Young middle class workers are struggling financially, while everyone knows the billionaire class is doing quite well.

The reason is because Washington has insidiously and thoroughly rigged the tax and regulatory system against the working poor and middle class, top-to-bottom, secretly taking and transferring almost all of their economic gains for the past five decades to the billionaire class. And the transfer of wealth begins before working people even see their paychecks in their checking accounts.

The first way government impoverishes the middle class is through racking up a huge national debt. The debt will increase $14,500 per household in 2025 and another $18,300 per household in 2026 and 2027 for each of America’s 131 million households. That’s on top of the $283,000 per household every American family already owes from the $37.1 trillion national debt. It’s a huge burden for the median household, which will gross only about $87,000 this year (the U.S. Census says the median household income was $80,610 in 2023 and nominal GDP increased about 8.5% since 2023).

All of that new debt will be added, or at least will be in motion to be added, before the average American family cashes their first paycheck on the first week of January. And the annual $1 trillion-plus interest payments will place upward pressure on money creation by the federal government in the forms of both currency inflation and credit inflation.

Before that median family receives their first paycheck for the year, while they are awaiting payday, they’ll have paid a highly regressive tax in the form of inflation.

In its most fundamental essence, inflation is a transfer tax from the laborer to real estate barons and the financial industry that work primarily with debt. As an economist, I really don’t need to make a statistical argument that inflation hurts working people; we all know it intuitively when we go into the grocery store or to the gas station. But I’ll outline the argument anyway. Regular price inflation as measured by the Consumer Price Index is a direct result of new money creation by the U.S. Mint and Federal Reserve Bank. It taxes creditors like wage earners, renters and those with checking and savings account deposits by making their dollar-denominated assets worth less.

On the other hand, people who have hard non-cash assets like stocks, yachts, rare art, and commodities are unaffected by inflation. No level of inflation ever sunk a yacht or took a penny of value from a diamond necklace.

Moreover, financial institutions that work with debt or real estate developers that leverage mortgages over their properties benefit greatly from currency inflation and the price inflation that results from it. Mortgages are slowly, and sometimes not so slowly, forgiven by the falling dollar while property values increase in nominal dollars. Every home owner knows this intuitively from their own mortgage, which gets easier to pay with passing years. Multiply that times 100 or 1,000 for a billionaire real estate developer and just a 3% inflation rate can mean hundreds of millions of dollars of financial gain. A real estate developer with $1 billion dollar net worth, title to $5 billion in real estate properties and $4 billion in mortgage debt sees a benefit of $120 million every year from 3% inflation in terms of mortgage forgiveness.

Price inflation also acts as a soft “put” for real estate and stock speculators, moving most assets upward automatically, something that can be leveraged with margins and more speculative financial instruments that have multiplied since the dollar went fully off the gold standard in 1971.

Inflation is an increase in the money supply, thus it lowers the purchasing power of existing dollar denominated assets owed to creditors and forgives part of the loans owed by debtors. And the laborer, who is almost always a creditor for at least a week’s worth of labor, is always a social creditor.

On average, the median worker is a creditor to his employer for two weeks of his labor (the time from when he begins his labor until payday, which is longer for those paid biweekly and shorter for day-laborers) and has a month’s salary credited to his bank in his checking and savings accounts (or holds in cash as a credit to the U.S. government).

Those six weeks of wages on credit constitute a minimum tax of about $300 per year for a median wage-earning household under a 3% inflation regimen, and maybe $450-500 for a young family renting. It’s often a lot more than that, as many wages are fixed for contract periods assuming 2-3% price inflation, and when the CPI jumped 8% in 2022, most people were left for years trying to catch their wages back up to 2021 levels.

A $300-500 annual tax sounds like a small amount for the median family, but turns into a Richard Pryor-in-Superman III-level scheme for a few billionaires. A struggling average family could certainly put that $300-500 in a normal year (or several thousand dollars in 2022-23) to positive use toward fixing a car or paying a few monthly bills. But instead it becomes a huge benefit when tens of thousands of workers’ spending power are pooled (virtually speaking) and transferred over to forgive the debts of billionaire real estate developers and the financial industry (which is the very business of being in debt).

