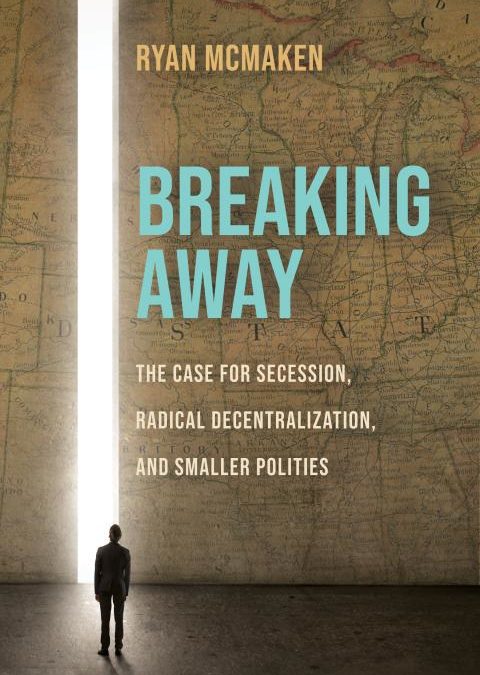

Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities by Ryan McMaken Mises Institute, 2022, 230 pp. Those of us who think that there should be no state at all, or at most a very limited one, must view all existing states with dissatisfaction, though some are better than others. In assessing how good or bad a state is, does the extent of the territory it controls matter? Offhand, you might think it doesn’t. Isn’t the only relevant dimension by which to judge states the nature and degree of control they have over their people? The United States in the...