petroyuan, which some are predicting will launch before the end of the year, will be fully convertible into gold on Shanghai and Hong Kong exchanges.

The establishment of the petroyuan will allow countries seeking to limit their dependency on the dollar — as well as circumvent U.S. sanctions — to buy and sell oil through an alternative means. This is no small thing, says Gal Luft, co-director of the Institute for the Analysis of Global Security.

“Game changer it is not — at least not yet,” Luft told CNBC. “But it is another indicator of the beginning of the glacial, and I emphasize the word glacial, decline of the dollar.”

Challenges to the petroyuan’s success are many, including the fact that markets have been trading in dollars for over four decades. Another, says John Driscoll, director of JTD Energy Services in Singapore, is the Chinese government itself.

“My biggest reservations are the role of the Chinese central government, potential state intervention and favoritism toward Chinese companies,” Driscoll told CNBC. “China may be world’s fastest growing and most formidable energy consumer, but its central government plays a dominant role in the energy sector.”

But as the world’s largest importer of crude oil, some analysts say China is in a position to make demands. This is precisely what it will do with Saudi Arabia, predicts Carl Weinberg, chief economist and managing director at High Frequency Economics. He also says this will have a domino effect in global markets.

“I believe that yuan pricing of oil is coming and as soon as the Saudis move to accept it — as the Chinese will compel them to do — then the rest of the oil market will move along with them,” he told CNBC in early October.

Adam Levinson, a hedge fund manager at Graticule Asset Management Asia, appears to agree. He told Bloomberg Tuesday that the launch of the petroyuan will be a “wake up call” for any investors who haven’t been paying attention to China’s plans.

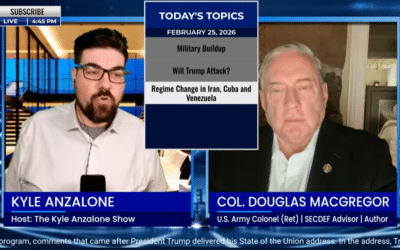

The Kyle Anzalone Show [GUEST] Dave DeCamp: BREAKING: Tucker Carlson detained in ISRAEL! – Trump’s Iran Strategy Exposed!

A journalist gets detained. Carriers surge toward the Gulf. Politicians talk in slogans while the facts stay fuzzy. We connect these threads to show how U.S. power, Israeli interests, and media narratives are steering Washington toward a dangerous collision with Iran...

![The Kyle Anzalone Show [GUEST] Dave DeCamp: BREAKING: Tucker Carlson detained in ISRAEL! – Trump’s Iran Strategy Exposed!](https://offload-wp-files.sfo3.digitaloceanspaces.com/2026/02/Screenshot-2026-02-27-115531-400x250.png)