Wages are just shy of $13 trillion in the U.S. economy in 2025. Collectively, with just 3% inflation rate annually, those six weeks’ worth of wages constitute a transfer of at least $45 billion from laborers to the real estate and financial sectors—every year, year after year. In the high inflation 2022-23 period, the transfer from most working poor to the super-rich totaled at least in the hundreds of billions. Is it any wonder the real estate and financial sectors have consumed an ever-larger segment of U.S. GDP over the past five decades, with especially large gains in this decade?

Poorer people are also creditors to their landlords for their rent (first and last month’s rent, and security deposit is fronted, typically, before you can even occupy an apartment), though the median income earner is also a home owner. But not the younger median income earner. Adults aged 25-34 only had a 39% home ownership rate in 2022, and that rate has fallen precipitously as interest rates have risen substantially since that time. In 1980, the home ownership figure for the 25-34 age group was 51.6%.

What happened?

What happened was credit inflation, which accelerated asset price inflation far beyond both the Consumer Price Index and wage increases. Cheap credit, which really took off in the 2000-2022 period, when the Federal Reserve Bank was actively suppressing interest rates to near zero, spiked sticker prices in real estate, the stock market and any hard asset that was a sanctuary from price inflation. As a general rule, the market “price” for a home, most of which are purchased on credit, is the monthly payment, which is a composite of the sticker price and the interest rates. Suppress the interest rates, and the sticker price rises; raise the interest rate and the sticker price falls. As a result, the median sticker price of a home went from an average of three times median household income in 2000 to 5.6 times median household income by 2022.

And then, in 2022 the Federal Reserve Bank jacked up interest rates back close to historical ranges, making home ownership much more unaffordable for new home buyers (and even for existing homeowners with low interest rate mortgages who needed to move).

So it should be no surprise that the home ownership rate in the United States is down to 65.2%, from an all-time high of 69.4% in 2004, and lower than home ownership rates in the early 1980s, driven by lower home ownership rates among young families.

For the median young American family, that’s a loss of $226,000 going toward the sticker price of a new home alone, not counting additional hundreds of thousands of dollars in higher interest payments since 2022 when interest rates rose back close to historic norms, all because the money-changers in the Federal Reserve Bank temple say they know best how to run the economy. I’d argue they do, but only how to run it best for themselves and their billionaire cronies.

The above are the taxes ordinary American laborers pay before they even get their Friday paycheck. On payday, you’ll notice you don’t get your full paycheck. There are several major deductions between your gross and your net pay: FICA/HI payroll taxes, income tax withholding from the federal government, and—in most states—state income taxes.

