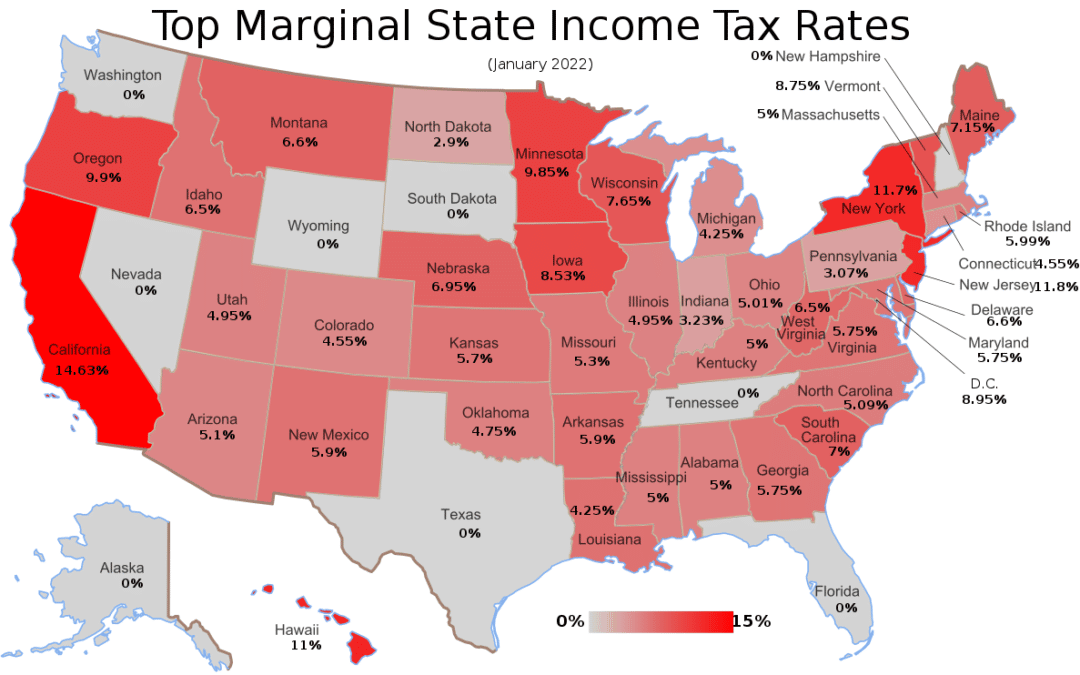

State and local governments raised $1.9 trillion in taxes in 2020. The main sources were sales taxes (35 percent), property taxes (32 percent), and individual income taxes (23 percent). But nine states do not impose an individual income tax. How do they run their governments without it? The nine states without an individual income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. The states are in every part of the country and have different industry mixes, histories, and political cultures. What they have in common is providing needed...