Last week, Jerome Powell & Co. met to issue an immediate decision regarding the status of the federal funds rate for March, and to provide some insight into the trajectory of monetary policy for the rest of 2024 and into 2025. As with the past few inflation readings, with January, February, and March showing inflation ticking up and underlying inflationary pressures remaining strong, talk continues to surround the Fed’s “level of confidence” whether the time is right to start cutting rates.

That the Fed will cut rates is still taken to be a given, but Powell held off again last week, leaving the rate between 5.25% and 5.5%, and the new, accompanying dot plot Fed officials released shows that central banks are now anticipating fewer rate cuts than had been publicly predicted as little as three months ago. Observers will recall that back in those heady days of December there was public speculation that as many as a half dozen quarter point cuts could occur in 2024. Optimists are still cheering the promised three, and Fed officials still ooze that particular aura insouciant confidence so peculiar to government officials. But realistically, the stickiness of inflation the past three prints and the halving of projections in a quarter should properly be viewed as disastrous.

With the Consumer Price Index (CPI) and the Fed’s preferred Personal Consumption Expenditure (PCE) metric both showing three consecutive increases to start the year, Powell’s adamance that 2% will continue to be the Fed’s target number looks increasingly at odds with what markets are predicting and what Fed officials are saying. Despite calls for him to abandon the admittedly arbitrarily and relatively recently set target, he has held on, maintaining in the face of increasing evidence that inflationary pressures are creeping upwards again that “the Fed doesn’t need to see significant changes in the inflation data” to begin the projected cuts. Only, it isn’t quite sure the battle against inflation has been won yet.

It has—they just aren’t quite sure it has.

Keep the faith!

This has been Powell’s line practically since July of 2023: we’ve won…only we’re just not sure we’ve won…yet…please hold.

Markets meanwhile have been zooming, while in Washington the government has been spending money like trillions in annual deficits really just don’t matter.

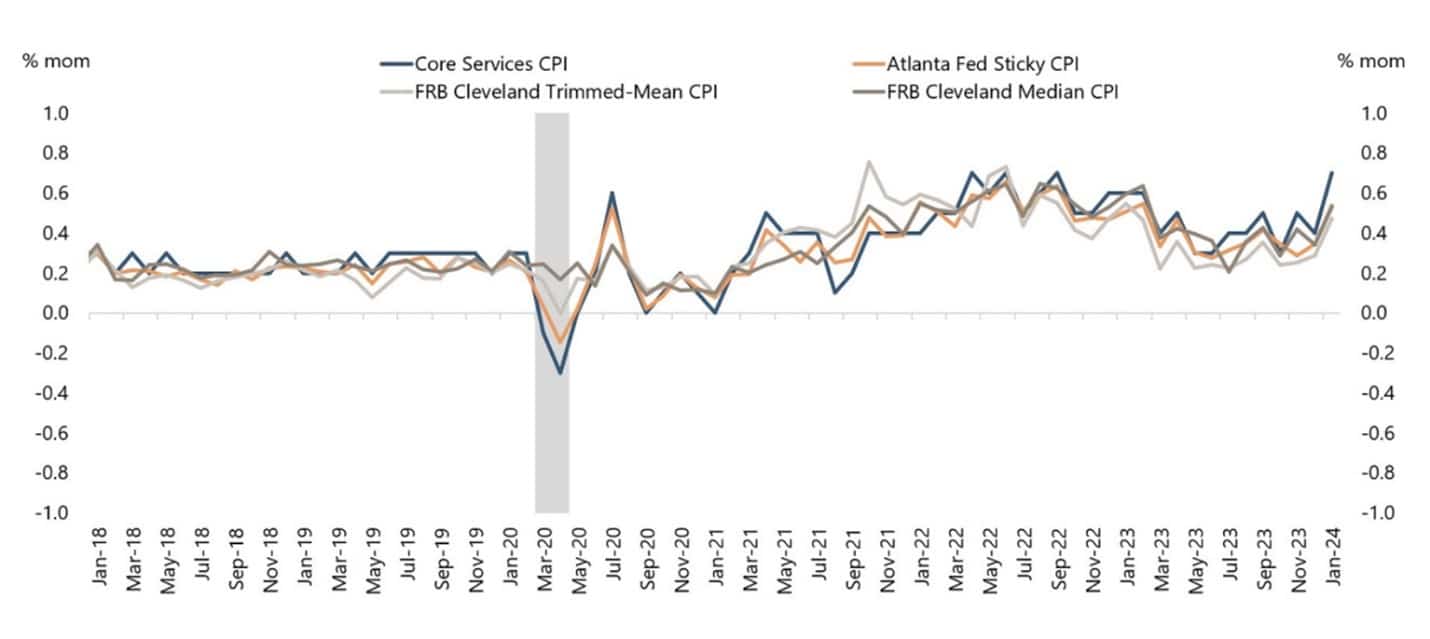

There are, therefore, serious arguments for not cutting rates. Of course, it is an election year and Powell & Co. won’t be looking to undermine the economy (any further) before then—to say nothing of the troubled banks or the mounting interest costs of servicing the existing national debt at these higher interest rates—but as mentioned above, per the BLS and Fed the underlying inflationary pressures are clearly there:

For another thing the job market remains tight and there is little Powell & Co. can do about this (it being a simple function of demographic turnover and people needing to work multiple jobs to make ends meet). This labor market tightness has contributed, and will continue to contribute, to inflationary pressures, the wage-price effect. Lastly, the economy continues to grow; and while it is true that GDP growth is being pushed by government spending, that reality frankly isn’t going anywhere (the budget office projecting $2 trillion deficits to be the norm over the next decade).

Essentially, with so many forces pushing against the Fed’s efforts, Powell giving in to rate cut expectations (which shouldn’t have been stoked in the first place: remember “no more forward guidance”?) means that inflation returning to 2% is unlikely to happen.

Inflation is of such a character that once it’s out of the bottle it can be hard to get back in. Apart from noting that were inflation still calculated in the same way it was decades ago, peak inflation last year would have been close to 20%, with inflation running just 3% annually, prices will double approximately every 25 years: can you imagine kids today being in their fifties and paying $20 or $30 for a single combo meal at McDonald’s?

How about when they’re in their forties?

If Powell gives up the fight and starts cutting rates and we get a rerun of the years 1972-1982, we might well see exactly that.

Just as a frame of reference for the doubting: a double cheeseburger at McDonalds was $0.38 in 1965.