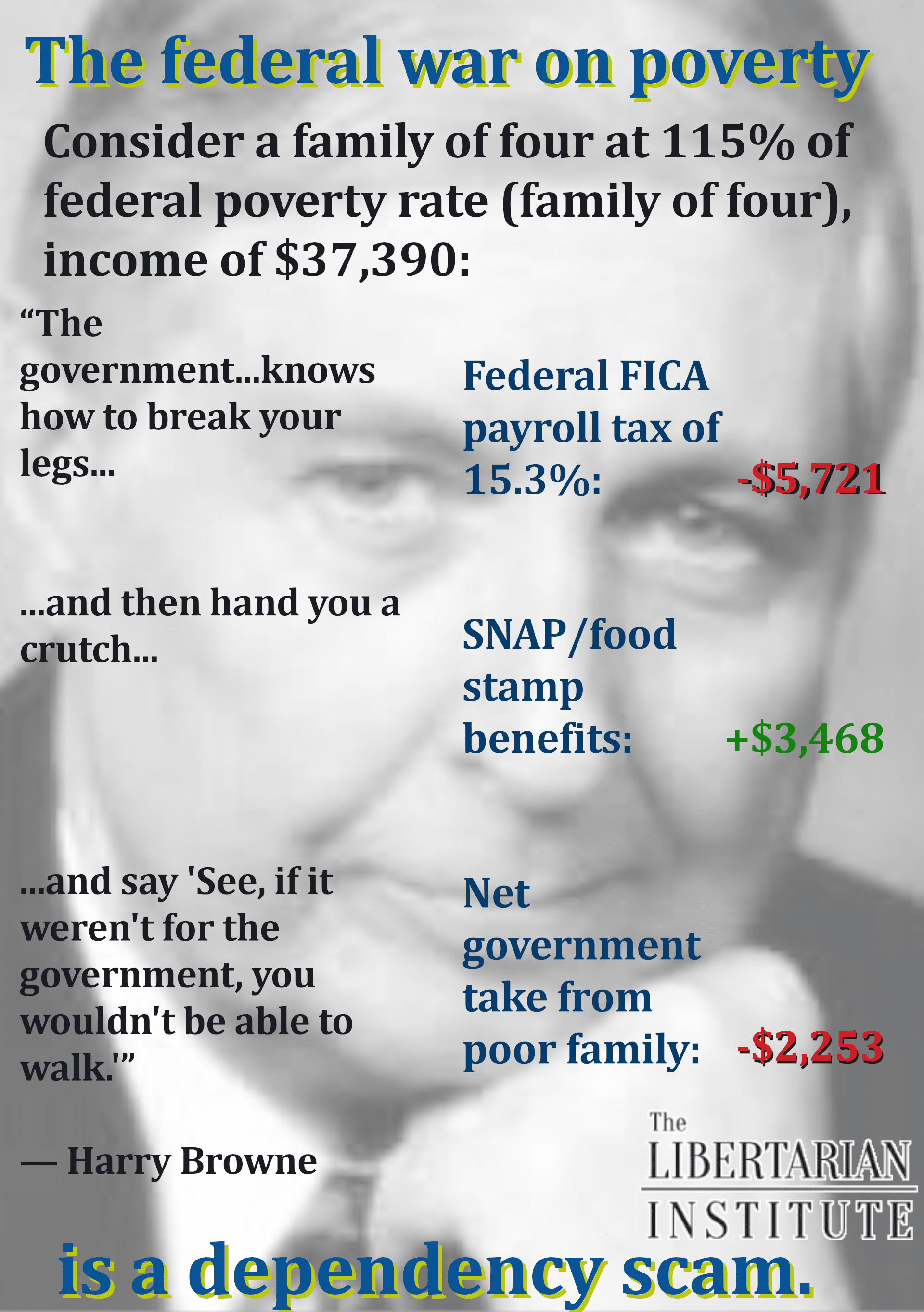

The total FICA payroll tax is 15.3% of your pay (when Social Security started it was just 2%), though unless you’re self-employed the federal government arranges to make it look like your employer is paying half the tax. But it’s all deducted from what you’d otherwise be paid. And this, the third most regressive tax in the federal tax arsenal (after debt and inflation), is paid exclusively by laborers. A family of four earning wages at the poverty level (about $33,000) pays more than $5,000 in payroll taxes (compared to the median household tax level of $13,311). Hedge fund moguls, real estate developers and trust fund babies typically pay nothing toward payroll taxes, or, for that matter, income taxes.

