When I first started learning about how the Federal Reserve system works, I watched an excellent short documentary from the Mises Institute titled Money, Banking, and the Federal Reserve, which was released in 1996 (a transcript of the video is available here, or as a PDF file here). That video was also one of my early introductions to the great Ron Paul, whom I also later came to admire for his sensible views on foreign policy. If you have never seen it, I highly encourage you to watch it.

Last month, the Mises Institute released a new 40-minute documentary titled Playing with Fire: Money, Banking, and the Federal Reserve, which reiterates the need to end this government-legislated private monopoly over the currency supply, including by taking a look at how the Fed has expanded its own power since the 2008 financial crisis, which was precipitated by the collapse of the housing bubble that the Fed blew up with its inflationary monetary policy.

The new documentary explains the importance of sound money as a medium of exchange and a unit of account and how the central banking system engages in legalized counterfeiting to manipulate people’s borrowing and spending behaviors for the benefit of the few at the expense of everyone else in society.

This system arose from banks issuing paper certificates redeemable for gold deposited in their vaults, where in time the bankers, realizing that only a certain proportion of depositors ever came in to withdraw their money in any given period of time, began lending out paper certificates backed by nothing.

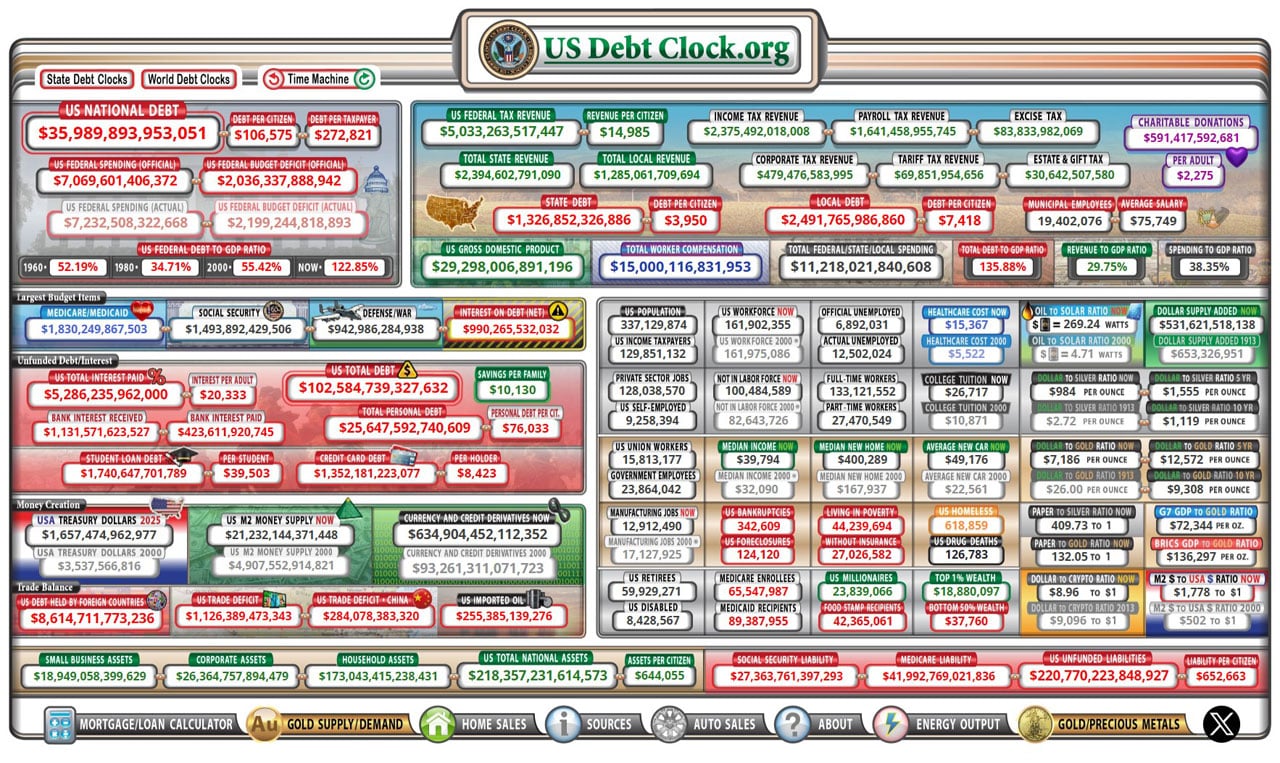

Under the “fractional reserve” monetary system, the Federal Reserve expands the base money supply by monetizing government debt, purchasing Treasury securities with dollars created out of thin air. In other words, the Fed exists to engage in legalized counterfeiting, which of course the government loves because it enables politicians to engage in insane amounts of spending without having to directly tax the public. Instead, the spending is paid for through the “hidden tax” of inflation.

