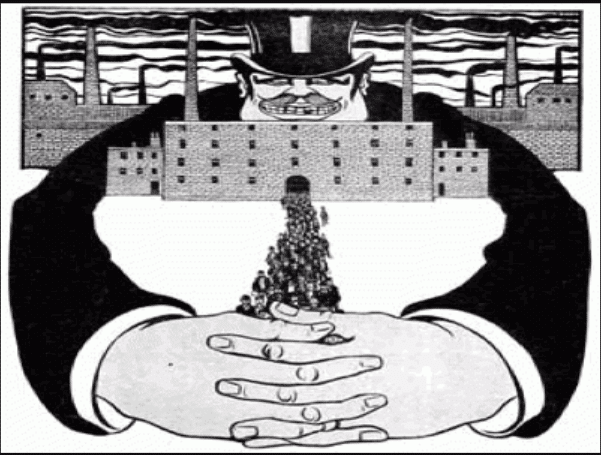

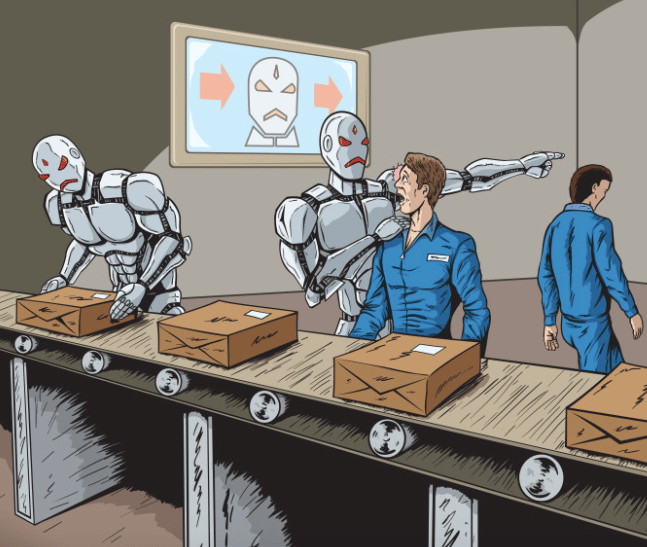

"Successful economies are not jungles, they’re gardens, which is to say that markets, like gardens, must be tended, that the market is the greatest social technology ever invented to solving human problems, but unconstrained by social or democratic regulation, markets inevitably create more problems than they solve.” These are the words of Nick Hanauer, a self-described capitalist. And a billionaire. He was an early investor in Amazon.com and founded Aquantive Inc., which was purchased by Microsoft for $6.4 billion. More recently, he has been receiving a lot of attention as a “thinker.”...