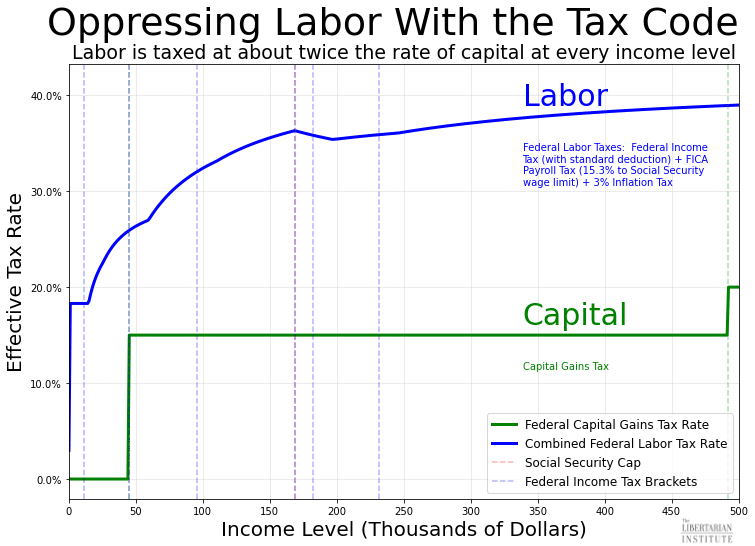

In fact, real estate developers and hedge fund operators typically only pay the capital gains tax, which tops out in most cases at 20% (or 23.8% in some rare cases), and they don’t pay the tax until they cash out of their investments. So while labor has both the 15.3% payroll tax and income tax withholding (plus inflation) deducted from dollar one, before they even see their paychecks, billionaires working with capital keep all their money until they cash out.

What this means is labor is taxed at roughly twice the rate of capital at every income level, and they pay it first, rather than how capital pays taxes later.

So, at the moment the young laborer has first gotten his check, he has paid the price inflation tax (~$500), possibly the credit inflation tax on his housing (a one-time cost of over $226,000), the payroll tax ($13,311) and the federal income tax (average of $2,472) and in many cases the state income tax (as much as another $1,800). Meanwhile, the billionaire investor has yet to pay anything and has generally hugely benefitted from both kinds of inflation.

The next thing the worker needs to do after securing housing and cashing his check is to buy food and clothing, the two other necessities of life. And the food and clothing markets are also rigged, though less so than the housing market. In the past four years, food prices have increased as fast as housing prices, and it’s not a result of greedy family farmers or market capitalism.

The first thing you need to understand is that federal agriculture subsidy government programs are engineered to make consumers a double loser: the stated goal of federal programs is “price support,” meaning higher prices for consumers. So workers have to pay the taxes for the program and have to pay again for the higher prices at the supermarket and retail clothing stores that these programs are designed to create. Federal subsidies run a whole spectrum of commodities, from food products like peanuts, rice and honey to clothing raw materials like cotton and wool.

If food and clothing seem like they’re more expensive than they should be, it’s because higher prices are conscious federal government policy, not because greedy capitalists raised prices in a free market. Farm price supports will cost taxpayers $54.8 billion in 2025 directly (including direct price supports and insurance subsidies), and if we assume the indirect cost of those higher prices at the supermarket and clothing store checkout counters roughly match the program costs, we come to a total of $109.6 billion. That’s about $836 per household in America, more for larger families and less for smaller families.

The average food stamp/SNAP recipient check in 2024 was $187 per month, so it’s probably close to $200 in 2025. While federal farm subsidies to raise food and clothing prices doesn’t by itself fully cover the average SNAP benefit, it explains why there are so many families who need SNAP benefits and local volunteer food banks are overflowing with hungry poor people, many of whom are working full-time. And it shows hunger is not the result of the natural market forces of capitalism.

And both food and clothing have additionally higher prices because they are farmed or manufactured by labor that is taxed heavily, transported by trucks that are taxed, using gasoline that is heavily taxed, and brought to and sold at supermarkets and department stores (or Amazon delivery staff) by labor that is heavily taxed.

It should also be pointed out that federal agricultural subsidies don’t go to the best family farmers who grow the best produce, but more often than not go to rich agribusiness (BigAg) that have the lawyers and accountants on staff able to take maximum advantage of the subsidies.

Like federal agricultural subsidies that make the consumer a two-time loser in the grocery market, federal health care policy makes poor and struggling young families two-time losers that subsidize wealthy retired people, along with enriching the giant medical and pharmaceutical industries have played fine-tuned government regulations like a harp. These companies maximize government subsidies and milk the average working person for ever-increasing health care costs in an atmosphere of limited competition because health care is artificially tied to employment via legislation emanating from Washington.

