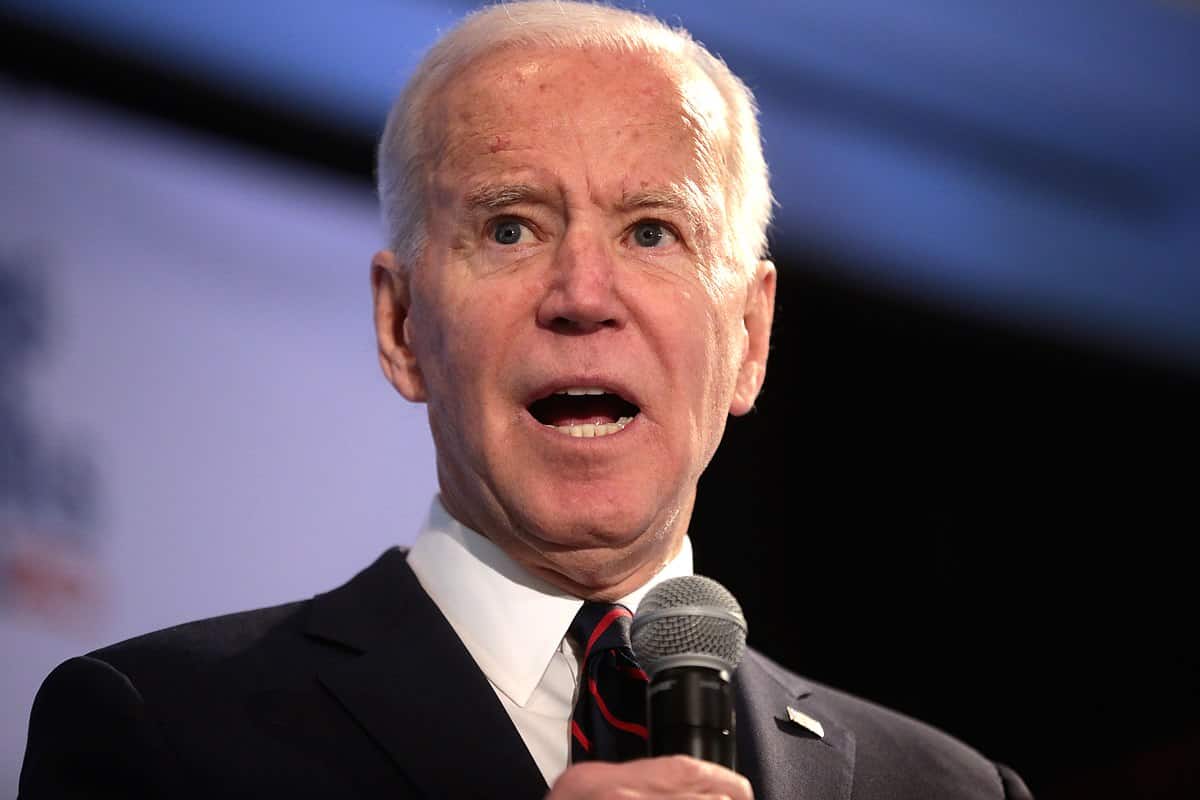

Speaking at the Eisenhower Executive Office Building, President Joe Biden on Tuesday morning declared inflation to be his top “domestic priority” and insisted that inflation would not be a problem were it not for covid and the war in Ukraine. There was little room, however, for any sound economics in a speech that was little more than a campaign speech for the ruling Democratic Party in an election year in which the party looks to take a beating at the ballot box.

In truth, it is the U.S. regime itself—and the regime’s central bank—that is the real cause of today’s galloping inflation. And even worse, neither the central bank nor the White House will admit its role or reverse course. Last week it was clear that Fed chairman Jerome Powell refuses to admit any role in today’s price inflation, and he apparently has no clue about what to do about it. This week, Biden insists his own government is blameless all while further pursuing regulation and taxes that will only make inflation worse.

It’s Putin’s Fault!

With inflation at forty-year highs, and with wages falling behind, Biden was careful Tuesday morning to spin inflation as the fault of anything and everything except the U.S. government and the Federal Reserve.

