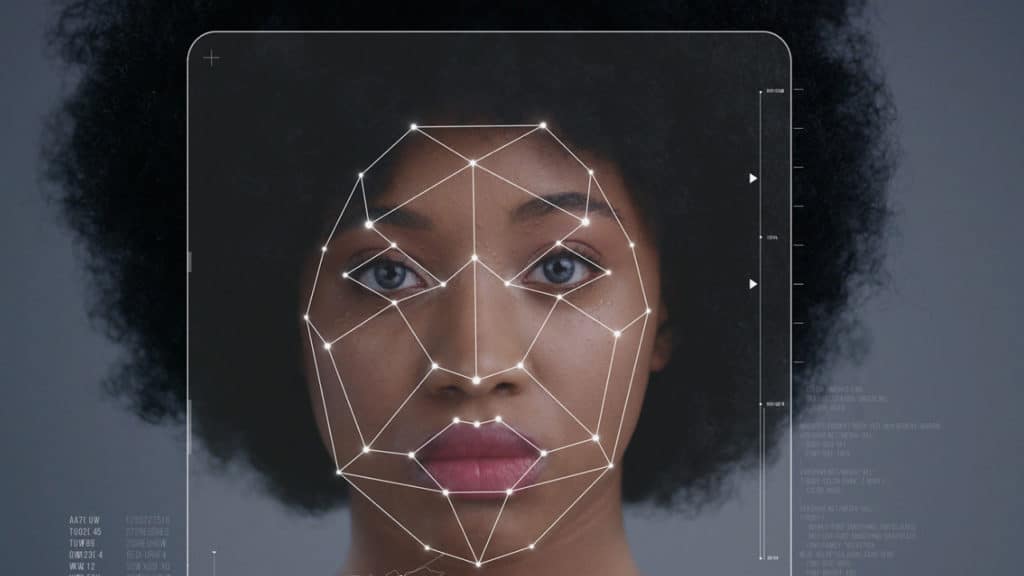

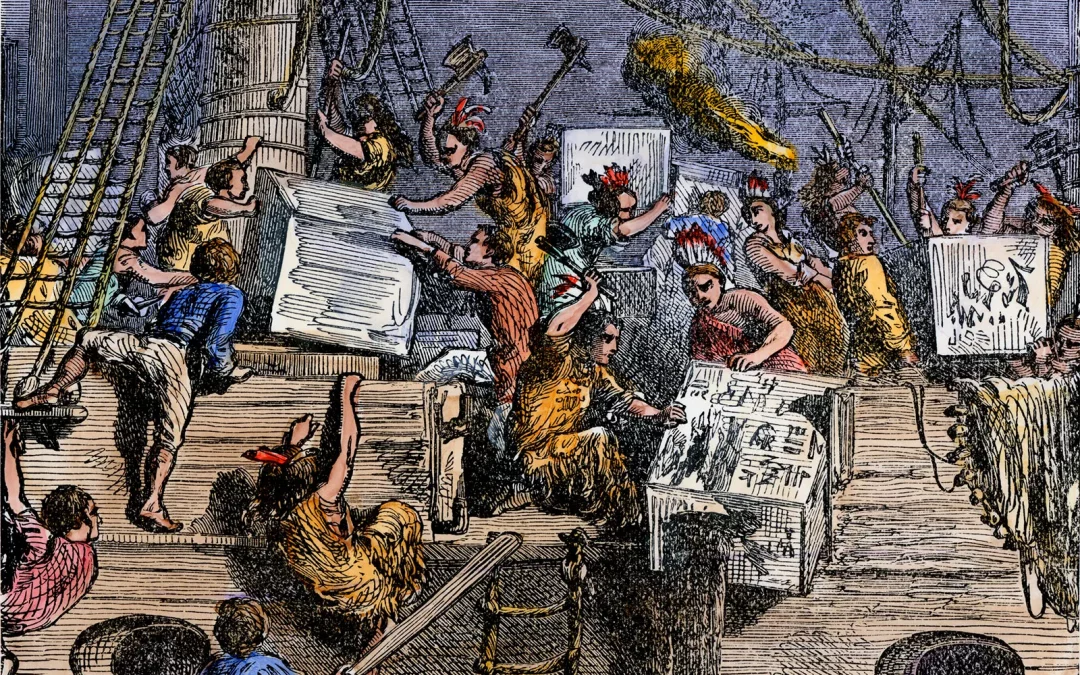

A bill introduced in the Florida House would ban the use of central bank digital currency (CBDC) in the state. Rep. Wyman Duggan (R) brought House Bill 7049 (H7049) to the House Commerce Committee on March 28, and the committee voted along party lines to officially introduce the bill. The legislation would explicitly exclude a CBDC from the definition of money in Florida, effectively banning its use in the state. H7049 defines central bank digital currency as a “digital medium of exchange, or digital monetary unit of account issued by the United States Federal Reserve System, a federal...