The average cost of a health care insurance policy in 2025 is $23,968 for a family plan, counting both employer and employee contributions, and it should go without saying that this doesn’t even cover all the expenses a family needs for health care. There’s no rational reason a young family should have to pay nearly half a million dollars for a health care policy over twenty years when all most do is take the kids to the doctor for annual check-ups, seasonal flu, some ear infections, and an occasional sprained ankle. And that intuition is validated by the data.

The natural market in health care is that young people, who are the poorest age demographic, tend to have the lowest health care costs, while the elderly who have gained wealth throughout their lives tend to have higher health care costs by several multiples.

The federal government has reversed the payment systems in this natural market. And this is not a reference only to the Medicare payroll taxes that workers start paying at age sixteen when they first enter the workforce which are spent immediately on existing retirees. The government Medicare (and Medicaid) systems are heavily subsidized by private insurance premiums.

It sounds weird to claim that the private system subsidizes the public system. It’s kind of the reverse of the agricultural market. Here’s how it works: Every hospital and most doctors’ offices lose money on Medicare and Medicaid patients. They can’t bill enough to Medicare and Medicaid in order to make up for their minimum costs from Medicare patients. So private hospitals make up the difference by charging private insurers double (or, often, more than double) the Medicare reimbursement rate. Hospitals can only make ends meet if they make a profit on private insurance plans, or if they have some other giant government cash flow stream.

The Rand Corporation came out with a study last year showing private insurers had to pay out 254% of what Medicare paid out in 2022, matching numbers in similar earlier studies. That means two things: (1) if Senator Bernie Sanders (I-VT) gets his way and imposes “Medicare for all,” the nation’s whole health care infrastructure will collapse financially, and (2) young families are paying roughly twice the break-even point for their health care in the private market in order to subsidize the government systems.

In other words, health care for a young family should cost $12,000 per year, at most, and not $24,000, under any vague semblance of a real free market in medicine. And that’s assuming all the other sweetheart deals for BigPharma, which charges Americans more than double for drug prices than in most other countries, remain in place.

Collectively, America’s health care system constitutes a huge intergenerational wealth transfer. About $1 trillion from poor working families to wealthy retirees through health insurance premiums, not counting the other nearly $1 trillion in HI payroll taxes that nominally fund Medicare.

The Deep State has built an entire propaganda infrastructure to defend this plutocracy. Real tax cuts and policy relief for working people are almost never on the political docket. Republicans promise tiny income tax cuts that expire at the close of President Donald Trump’s term of office, a cynical Washington gimmick designed to get workers to re-elect the GOP and keep the system of robbing wage-earners ongoing. Democrats are worse, essentially telling workers “you’ll get nothing and like it” in 2024, while promising to increase taxes on the rich. Working people know they can’t eat taxes on the rich, or make their rent with taxes on the rich, and the Democratic politicians selling this line know it’s mathematically impossible for taxes on the billionaires to even balance the budget in the long term. They’re evil, but they’re not stupid. The problem is not that the rich aren’t taxed enough, but that the poor and middle classes are oppressively taxed and much of the proceeds of those taxes are transferred to the billionaire class.

The bipartisan slogan for piling debt onto the unborn is “deficits don’t matter” even as interest payments on the national debt have topped $1 trillion per year, equal to all payroll taxes for Medicare.

The Federal Reserve Bank dutifully retails the propaganda line that inflation is necessary for a healthy economy. It is, but it’s only necessary for a healthy billionaire vampire economy. Tell anyone infected with this propaganda narrative that prices should tend to fall naturally through deflation as production gets more efficient (as prices did in the U.S. by about 40% from 1800-1913) and you’ll hear some ignorant and panicked propaganda sounding something like “Humina-humina-do-you-want-another-Great Depression?”

