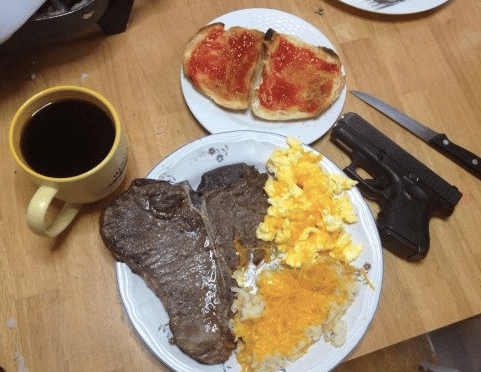

Check out this graph, data for which were drawn from the USDA and CDC: With a correlation coefficient of about -0.94, these data indicate that for the decade 2000-2009 there was a strong inverse relationship between per capita consumption of beef and the number of suicides by handgun. That is, this correlation seems to imply that the decline in total beef consumed per person over the course of the decade was linked to the number of suicides by handgun, which rose at virtually the same rate. This proves that there's a relationship between an individual's meat consumption and his likelihood to...