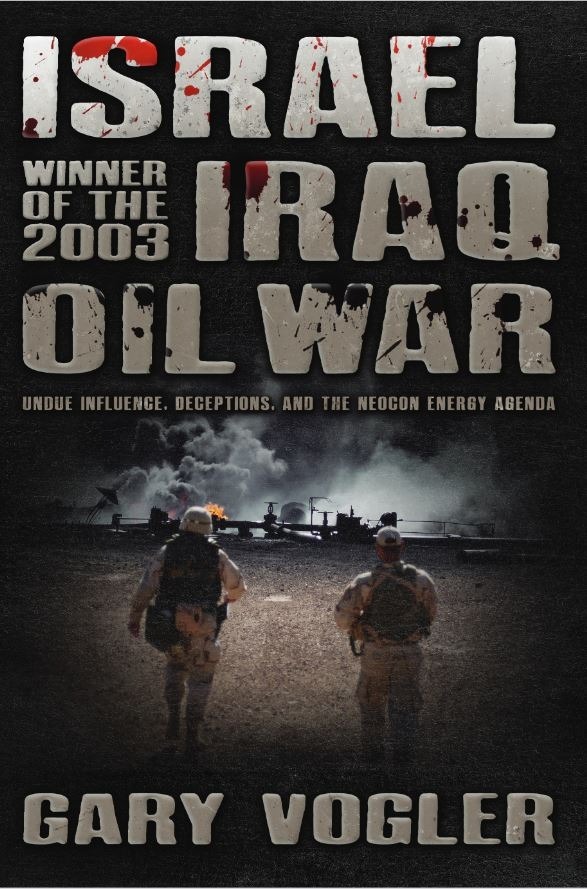

I log onto X (formerly Twitter) for the first time in awhile. The news feed is aghast with Trump vs Harris post debate ‘analysis’ and ‘9/11’ ‘evidence’ and memes. The Truther stuff, central bankers planned the sinking of the Titanic sort of thing. The usual George...