Specifically, Biden placed the blame of price inflation on COVID-19 and on “Mr. Putin” for the war in Ukraine. Biden claimed the covid disease itself—i.e., not the forced government lockdowns—has been to blame for logistical problems and shortages that have contributed to rising prices. Moreover, Biden blamed the war in Ukraine for increasing prices given Ukraine’s role as a grain-exporting nation and the current difficulty of exporting from war-torn regions.

Biden is correct in that these events have a role in raising some prices, but it is a straight-up lie to imply or state that logistics and grain-export problems are the main reasons for price inflation in the United States today.

The real cause of price inflation is monetary inflation, and monetary inflation has been on overdrive for more than a decade. Over the past two years, moreover, monetary inflation has accelerated to even more remarkably high levels.

Since 2009, the Federal Reserve, the U.S. regime’s central bank, has printed more than $8.9 trillion to buy up mortgage securities and government debt. This increased after 2020 as the Fed again accelerated purchases of government bonds in order to keep interest rates low on a national debt exploding upward.

In addition to that $8 trillion created out of thin air, the Fed also set the target federal funds rate to historic lows to add liquidity into the banking system. This encouraged commercial banks to further accelerate monetary inflation through the mechanisms of fractional reserve banking.

Today, $12 trillion of the existing $21 trillion was created after 2009. That means 60 percent of today’s entire M2 money supply was created in only the past fourteen years.

This wave of monetary creation has grown so immense that even International Monetary Fund economists can no longer deny the role of central banks in surging prices. IMF director Kristalina Georgieva last month admitted central banks globally “printed too much money and didn’t think of unintended consequences.”:

I think we are not paying sufficient attention to the law of unintended consequences. We take decisions with an objective in mind and rarely think through what may happen that is not our objective. And then we wrestle with the impact of it.

Take any decision that is a massive decision, like the decision that we need to spend to support the economy. At that time, we did recognize that maybe too much money in circulation and too few goods, but didn’t really quite think through the consequence in a way that upfront would have informed better what we do.

Without all this new money creation, the inflation we’re witnessing today would be impossible. This isn’t to say that we wouldn’t see some rising prices considering wars and China’s ongoing lockdowns. Those events certainly do drive up some prices.

But in an environment without constant monetary inflation perpetrated by central banks, inflation would not be general in the way it is now. Some prices would increase, but other prices would decline, as would make sense when the money supply is limited. There would only be so much money to go around so price inflation in some areas would be balanced by price deflation in others. But with monetary inflation running rampant, price inflation can do the same throughout the entire economy: more money is chasing goods and services.

Biden Is Making Price Inflation Worse by Hobbling Production

But even in time periods when monetary inflation is rampant, the effect on price inflation can be tempered by increased production and increased worker productivity. Specifically, improved technology, innovation, and international trade are all disinflationary forces that can make price inflation less bad.

The Biden administration, however, is currently waging war on innovation, productivity, and trade, and thus making price inflation even worse. In his Tuesday speech, Biden called for even more regulation on businesses and higher taxes. He wants more power to coerce businesses into higher fuel economy, and to mandate more electric vehicles. He wants to increase fees on oil and gas producers. He wants higher taxes on employers.

This will all only serve to cripple production and thus will put further upward pressure on price inflation.

As far as foreign production goes, the Biden administration has largely preserved the Trump administration’s antitrade innovations. Biden’s anti-Russia policies have also only served to further cripple international trade by imposing economic sanctions on nations—including those that have friendly relations with the U.S.—who consume critical Russian goods. This will be most disastrous for the poorest countries of the world, but American consumers will be impacted as well. (Gas prices in the US on Tuesday hit a new high.) As a result, the US has done much to raise energy and food prices worldwide while taking no steps at all to seek a diplomatic solution to the end of the war in Ukraine.

Americans now have the misfortune of living under a regime that relentlessly inflates the money supply while working to cripple production. This is a recipe for ongoing inflation in both assets and consumer goods.

But you won’t hear anything about this from the White House. Last year, the inflation culprit was “greed,” which supposedly prompted corporations to raise prices. (Why inflation-casing greed suddenly became far worse in 2021 is never explained.) Now, Putin provides a convenient scapegoat. For the past six months, the regime has repeatedly groped around for whatever bogeyman could be blamed—so long as the central bank remains blameless.

This article was originally featured at The Free Thought Project and is republished with permission.