When asked how far the U.S. government has plunged into the red, many fiscally-conscious Americans will tell you the national debt has reached $37 trillion. As distressing as that official number is, America’s true fiscal situation is even worse—far worse. According to a barely-publicized Treasury report, the actual grand total of Uncle Sam’s obligations is more than $151 trillion.

That huge discrepancy springs from the fact that the federal government doesn’t hold itself to the same accounting standards it imposes on businesses. Rather than using accrual accounting—which recognizes expenses when they’re incurred—our Washington overlords self-servingly use simple cash accounting, only recognizing expenses when they’re paid. As a result, discourse on federal obligations solely focuses on the national debt, comprising Treasury bills, notes and bonds.

Once a year, however, an obscure report delivers a more accurate version of Uncle Sam’s balance sheet. While it receives almost no attention from journalists or public officials, the Treasury Department is required to submit an annual report to Congress detailing the government’s financial condition. Critically, the 1994 law compelling this report mandates that it reflect “unfunded liabilities”—that is, commitments made without any dedicated assets or income streams to ensure they’ll be kept.

One of the larger categories of those unfunded liabilities is future federal employee and veterans benefits. At the end of the 2024 fiscal year, this alone represented a $15 trillion obligation. However, by leaps and bounds, the largest unfunded liabilities spring from America’s social insurance obligations—primarily Social Security and Medicare. At fiscal-year end, these liabilities totaled a towering $105.8 trillion.

Stacking these and other unfunded liabilities on top of the publicly-held national debt and other obligations, you arrive at a grand total of $151.3 trillion at the end of the 2024 fiscal year. Offsetting that by an estimated $7.9 trillion in US government commercial assets—including property, plant, equipment and purported gold holdings—a Just Facts analysis puts Uncle Sam at an overall net-negative $143 trillion.

Writing at the Heartland Institute, Just Facts president James Agresti put that nearly-incomprehensible total in perspective:

“$143 trillion amounts to 85% of the net wealth Americans have accumulated since the nation’s founding, estimated by the Federal Reserve to be $169 trillion. This includes all of their assets in savings, real estate, corporate stocks, private businesses, and even consumer durable goods like automobiles and furniture.”

Those numbers reflected the government’s position on September 30, 2024. They’ve not only grown significantly worse in the intervening months, they’re deteriorating at a blistering pace even as you read this: Not even counting the unfunded liabilities that represent the biggest part of the problem, the national debt alone is increasing at something like $156 million per hour.

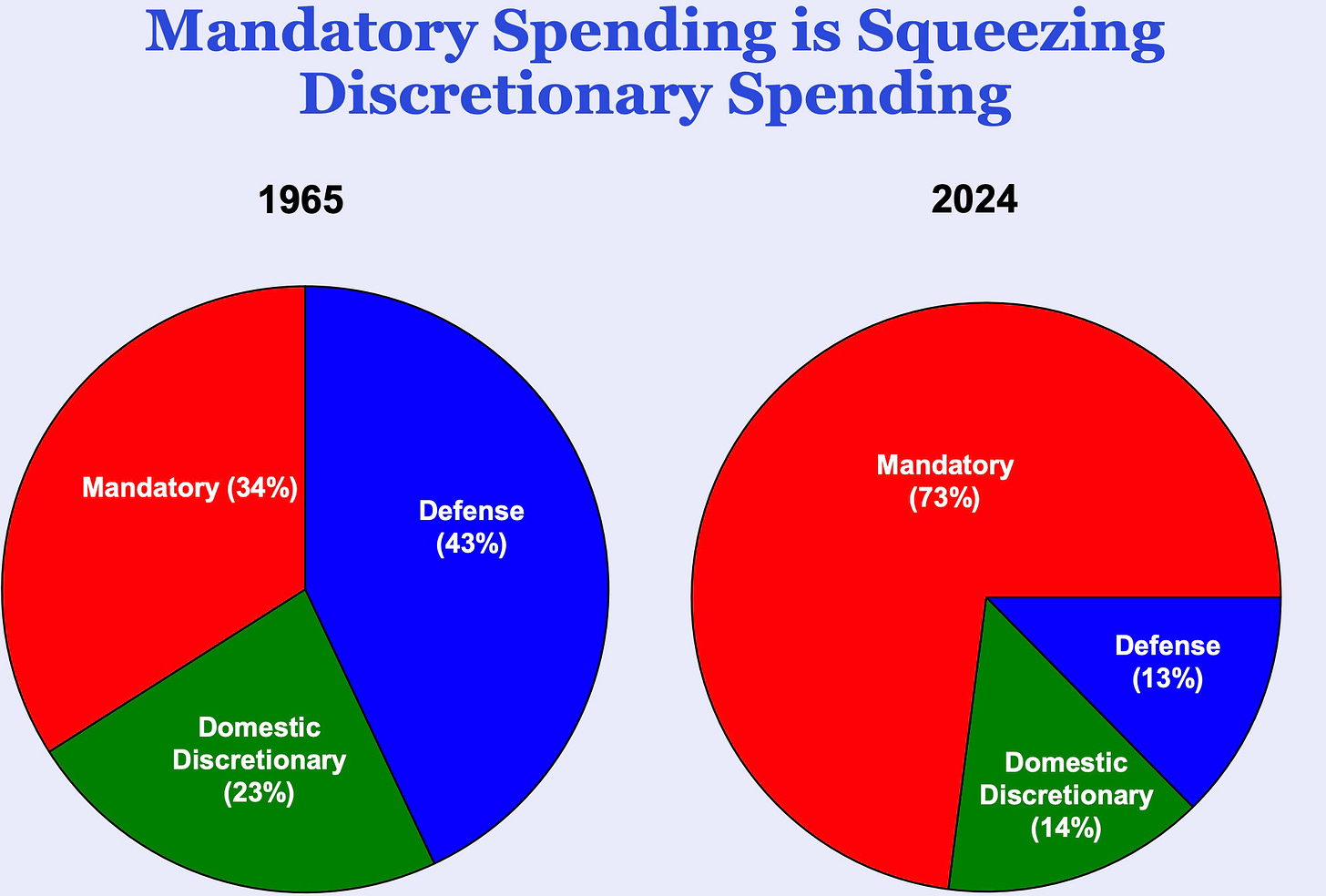

Wrangling over the budget isn’t going to save us. Congressional debates tend to center on discretionary spending—outlays that require a vote by Congress during the appropriations process. However, America’s steady march to insolvency is driven by so-called mandatory spending, which is hardwired by previously-enacted laws.

In what may be the most ominous indication that the government is on an autopilot-course for catastrophe, the proportion of total federal outlays driven by mandatory spending has more than doubled since 1965—from 34% to 73% in 2024. It was at 71% just two years earlier, in 2022.

The two largest examples of mandatory spending are Social Security and Medicare. Those old-age programs are now well within sight of a crisis that’s been warned about for a generation: According to the latest report from their program trustees, Social Security and Medicare trust funds are now just seven years from insolvency.

While the federal government requires private-sector pension plans to maintain assets equal to the present value of future obligations, the federal government exempts itself from providing the same security to the citizens that it forces into the Social Security program. Contrary to the mythology that payroll taxes are placed in individual “accounts” held for our future benefit, that money is immediately being dished out to other people who’ve already reached the benefit-receiving phase—which is why Social Security can be reasonably compared to a Ponzi scheme.