The billionaire-funded propaganda narrative shouts from the rooftops that housing prices are only higher relative to salary because “New U.S. homes today are 1,000 square feet larger than in 1973 and living space per person has nearly doubled,” arguing home owners are just buying bigger houses and this explains the higher prices. The propaganda trick is only to measure “new” homes, the series of McMansions being built in recent decades, and not count the vast stock of modest housing units long in use in the market.

Additionally, billionaire shills like the American Enterprise Institute headline cited above skew it by counting average sizes and not medians and also by adding smaller family sizes to their calculation in order to maximize distortion. A housing market of four houses of 1,000 square feet has an average and median of 1,000 square feet. If a fifth person comes into the market with a 6,000 square foot McMansion, the average doubles to 2,000 square feet while the median remains the same 1,000 square feet. It doesn’t mean the regular guy is living in a bigger house. And, of course, if somebody told you eggs are cheaper because you have to buy eggs for fewer kids in your household than your parents did in the 1970s, you’d probably punch him for being such an insufferable dope. The median (the 50th percentile) size of houses in America only increased about 190 square feet since the 1970s, about the size of a 13’x14’ bedroom, for the inflation-adjusted cost of several hundred thousand dollars to the median buyer (almost double the price of the whole house).

Payroll taxes are dogmatically billed as the “third rail of politics” according to the official billionaire narrative. Payroll taxes “pay” for the vital programs of Social Security and Medicare, or so they say, with the surplus vested in a “trust fund” that the government claims is vested in U.S. Treasury bills earning interest. What they don’t tell you is that payroll taxes, including the “trust funds,” just go right into a giant federal slush fund and are spent immediately. Nor do they tell you that the already fully spent “trust funds”—merely several empty electronic ledgers—are vested in Treasury bills that have lost more than $1 trillion in spending power because the Federal Reserve Bank as a matter of policy suppressed the yields of Treasury bills to the point the “trust funds” have been earning lower interest rates than the rate of inflation for the past five years straight. Did you get that? The Federal government has reached a level of theft that even reaches into the fictional Social Security and Medicare trust funds robs them of $1 trillion of what they pretend to have in the bank.

Billionaire apologists like the Heritage Foundation’s Adam Michel recites the propaganda that “the top 1% of income earners—those who earned more than $540,000—earned 21% of all U.S. income while paying 40% of all federal income taxes. The top 10% earned 48% of the income and paid 71% of federal income taxes.” And that’s factually true…for income taxes alone. It leaves out inflation and payroll taxes and the fact that billionaire investors generally pay a much lower capital gains tax instead of income taxes. And that omission is not accidental.

The whole goal of the controlled Republican right is to convince you that billionaires are already impossibly saddled with high tax rates and that the poor and middle classes pay almost nothing, just as the whole goal of the controlled Democratic left is to convince you that the $187/month SNAP check or the $5,000 Pell Grants for your kids when they get to college means you’re getting a great deal from the federal government.

The truth is that you’re not getting your money’s worth. The federal government’s $7 trillion in spending in 2025 means the average household will pay the government $53,400 in taxes and new debt this year alone, with several tens of thousands more in state and local taxes.

Even a poor working family that makes far less than the median income will experience a loss of tens of thousands from their wages, and the purchasing power thereof, transferred every year to government programs subsidizing billionaire real estate developers, big banks and finance, BigAg, BigPharma, the military-industrial complex and health insurance companies. As George Carlin said, it’s a big club and you ain’t in it.

That transfer of trillions of dollars annually from the poor and middle class to the wealthy is the primary reason for the widening gap between the super-rich and the poor and middle class in America, not lower Reagan-era income tax rates still paid by wealthy lawyers, doctors, and salaried software developers.

Conservatives and libertarians have long, and rightly, opposed class warfare by the poor against the rich generally. But what should the response be when a select proportion of the super-rich, armed with government crony subsidies and one-sided protective regulations, wage class warfare against the middle class and the poor, perpetually robbing them blind?

That’s an even worse kind of class warfare, and perhaps the very worst kind of class warfare.