Terms to search:

- Nakba Day

- Patria Disaster (1940)

- Law of Return

- Israel Demolition of Palestinian Property

- First Intifada

- Broken Bone Policy

- Shin Bet

- Irgun

- Stern aka Lehi

- Haganah

- Israeli torture in occupied territories

- Marriage in Israel

- Absentee Property Law

- Citizenship & Entry Law

- Israeli Lands Law & Jewish National Fund

- Operation Defensive Shield

- Grapes of Wrath

- Qana Massacre

- 2006 Qana

- IDF Operations

- Remote Controlled Machine Guns

- Lavon Affair

- Al-Fakhura School

- Gaza UN Shelter

- USS Liberty

- Assassination

- Dahiya Doctrine

- Mowing the Grass Gaza

- Palestinian National Authority

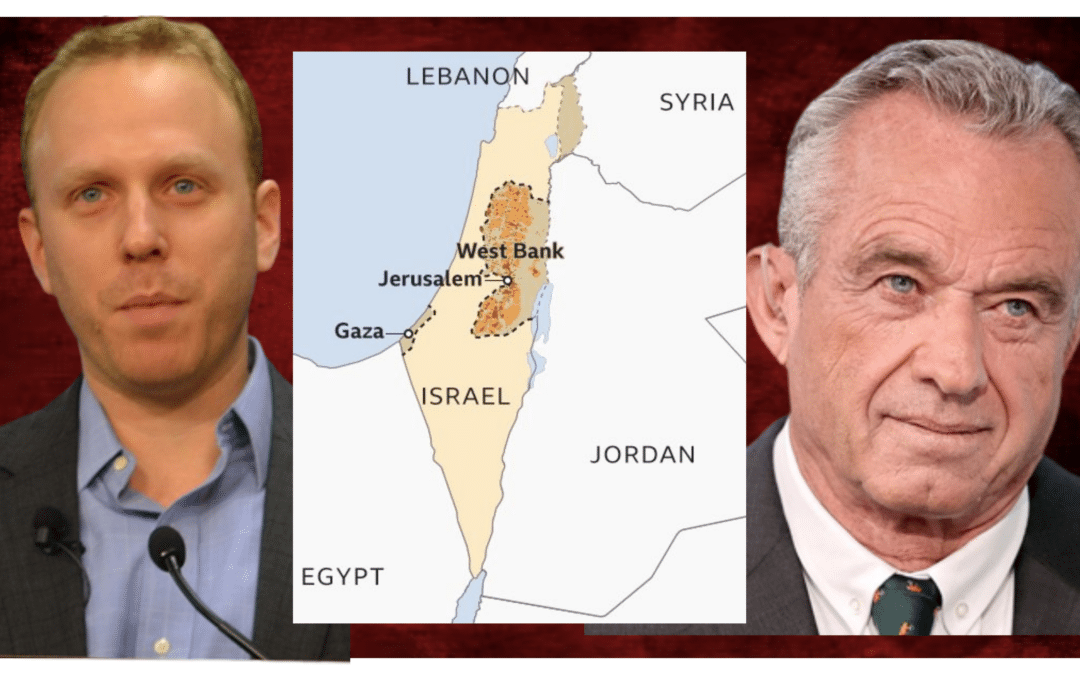

- West Bank Barrier

- Gaza War

- Arna’s Children

- Killing Gaza

- Second Intifada

- Jenin Crimes

- Bahr El-Baqar Primary School Bombing

- Ghaziyeh Airstrikes

- Beit Rima

- Hula Massacre

- Ibrahim al-Maqadma Mosque missile strike

- Kafr Qasim massacre

- Khan Yunis massacre

- Maarakeh Bombing

- Mansouri Attack

- Nabatieh Fawka Attack

- Qibya Massacre

- Rafah Massacre

- UN Resolution 242

- Jewish Population Overtime

- Peel Commission

- Resolution 181

- Sykes-Picot Agreement

- Balfour Declaration

- Ras Sedr massacre

- Wehda Street massacre

- Zeitoun District Massacre

- Zrarieh raid

- King David Hotel Bombing

- Jaffa annexation

- Lehava

- Kahanism

- Death March

- Now It Can Be Told (Iraq, 1951)

- 1967 War Controversy

- Trump Heights

- 1973 Yom Kippur War

- Hasbara

- Conscription in Israel

- Deir Yassin massacre

- Eilabun massacre

- Ein al-Zeitun massacre

- Tantura massacre

- Safsaf massacre

- Sa’sa Massacre

- Hospital Airstrikes