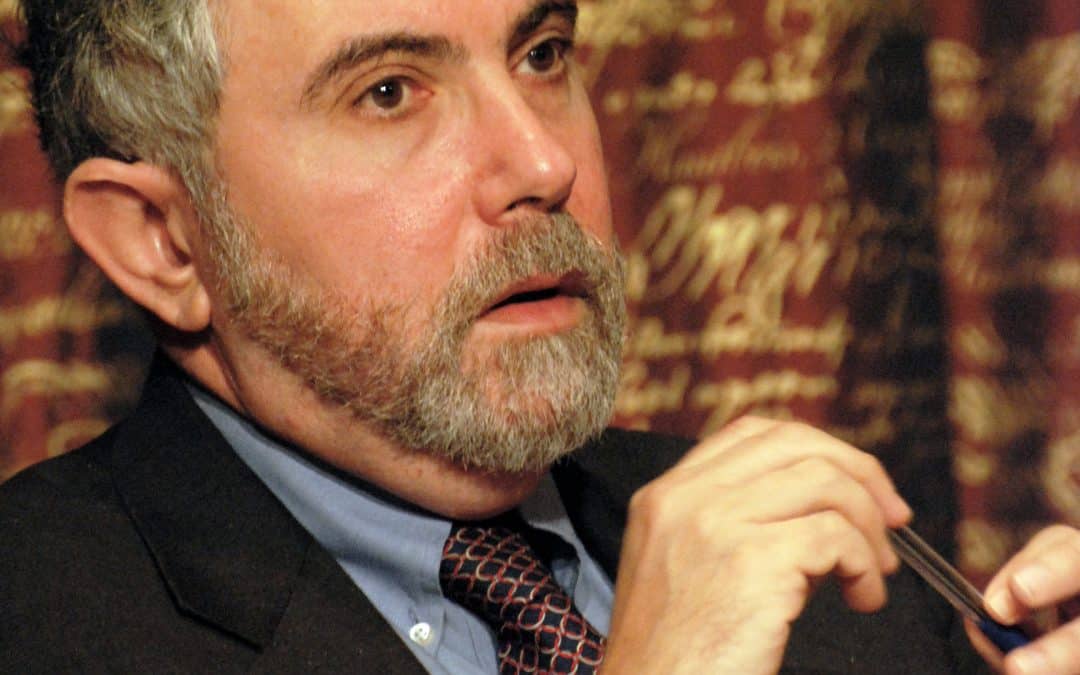

After spending twenty-five years as a columnist for The New York Times, Paul Krugman is finally retiring from that position—twenty-five years too late, if one wishes to be honest. It is hard to measure the influence he had from that perch, but his columns surely were the deciding factor in his winning the Nobel in economics in 2008 after eight years of lambasting the George W. Bush administration. (His Nobel Prize was given, ostensibly, for “his work in economic geography and in identifying international trade patterns,” but one should have no doubt that, without having the power and...