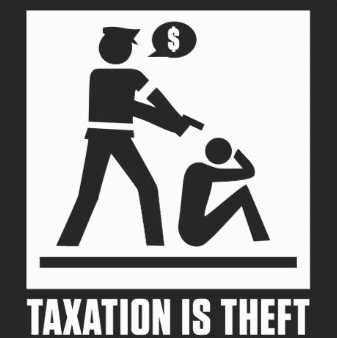

Libertarians think that taxation is theft. The government takes away part of your income and property by force. Your payments aren’t voluntary. If you think they are, try to withhold payment and see what happens.

An influential book by Liam Murphy and Thomas Nagel, The Myth of Ownership, tries to show that this view of taxation is wrong. Many people, they say, foolishly resent taxes. By what right does the government take away part of what we own? Isn’t this legalized theft? The government may claim that it needs the funds to provide essential social services: are the poor to be left to starve? But these assertions do not justify its policy of forcible seizure. Isn’t it up to each owner of property to decide what, if anything, he wishes to donate to charity and other good causes?

You might guess that the authors will respond, along conventional leftist lines, with a denial that property rights are absolute: you do not have the right to keep all that you own, if the government’s exactions are devoted to a good purpose. Quite the contrary, they adopt a much more radical stance. You are not giving away anything at all to the government when you pay taxes, since you own only what the laws say you do.

Our authors are nothing if not direct on this point: “If there is a dominant theme that runs through our discussion, it is this: Private property is a legal convention, defined in part by the tax system; therefore, the tax system cannot be evaluated by looking at its impact on private property, conceived as something that has independent existence and validity. Taxes must be evaluated as part of the overall system of property rights that they help to create. . . . The conventional nature of property rights is both perfectly obvious and remarkably easy to forget . . . We cannot start by taking as given . . . some initial allocation of possessions— what people own, what is theirs, prior to government interference.”

An example quickly discloses the authors’ fallacy. Suppose that the government banned advocacy of libertarian property rights. Against those who claimed that this interfered with free speech, advocates of the new measure replied in this way: “Don’t you see the obvious conceptual error that underlies your protest? ‘Free speech’ is a legal category. People have no independent liberty of speech, apart from what a particular legal system grants them. Your opposition is absurd: away with you!”

I doubt that Murphy and Nagel would display much patience for this sophistry. Legal rights indeed depend on the specifications of a particular legal system; but it is perfectly in order to say that people have moral rights, not created by the legal system, that the law ought to respect.

In like fashion, opponents of taxation are guiltless of the conceptual error Murphy and Nagel impute to them. They maintain that people possess property rights that the government ought to recognize. Why is the falsity of this view “perfectly obvious”? It is rather Murphy and Nagel who have lapsed into grievous error: they confuse legal with moral rights.

The authors at one place acknowledge the point at issue: “[D]eontological theories hold that property rights are in part determined by our individual sovereignty over ourselves. . . . On a deontological approach, there is likely to be a presumption of some form of natural entitlement that determines what is yours or mine and what isn’t, and this prima facie presumption has to be overridden by other considerations if appropriation by taxes is to be justified. On a consequentialist approach, by contrast, the tax system is simply part of the design of any sophisticated modern system of property rights.”

Our authors of course reject the entitlement view, but they have here made a crucial admission. Given that this theory exists, is it not evident that their earlier account is false? The alleged error that opponents of taxation commit is present only if the conventionalist theory is true. Supporters of Lockean entitlements to property may be incorrect, but they at least have a theory: they stand acquitted of simply failing to grasp a conceptual point, the charge that Murphy and Nagel bring against them. Do they think the Lockean account obviously incoherent? They say nothing against it but instead go on interminably to accuse opponents of their view of confusion.

The conventionalist theory they support leads quickly to disaster. Isn’t it “perfectly obvious” that it makes us all slaves of the government? Once more, Murphy and Nagel acknowledge the objection. Their view “is likely to arouse strong resistance” because it “sounds too much like the claim that the entire social product really belongs to the government, and that all after-tax income should be seen as a kind of dole that each of us receives from the government, if it chooses to look on us with favor”

They fail to see that their admission gives away the game. If, as they admit, individual rights require some degree of private property, then the government cannot morally tax away this property. If so, there are moral limits to the taxing power, and it is not “a matter of logic” that there cannot be a pre-tax income over which persons retain full control

Murphy and Nagel are pure conventionalists about property when this enables them to attack libertarians, but they shrink from the full implications of the position. How is this tension in their presentation to be resolved? I suspect that in practice they would not deviate very far from the total subordination of property rights to the state. They consider endowment taxation, in which people are taxed, not just on their income, but rather on their potential to generate revenue. Someone who abandoned a multi-million-dollar business career in order to become a Trappist monk might on the endowment account be taxed as if he continued to receive his former high income. Our authors eventually reject this monstrous proposal, though not on the grounds that it compels people to work.

To reject the proposal because it compelled people to work would put them suspiciously close to a famous argument, advanced very effectively by Robert Nozick, that income taxes are akin to forced labor. Of course our authors cannot accept so libertarian a view; “we may assume that this argument is not dispositive against taxation of earnings.” Since taxation is acceptable—this we know a priori—no argument that holds it illegitimate is right. But then we cannot reject endowment taxation if we reason in a way that would also condemn the income tax. “[T]here is no intrinsic moral objection to taxing people who don’t earn wages” (p. 124). We can, then, maintain that endowment taxation is “too radical” an interference with autonomy; but we cannot in principle reject it.

If you affirm a “conventionalist” account of property, you will wind up in dark waters. Taxation is indeed theft.

Reprinted from the Mises Institute.