From that monetary base, other banks then further expand the money supply by issuing loans. One misconception is that banks lend depositors’ money, so that if a $1,000 deposit is made, the bank can loan out $900 of it and keep $100 in reserve. Instead, what happens is from that $1,000 deposit, the bank can lend $9,000 created out of thin air while maintaining the legal reserve requirement.

Under this system of legalized counterfeiting, the banks are inherently insolvent, which is why there exists the risk of a “bank run” in which a mass panic causes everyone at once to go try to withdraw their money, but since only a certain proportion of that money actually exists in tangible form, the inherent insolvency is exposed, and bank failure occurs.

The Fed was created in 1913 by an act of government legislature with the stated aim of stabilizing the banking system, but instead it has given us permanent inflation as a feature of the economy and the cycle of booms and busts characterized by illusory economic growth that is really an unsustainable misallocation of resources that is inevitably followed by a market correction known as a recession.

We’re supposed to view the recession as the problem that the Fed will cure by doing what it always does, which is to print more money, creating artificial demand for Treasury securities that pushes interest rates down below where they would otherwise be if determined by the market. Actually, the recession is the cure for the unsustainable boom caused by the Fed’s monetary inflation and manipulation of interest rates, which are a critical price in the economy signaling to investors and entrepreneurs how scarce resources ought to be allocated.

The documentary explains the Austrian theory of the business cycle using the appropriate analogy of the Fed acting as both the fireman arriving on the scene to put the fire out and as the arsonist who started the fire in the first place.

Through its monetary manipulation, the Fed creates winners and losers in the economy. Those who get the new money first at low rates are able to use it to buy up assets before the resulting price increases, while everyone else in society is robbed of their purchasing power, thus effecting an upward transfer of wealth from the poor and middle class to the politically connected financial elites.

Then, of course, when the banks do get into trouble during times of economic crisis, they get bailed out at the public’s expense. As explained in the video, the profits are privatized while the losses are socialized. The biggest losers are the average American workers and families.

Since the COVID‑19 pandemic, we continue to see the economic devastation and soaring price inflation described by the mainstream media as a consequence of “the pandemic” or “the virus” when in fact it was caused by the government deliberately shutting down the economy and spending trillions of dollars created out of thin air to try to keep things going.

It was the lockdown insanity and the Fed’s monetary inflation that caused the housing affordability crisis that clueless politicians try to blame on the free market, including the claim that it is a failure of the market to produce enough supply of houses, which isn’t true, as I discussed in my October 19 article “Kamala Harris’s Economic Ignorance and the Housing Affordability Crisis”, and as economist Thomas Eddlem demonstrates graphically at The Libertarian Institute in his November 5 article “The Myth of an American Housing Shortage”.

It wasn’t the free market that caused the median sale price for an existing home to soar from $273,342 in 2019 to $414,701 in 2023!

The Mises film also discusses the threat of a central bank digital currency (CBDC), which always brings to my mind the passage from the book of Revelation about how Satan would deceive the world and cause all to “to receive a mark” so that “no one might buy or sell except one who has the mark or the name of the beast, or the number of his name.”

As noted in the video, “An increase in the money supply does not benefit society. It benefits some at the expense of others.” And as the great Ron Paul says, if you want to have sound money and a healthy economy, just get rid of the Fed.

To learn more about how the Federal Reserve’s monetary inflation caused the housing bubble that precipitated the 2008 financial crisis, read my short book Ron Paul vs. Paul Krugman: Austrian vs. Keynesian Economics in the Financial Crisis, which was described by the financial weekly Barron’s as both funny and informative, conveying “more insight into the causes and cures of business cycles than most textbooks”.

Cross-posted from JeremyRHammond.com.

![The Kyle Anzalone Show [GUEST] Dave DeCamp: BREAKING: Tucker Carlson detained in ISRAEL! – Trump’s Iran Strategy Exposed!](https://offload-wp-files.sfo3.digitaloceanspaces.com/2026/02/Screenshot-2026-02-27-115531-400x250.png)