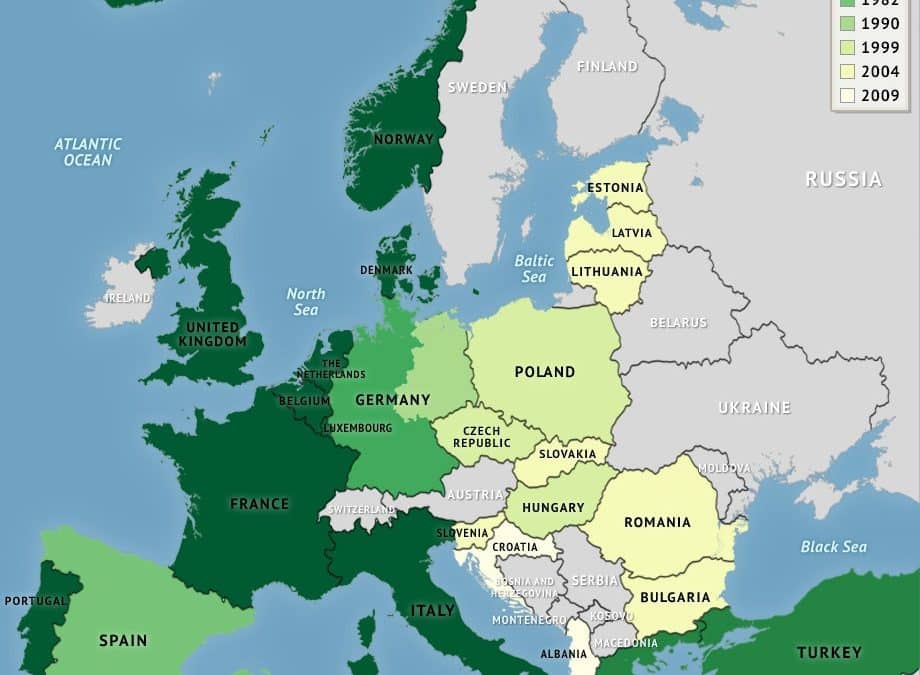

In his farewell address, George Washington said, “It is our true policy to steer clear of permanent alliances with any portion of the foreign world.” What an offensive notion to Pentagon generals, weapon industry execs, DC think tankers and State Department bureaucrats, who, rather than avoiding permanent alliances, have been relentless in their quest to pile on new ones. That impulse is vividly exemplified by the dangerously provocative post-Cold War expansion of NATO, and its consequences are apparent in today’s Ukraine-centered tensions with Russia. NATO was created to oppose a Soviet...