Want to know the truth about student loans?

Good luck.

As with so many emotionally-loaded and politically-charged issues of the day, it’s nearly impossible for someone to know the full truth about student loans.

By the time the issue is run through the propaganda generators of the left and right, by the time that the bleeding-heart media puts its left spin on the issue, and by the time that data are cherry-picked to fit liberal and conservative pickers’ biases and blinders—by the time all this occurs, the facts become so mangled and distorted that the truth is buried.

In a poor imitation of Lazarus, I’ve tried to resurrect the truth in this commentary but am not confident that I’ve succeeded. Please continue reading to see what you think.

My first step in the resurrection process was to take what I already knew about student loans and to do additional research on the Internet.

In over 50 pages of Internet sources, I found hundreds of stories on how students have been victimized and/or bamboozled, but not one story going in the other direction—that is, not one story about “students” gaming the system to get money for room, board, and the overall good life on campus, with no intention of ever earning a degree or repaying the loan. In other words, there was not one story about recipients of student loans making victims out of taxpayers.

If the system isn’t being gamed by many of its beneficiaries, it will be the first government program in human history that hasn’t been gamed.

If the system is being gamed, would the bleeding-heart media have the intellectual curiosity and honesty to look into it and report on it? Would the media run human-interest stories exposing the gamers?

My biased answer is that they would not, judging by the paucity of human-interest stories on any of the tens of thousands of people who game the Social Security Disability system, or housing vouchers, or food stamps, or Veterans benefits, or the EEOC discrimination system, or the tax code, or any of the hundreds of other government social-welfare programs, entitlements, and tax breaks, whether intended for the poor, the middle class or the wealthy.

There must be a rule posted in every newsroom in the country not to go there, given that so few reporters and assignment editors go there.

Thankfully, Judge Judy is not afraid to go there. Yes, you read that right.

To my knowledge, her show is the only show on TV that has exposed people who game the tuition loan system. Litigants have been on the show who have a sixth-grade vocabulary and command of English yet attend college. When Judge Judy has asked them how they got the money for college if they don’t work, they answer that they are on some form of public assistance and have a tuition loan.

This has led me to research whether it’s possible for someone on public assistance with no credit history and no work history to obtain a student loan. Yes, it’s not only possible but encouraged on various websites. Not only that, but as long as the borrower’s earned income remains at zero, no payments have to made on the loan, which is a perverse incentive not to ever get a job.

Someone would have to be delusional or Pollyannaish or communistic to think that such a provision doesn’t lead to abuses.

Don’t get me wrong or stereotype me as a right-wing hurler of histrionics and hyperbole about welfare queens. I know that many middle- and upper-class Americans are just as addicted to free stuff as many of the poor. Also, there is no denying that the tuition loan industry is a disgusting example of crony capitalism and of amoral lenders and nonprofit and for-profit colleges preying on gullible people and driving up the cost of college in the process. The feeding frenzy over tuition loans sickens me. Particularly sickening are all the websites that advertise the fact that no credit history is needed to get a student loan. Even more nauseating are the sites that advertise debt consolidation as a way of reducing tuition loan payments.

But it’s also important to keep in mind that these travesties are the unintended consequences of our do-gooder government doing bad. This is not the medium to give a complete history of how the government created the problem, but if you have any doubt that this is the case, the history is relatively easy to find. For example, the article at the following link does a pretty good job of giving the history, albeit with somewhat of a liberal bias.

http://www.dollarsandsense.org/archives/2015/0515soederberg.html

On second thought, the travesties are the result of intended consequences, not unintended consequences. Unless they were morons, the government apparatchiks and legislators who wrote tuition loan legislation and regulations had to know that the result would be feeding frenzy in which the powerful would devour the powerless, and free riders would devour taxpayers. They also had to know that tuition loan programs would spawn so many interest groups, including colleges, that the programs would become politically unassailable.

Still, this doesn’t absolve individuals of the personal responsibility for bad decisions or excuse the media for not exposing people who game the system. Once society treats everyone as a victim, then victimology becomes a cultural norm.

A case in point is an article published at Time.com about a student who, according to the article, “did everything right.” He studied hard, got good grades, and went to dental school. The article goes on to weep that in the process he ended up with $400,000 in tuition debt. Well, sorry, but going into $400,000 of debt to get a dental degree when there is a glut of dentists is not doing everything right.

Another case in point is the media wailing about the average tuition debt being $30,000, which, they say, has resulted in millions of Americans being debt slaves for the rest of their lives. But at the same time, they are silent about the average auto debt being nearly the same amount as the average tuition debt; or the fact that at the end of a 72-month auto loan, the borrower is left with a nearly worthless beater instead of an education; or the fact that many of the Americans who wail about student debt drive expensive cars.

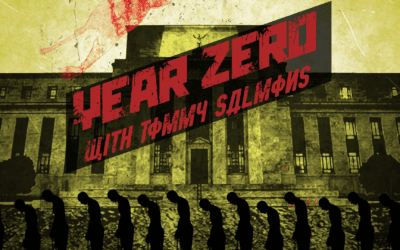

The final case in point is a guy who posted an article titled, “Screw you! I’m never paying back my student loans.” Accompanying his commentary is the illustration below. (If the illustration can’t be seen due to formatting problems, it’s an illustration of a guy with his middle finger sticking up; that is, the guy is shooting the bird to those who loaned him money—and probably to you, too.)

At least the guy isn’t afraid to speak the truth about student loans.